Effective Strategies for Securing Financial Aid to Support Your College Education

Pursuing higher education can often feel like navigating a complex maze, especially when it comes to finances. Many students find themselves wondering how to secure the necessary resources to make their academic dreams a reality. Fortunately, there are numerous avenues available to help alleviate the burden of tuition costs.

Understanding the various options for support can be the key to unlocking potential for many individuals. From government programs to institutional scholarships, the landscape is full of possibilities. It’s crucial to dig deep into these resources and begin exploring them early in your journey.

Moreover, developing a keen understanding of eligibility criteria and application processes can make a significant difference in the outcome. Engaging with financial planning from an informed perspective not only enhances one’s chances of success but also instills confidence in the pursuit of knowledge. Let’s dive into the specifics and uncover the resources that can help transform aspirations into achievements.

Understanding Different Types of Assistance

When it comes to affording higher education, many options are available to help lighten the financial load. Navigating through the various forms of support can be overwhelming, but it’s essential to find the right mix that suits individual situations. Each category of support has its unique benefits and requirements, offering different levels of aid based on need and eligibility.

One major category is grants, which are typically awarded based on financial need. These funds don’t have to be repaid, making them an attractive option for students facing monetary challenges. Then there are scholarships, often based on merit or achievements in academics, sports, or the arts. These, too, do not require repayment, allowing students to focus on their studies without worrying about accumulating debt.

Loans represent another form of assistance, providing funds that must be paid back after graduation. While they can help cover costs, it’s crucial to understand the terms and interest rates involved. Work-study programs are also an option, allowing students to earn money while attending classes, giving them practical experience along with financial support.

Ultimately, a combination of these different types of assistance can provide a comprehensive solution, helping to create a more manageable path toward achieving educational goals. Understanding how each type operates and aligning them with personal needs is key to making informed decisions in the journey through higher learning.

Steps to Apply for Scholarships Effectively

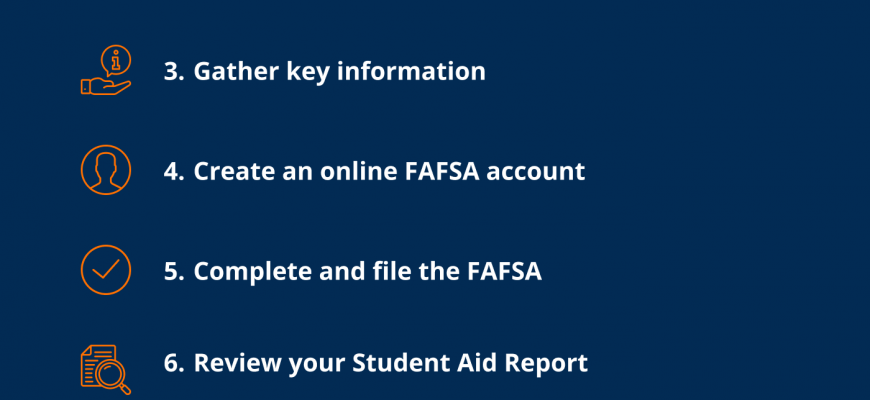

Applying for scholarships can seem like a daunting task, but breaking it down into manageable steps makes the process smoother. With the right approach, you can enhance your chances of receiving funding to support your educational journey. Let’s explore how to tackle scholarship applications with confidence and strategy.

First and foremost, research is key. Start by identifying scholarships that align with your background, interests, and future goals. Websites dedicated to scholarship listings, along with your school’s financial office, can provide a wealth of options. Make a list to keep track of deadlines and requirements for each opportunity.

Next, prepare your documents ahead of time. Most applications will require transcripts, letters of recommendation, and essays that highlight your unique qualities and aspirations. Dedicate some time to crafting a personal statement that reflects your personality and achievements, ensuring it stands out from the rest.

Don’t hesitate to ask for help. Reach out to teachers, mentors, or peers for feedback on your essay and overall application. A fresh pair of eyes can provide valuable insights and help you polish your submission. Additionally, consider discussing your plans with those who have experience in applying for scholarships–they might have tips or suggestions to share.

Finally, stay organized and proactive. Set reminders for deadlines and follow up on your applications if necessary. After submitting, take the time to explore other opportunities and continue improving your skills and experiences, making you an even stronger candidate for future scholarships.

Navigating Student Loans and Repayment Options

When it comes to financing your education, understanding the landscape of loans and how to manage them is crucial. Many individuals find themselves in a maze of terms, interest rates, and repayment plans that can be overwhelming. It’s all about finding the right path that aligns with your goals while keeping your future financial health in mind.

Loan Types play a significant role in your journey. There are federal and private options, each with unique features. Federal loans often provide lower interest rates and more favorable terms, while private loans can vary widely depending on the lender. Weighing the pros and cons of each can help you make an informed choice.

As you embark on this educational adventure, it’s essential to look into repayment plans. Options like standard, graduated, or income-driven repayment could significantly impact how you manage your monthly expenses post-graduation. Income-driven plans, in particular, adjust your payments based on how much you earn, potentially easing the burden during those first few years on the job market.

Monitoring your debts is just as important as managing your loans. Keeping track of your loans, interest rates, and repayment schedules can offer clarity and help you avoid unnecessary stress. Additionally, consider refinancing as a tool if you find yourself with high-interest loans; this could lower your monthly payments and save you money over time.

Ultimately, educating yourself about the various options available and developing a thorough repayment strategy will allow you to navigate your student loan journey with confidence. Embrace the resources at your disposal and pave a smoother path toward financial well-being.