Top Strategies for Maximizing Your VAT Refunds While Traveling in Europe

When you embark on a journey across the continent, there’s more than just sights and experiences awaiting you. If you’re a savvy traveler, you might find yourself sitting on a hidden treasure that can lighten your financial load. It’s all about navigating the system to reclaim a portion of what you’ve spent during your adventures. Sounds intriguing, right?

Many visitors to various countries encounter certain policies designed to assist them in reclaiming funds spent on their purchases while abroad. This process can make a significant difference to your travel budget, allowing you to splurge a little more on that exquisite dinner or take home a charming souvenir without worrying about the cost. Understanding the ins and outs of this system can unlock a world of savings.

In this guide, we’ll explore different approaches taken by various nations, sharing practical tips and insights on how to effectively navigate these opportunities. From discovering the necessary paperwork to understanding eligibility requirements, you’ll be well-equipped to make the most of your spending abroad. So, let’s dive in and uncover the potential for savings waiting for you!

Top Countries for Tax Reclaims

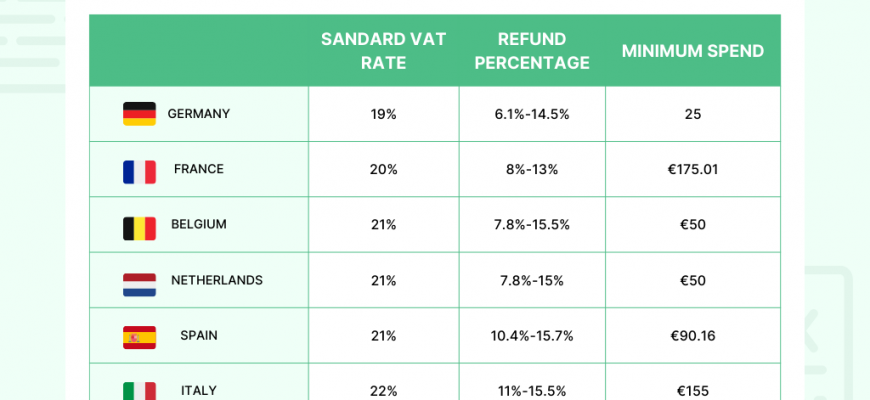

Traveling abroad can be thrilling, and part of that excitement is getting back some of the money spent while exploring. Certain nations stand out when it comes to returning part of your expenses, making your journey a bit more rewarding. Let’s dive into a few places where you can enjoy such perks, ensuring you keep more cash in your pocket.

First up is Italy. Known for its rich history, stunning architecture, and glorious cuisine, this country also has schemes in place that allow visitors to claim back a portion of their expenditures. Shoppers in popular cities like Rome and Milan often find this to be a fantastic way to enjoy their purchases while minimizing costs.

Next, we have Germany. This nation is famous for its vibrant culture and innovative technology, but it also offers attractive opportunities for visitors to reclaim some of their spending. Whether you’re snapping up souvenirs in Berlin or indulging in local delights in Munich, the process to retrieve funds is straightforward and beneficial.

France is another highlight on this list. Renowned for its art, fashion, and gourmet food, the allure of the Parisian experience is even sweeter when you know you can get some of your hard-earned money back. Shoppers can easily navigate the process, enhancing their visits to charming boutiques and major retailers alike.

Lastly, let’s not forget Spain. With its lively atmosphere and stunning landscapes, it’s a delight for any traveler. In addition to its attractions, Spain also provides visitors a chance to reclaim some costs, making your stay even more enjoyable. From Barcelona to Madrid, the added bonus of financial return is just one more reason to explore this vibrant nation.

How to Claim Your VAT Refund

When you travel abroad, you may not be aware that you can reclaim some of the taxes you paid on your purchases. This process can help you keep more of your hard-earned money, making your journey even more enjoyable. Let’s explore the steps you need to take to make the most of this opportunity.

First, keep all your receipts from the shops where you made your purchases. Most stores participating in this scheme will provide you with a special invoice or a certificate that outlines the taxes associated with your buy. Make sure to ask for these documents, as they are essential for the claim process.

Next, familiarize yourself with the specific eligibility criteria set by the country you’re visiting. Each place has its own rules regarding the minimum spend and the categories of goods that qualify. Don’t forget to check if there’s a deadline for submitting your claim after your departure.

Once you have everything in order, you will need to visit a customs office at the airport or point of exit. Here, present your receipts, the goods, and your passport. They will verify your purchases and stamp your documents, which is a crucial step before you can submit your paperwork.

After getting your customs approval, you can proceed to claim your money back. This can usually be done through a mail-in process or by using designated booths at the airport. Be sure to fill out all necessary forms accurately and provide the required information to avoid any delays.

Finally, keep an eye on your bank account or credit card, as refunds can take some time to process. Patience is key here, but once the transaction is completed, you’ll have successfully reclaimed money that’s rightfully yours!

Common Mistakes to Avoid When Requesting

When it comes to reclaiming taxes paid during your travels, there are a few pitfalls that people often encounter. Being aware of these common errors can save you time and effort, ensuring that your claims are processed smoothly and efficiently. Let’s dive into some of the typical missteps you should steer clear of when navigating this process.

One frequent oversight is not keeping thorough records of your purchases. Without proper documentation, including receipts and invoices, it can be challenging to validate your claims. Always collect and store these papers securely; they are key to substantiating your requests.

Another common mistake is failing to understand the eligibility criteria for the amounts you wish to claim. Different countries have varying rules on what qualifies. Take a moment to read up on these regulations so you don’t miss out on what you’re entitled to or face potential rejections.

Timing is also crucial. Many travelers underestimate the window during which they can file for tax recovery. It’s important to be aware of the deadlines in each country. Submitting your application late can lead to denied requests, so mark your calendar and make it a priority.

Additionally, many individuals overlook the importance of completing forms accurately. Small errors, such as incorrect personal information or missing sections, can cause delays or rejections. Double-check your details before sending anything off, ensuring everything is clearly and correctly filled out.

Lastly, don’t underestimate the power of seeking assistance if you’re unsure about the process. Whether it’s through online resources, knowledgeable staff at airports, or local tax representatives, getting help can provide clarity and avoid unnecessary complications.