Exploring the Possibility of Using a Credit Card with Cash App

In today’s digital landscape, the need for versatile payment methods has become increasingly important. Users seek convenience and flexibility as they navigate through various financial transactions. With multiple methods available, many people find themselves wondering about the possibilities and limitations that come with their preferred platforms.

One common query revolves around whether specific financial services allow linking to particular funding sources. Understanding this aspect can greatly enhance user experience and streamline the process of transferring funds or making purchases. Getting clarity on how different payment types interact is key for those looking to optimize their financial activities.

Given the diverse array of options available, it’s essential to delve deeper into the mechanics at play. Users may find that certain limitations apply when integrating various funding methods into their financial toolkit. Exploring these considerations can open up new avenues for simplifying transactions and making informed choices about spending.

Using Credit Cards with Cash App

If you’re looking to expand your payment options, connecting a financial product to your digital wallet can be a great way to manage your transactions. Many individuals seek to know the ability to link various financing methods for convenience and flexibility in their everyday purchases.

To begin with, establishing a relationship between your financial instrument and the platform is relatively straightforward. You’ll typically need to follow a few simple steps within the settings of the digital platform. After the initial setup, funds can be transferred seamlessly, enabling you to enjoy a convenient shopping experience.

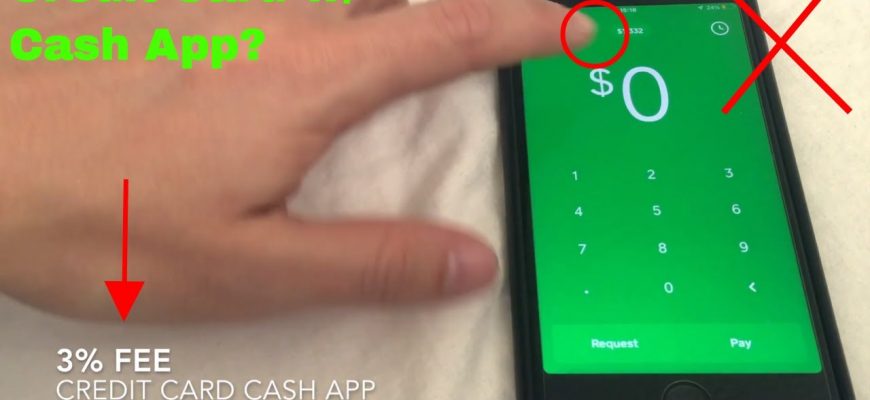

Keep in mind, that while this setup is beneficial, it’s important to remain aware of potential fees or limitations associated with transactions. Always checking the terms of service will provide clarity on any related costs.

Additionally, maintaining a good payment history with your financial product can enhance your overall experience. The digital platform might even offer rewards or incentives that align with your spending habits, making it worth your while to integrate this method into your financial routine.

So, whether you’re sending money to friends or making purchases online, exploring different financial options can truly streamline the process and add to the convenience of your everyday life.

Understanding Payment Methods

In today’s digital landscape, various platforms offer unique ways to handle financial transactions. Each method comes with its own set of rules and flexibility, making it essential to grasp the nuances of different options available for sending and receiving funds. Whether for personal expenses, business transactions, or sharing bills, it’s crucial to know what’s possible.

Exploring the Options gives users insight into how they can fund their activities. Common choices include bank transfers, debit mechanisms, and alternative funding sources that can enhance usability. Each avenue has its pros and cons, which can influence decision-making.

For those contemplating the integration of different financial tools, understanding fees, speed of transactions, and security measures is vital. By weighing these factors, users can optimize their experience and make informed choices that suit their needs.

In conclusion, having a clear picture of available payment avenues empowers individuals and businesses alike. Knowing the ins and outs can lead to smarter, more efficient financial maneuvers.

Pros and Cons of Credit Card Usage

When it comes to financial transactions, there are various options available that people can consider. Utilizing a financial product like a revolving loan can offer both advantages and disadvantages. Understanding these can help individuals make informed decisions regarding their finances.

Advantages:

Flexibility in spending is a significant benefit. Users can purchase items now and pay later, which can be particularly useful during emergencies or unexpected expenses. Additionally, many of these financial tools offer reward programs, allowing users to earn points or cash back on their purchases. This can lead to saving money over time or accessing perks such as travel benefits. Moreover, having a well-managed account can positively impact one’s credit score, making it easier to secure loans in the future.

Disadvantages:

On the flip side, one must be cautious about overspending. It’s easy to lose track of spending habits, leading to accumulating debt. High-interest rates can also become a burden if balances are not paid off promptly, resulting in a financial strain. Additionally, individuals may face fees for late payments or exceeding limits, which can add to their overall financial obligations. Lastly, the temptation to make impulsive buys could lead to regrettable purchases.

In conclusion, weighing the pros and cons is essential for anyone considering this option for managing finances. It’s crucial to approach such financial decisions thoughtfully to harness their benefits while mitigating potential pitfalls.