Options for Canceling Your Credit Card Effectively and Safely

In today’s financial landscape, individuals often find themselves reevaluating their monetary tools. Sometimes, circumstances shift, making it necessary to rethink relationships with various financial institutions. Whether due to changing needs, dissatisfaction, or financial management strategies, the option to discontinue a financial instrument becomes pertinent.

The process of severing ties with a particular service can be both relieving and complicated. It often involves a series of steps to ensure that all obligations are met while safeguarding personal information. Many individuals might feel overwhelmed by the thought of navigating this transition, but understanding the procedure can provide clarity and ease anxiety.

Throughout this discussion, we will delve into the various aspects surrounding the decision to part ways with a financial service. From understanding the implications to exploring alternative options, this journey aims to empower you with knowledge, allowing for informed choices that align with your financial aspirations.

Understanding Your Rights with Credit Cards

When it comes to managing your finances, it’s important to be aware of the protections and options available to you. Knowledge about what you can expect from your financial institution is vital. This insights help you navigate through various situations and empower you when it comes to your personal economic decisions.

For instance, you have the right to dispute transactions that seem incorrect or unauthorized. This ensures you aren’t held responsible for charges you didn’t agree to. Additionally, if you face difficulties in making payments, there are often options in place to assist you without the fear of harsh penalties.

Moreover, understanding the terms and conditions of your financial agreements ensures you won’t be caught off guard by changes in fees or interest rates. Many institutions also offer promotional periods where you can benefit from reduced rates, and it’s essential to be aware of when these promotions end.

Lastly, if you ever feel like your financial institution is not treating you fairly or following the agreed terms, you have options to escalate your concerns. This protection is in place to reinforce your position as a valued customer and ensure fair treatment throughout your financial journey.

Steps to Terminate Your Plastic Payment Tool Effectively

If you’ve decided it’s time to part ways with your financial instrument, there are several important actions to ensure a smooth transition. Taking the right steps can help you avoid any potential pitfalls and maintain your financial health. Here’s a guide to help you through the process with ease.

1. Review Your Balance: Before making any moves, check your outstanding balance. If you owe money, consider paying it off to avoid further interest charges. This step is crucial to simplify the termination process.

2. Redeem Rewards: If your payment tool offers any kind of rewards or points, make sure to redeem them before you proceed. Many financial institutions allow you to use points for cash back or gifts, but you might lose them once you sever the relationship.

3. Contact Customer Service: Reach out to the service representatives of your financial provider. They can inform you of specific procedures you need to follow. Sometimes, you may even need to provide a reason why you’re making this decision.

4. Put It in Writing: It’s a good idea to send a formal written request to terminate your service. Include essential details such as your account number and personal information. This creates a paper trail that can protect you in the future.

5. Destroy the Physical Item: After confirming the termination, make sure to dispose of the actual item safely. Shredding it is usually the best course of action to prevent any unauthorized use.

6. Monitor Your Credit Report: Keep an eye on your credit profile after the termination process. This can help you catch any unexpected changes or lingering balances that may arise.

By following these steps, you can ensure that ending your association with your financial tool is a hassle-free experience. This approach not only helps in managing your financial goals but also preserves your credit standing.

Consequences of Terminating a Financial Account

When you decide to end your relationship with a financial institution regarding a particular payment mechanism, it’s crucial to understand the potential repercussions that may follow. Although it might seem like a straightforward choice, this action can have ripple effects on various aspects of your finances.

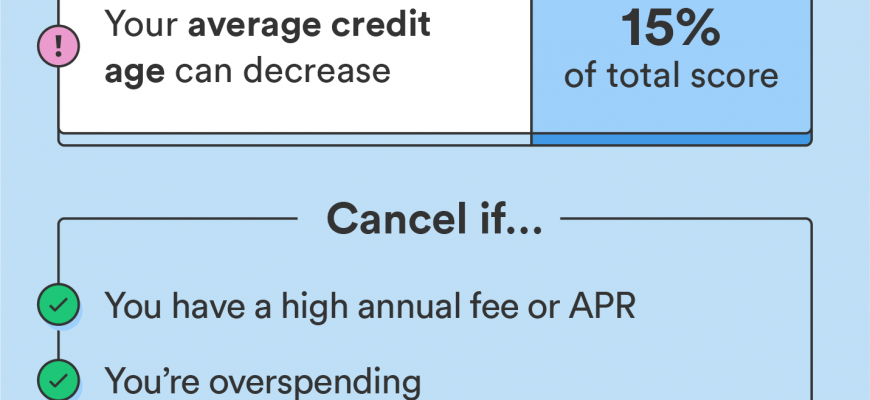

Impact on Your Credit Score: One of the primary outcomes of severing ties with such an account is its influence on your credit rating. Closing an account can affect the length of your credit history and your overall utilization ratio. A sudden decrease in available credit may lead to an increase in your debt-to-credit ratio, which could negatively affect your score.

Loss of Benefits: You might also lose some valuable perks. Many payment methods offer rewards, cash-back options, or other incentives that you forfeit upon termination. Weighing these benefits against any negatives associated with keeping the account is essential before making a final decision.

Future Approval Challenges: If you ever consider applying for a new financial tool or seeking a loan, a lower credit rating may hinder your chances of approval. Lenders often check your credit history, and any drop in your score can raise red flags.

In summary, while the decision to sever a financial account may seem justified at the moment, the long-term consequences can be significant. Taking the time to evaluate all aspects, including your credit health and future financial plans, can help you make a more informed choice.