Live Updates on Brent Crude Oil Price Movements

In today’s fast-paced financial environment, keeping an eye on the shifts in the global commodity market has become increasingly vital. The continuous changes in value for vital resources can impact everything from energy costs to economic stability across various regions. With this in mind, understanding the live movement of these essential assets allows investors and consumers alike to make informed decisions.

Staying updated is crucial, especially for those involved in industries heavily influenced by these market trends. Whether you’re a professional in finance or simply someone interested in economic dynamics, knowing the latest figures can provide valuable insights into broader market behaviors. Innovations in technology now enable real-time tracking of these commodities, making information more accessible than ever.

Engaging with these updates not only enriches your knowledge but also equips you to respond better in a constantly shifting landscape. The interplay between various factors, including geopolitical events and market demands, makes this sector particularly fascinating. It’s a world where even the slightest change can ripple across economies, affecting everything from your daily commute to the prices in your grocery store.

Current Trends in Brent Crude Prices

In today’s market, the fluctuations in energy commodity values have captured significant attention from traders and investors alike. These shifts are influenced by a myriad of factors, including geopolitical events, supply chain dynamics, and economic indicators. Understanding these trends is crucial for anyone looking to navigate the complexities of the energy sector.

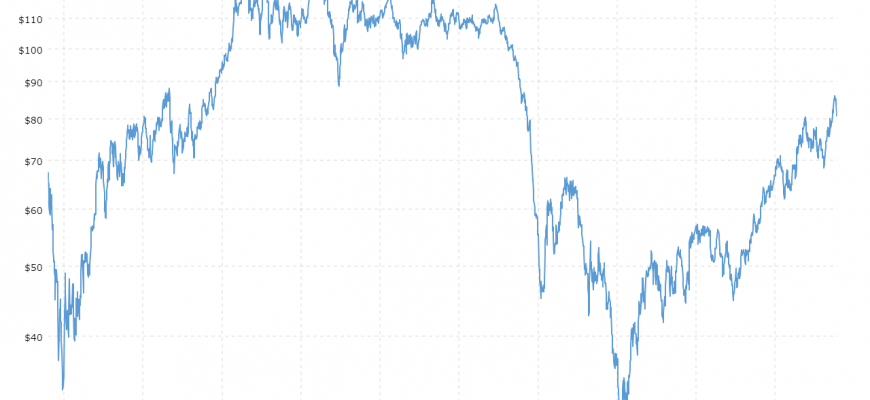

Recently, we’ve observed notable volatility, with value movements reflecting broader economic sentiments. Factors such as changes in production levels among major exporting nations and adjustments in demand due to seasonal variations play a pivotal role. Additionally, ongoing global events continue to shape perspectives on future consumption and supply forecasts.

As stakeholders monitor these developments, it becomes increasingly clear that adaptability is key. Investors are keenly focused on analytics and reports, searching for signals that might indicate where the market is headed next. Whether it’s a sudden political shift or a new economic policy, these elements can swiftly alter the landscape.

The conversation around renewable energy alternatives is also gaining momentum, prompting discussions about long-term implications for traditional energy markets. As technology advances and public awareness grows, the transition towards varied energy sources could redefine investment strategies moving forward.

Keeping an eye on these trends allows market participants to make informed decisions and better anticipate future shifts in value, ensuring they remain competitive in an ever-evolving environment.

Factors Influencing Energy Cost Fluctuations

Understanding the dynamics behind the shifts in energy expenses can be quite fascinating. Numerous elements play a significant role in determining where these costs are headed at any given moment. Suppliers, consumers, and external events all intertwine to create a complex web that ultimately influences how much we pay for our energy sources.

One of the primary factors is the balance between supply and demand. When production levels are high, and consumption remains steady or decreases, values tend to drop. Conversely, if demand spikes or production is disrupted due to geopolitical tensions or natural disasters, costs can surge unexpectedly. Market speculation also contributes heavily; traders often react to news and trends, causing prices to swing wildly based on anticipated future conditions.

Additionally, currency valuation impacts how energy is traded internationally. Fluctuations in exchange rates can make commodities more or less expensive for nations based on their currency strength. Government policies, including tariffs, sanctions, and regulations, further add complexity to the equation, influencing how freely these resources can be bought and sold globally.

Lastly, technological advancements and shifts towards renewable options are also shaping the landscape. As more sustainable alternatives gain traction, traditional energy sources might experience volatility as markets adjust to new realities. Understanding these multifaceted influences can shed light on why we see the numbers changing frequently and dramatically.

Impact of Global Events on Oil Markets

The fluctuations in the energy market often reflect a complex interplay of worldwide occurrences. From geopolitical tensions to natural disasters, these events can either bolster or destabilize the landscape for energy resources. Understanding how various situations influence supply and demand is crucial for both investors and consumers alike.

For instance, a conflict in a major producing region can lead to apprehensions about availability, prompting a surge in demand. Conversely, agreements aimed at production cuts can streamline supply and create ripples across the financial spectrum. Market participants closely monitor these developments, as sentiment can shift rapidly with breaking news.

Economic indicators, such as manufacturing output and employment rates, also play significant roles in shaping consumer demand. Strong economic performance generally drives higher consumption levels, while downturns can result in decreased appetite for energy. This connection between economic health and energy resource consumption is key to predicting potential market shifts.

Environmental policies and technological advancements are further elements that contribute to market dynamics. As nations implement new regulations aimed at reducing carbon footprints, the demand for alternative resources can change dramatically. Businesses and investors are required to adapt, following the trends towards sustainability and renewable alternatives.

Ultimately, understanding the multifaceted influences on the energy sector is essential for anyone engaged in tracking these resources. The ability to read the signs of shifting global landscapes can provide a strategic advantage, whether you’re an investor, a policymaker, or simply a concerned consumer.

This video is pure beauty! You have such a radiant presence;it’s mesmerizing!