Exploring the Possibility of Financial Aid for Everyone

When pursuing higher education, many are faced with the challenge of managing expenses. The costs associated with tuition, textbooks, and living arrangements can feel overwhelming. However, there are various programs and resources designed to assist individuals in alleviating some of these financial burdens. Understanding the landscape of available support can make a significant difference in the journey toward academic achievement.

Who qualifies for these opportunities? It’s a common concern among students and their families. The truth is, numerous factors influence eligibility, and many people may discover options they hadn’t previously considered. Whether you’re a recent high school graduate or an adult learner looking to expand your credentials, exploring potential resources is a crucial step in the process.

In this article, we’ll delve into the different types of support available and the criteria that might help you access them. From scholarships to grants and even work-study programs, the possibilities are diverse. Understanding these avenues not only opens doors but also helps individuals manage their educational investment more effectively, creating a clearer path toward their goals.

Understanding Financial Aid Eligibility

When it comes to pursuing higher education, navigating the complex world of support systems can feel overwhelming. Many individuals find themselves wondering about the criteria that define who qualifies for assistance. It’s essential to grasp the fundamentals that determine eligibility, as this knowledge can significantly impact one’s academic journey.

Several factors play a role in assessing who might qualify for support. For starters, the individual’s financial situation is paramount. Institutions often look at income levels, family size, and other financial obligations. Secondly, academic performance can also influence eligibility. Various programs may have specific requirements related to grades or test scores. Additionally, certain demographics or special circumstances, such as being a first-generation student, can open doors to different opportunities that might not be initially apparent.

Understanding these elements is crucial. By familiarizing oneself with the different avenues available, individuals can better position themselves to access resources that will assist them in achieving their educational dreams. Whether through grants, scholarships, or low-interest loans, unlocking opportunities begins with knowing the landscape and recognizing all the factors that come into play.

Types of Financial Support Available

When it comes to pursuing education or managing living expenses, many individuals find themselves exploring various types of assistance. This support comes in different forms, tailored to meet diverse needs and circumstances. Understanding these options can significantly impact one’s financial journey and overall peace of mind.

Grants are one of the most sought-after forms of help, as they don’t require repayment. These funds are typically awarded based on merit or specific criteria, such as income level or field of study. Scholarships operate similarly, often provided by schools or organizations, rewarding students for academic or extracurricular achievements.

Another option is loans, which, although they require repayment, can offer individuals the chance to cover significant expenses. These can be subsidized or unsubsidized, depending on factors like the applicant’s financial situation. Furthermore, work-study programs are a practical way for students to earn money while gaining valuable experience in their chosen fields.

Lastly, there are state and federal programs aimed at providing additional resources to those who demonstrate need. Understanding the various avenues available not only opens doors but also allows individuals to make informed decisions about their financial future.

Steps to Apply for Assistance

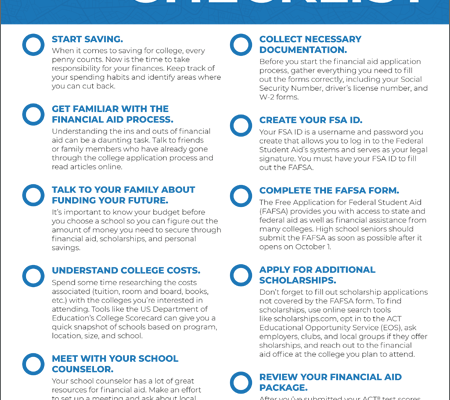

Initiating the process for support can be a straightforward journey if you know the right steps to follow. It’s essential to gather your information and understand what’s required so that you can navigate the application smoothly.

- Research Available Options:

Start by looking into different programs or institutions that offer support. Check eligibility criteria and types of assistance available to find a match that suits your situation.

- Collect Necessary Documentation:

Before applying, gather all required documents, such as identification, financial statements, and any other relevant materials that could strengthen your request.

- Complete the Application Form:

Fill out the application form diligently. Make sure every piece of information is accurate and reflects your current situation.

- Submit Your Application:

Once you have verified all details, it’s time to submit. Keep a copy for your records in case you need to refer back to it.

- Follow Up:

After submitting, don’t hesitate to check in regarding your application status. This could help you stay informed and possibly speed up the process.

By following these steps, you set yourself up for success on your journey to receiving the support you need.