Top Options for Securing Financial Aid for Your College Education

Embarking on the journey of higher learning can be both exciting and daunting, especially when it comes to figuring out how to support your studies financially. The landscape is filled with various methods to ease the burden of tuition and living expenses. Understanding what’s available is crucial to making informed decisions that align with your goals and circumstances.

The array of resources designed to assist students in navigating their educational pursuits may seem overwhelming at first glance. However, each option carries its own set of benefits and drawbacks. Whether it’s scholarships that reward academic merit, grants that provide assistance based on need, or employment opportunities that allow you to earn while you learn, there’s something to fit nearly every situation.

In this guide, we’ll take a closer look at these offerings, highlighting the most suitable resources. By the end, you’ll have a clearer understanding of how to finance your educational ambitions without breaking the bank.

Types of Support Available

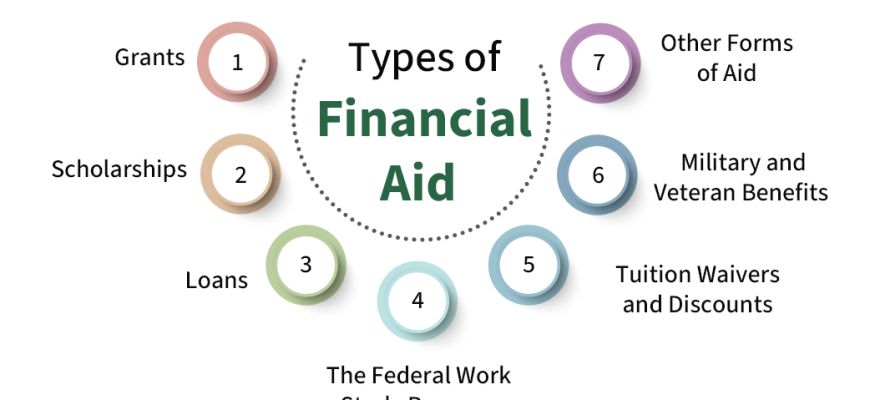

When it comes to funding your education journey, there are various options to consider. Understanding these choices can help you navigate the process more effectively and find what suits your circumstances best. Each avenue comes with its unique benefits and requirements, so it’s essential to explore all possibilities.

One popular option is scholarships, which are often awarded based on merit or specific criteria. They don’t require repayment, making them an attractive choice. Another common avenue is grants, typically based on demonstrated need. These funds also do not need to be repaid and can significantly ease your financial burden.

Loans are another consideration, where borrowed amounts must be paid back over time, usually with interest. They can help cover the gap between total costs and other forms of support. Additionally, work-study programs offer the chance to earn money while studying, helping to cover expenses through part-time employment.

Ultimately, every source of assistance has its unique appeal and structure. By researching and understanding these options, you can create a solid plan to finance your educational pursuits. Remember, the right combination can make a significant difference in your overall experience and success.

Understanding Grants and Scholarships

When it comes to funding your education, there are a couple of options that really stand out. These avenues not only lighten the financial burden but also pave the way for a more accessible academic journey. They are designed to support students in achieving their educational goals without the constant worry of steep repayments.

Grants are essentially gifts that do not require repayment, often awarded based on need or specific criteria set by the issuing body. They can come from the government, institutions, or private organizations, making them an appealing choice for many. On the other hand, scholarships are typically awarded for merit–whether that’s academic excellence, talent in sports, or involvement in community service. These can come from schools, nonprofits, or businesses looking to support deserving individuals.

Both options offer unique benefits, and understanding their differences can help you make informed decisions about funding your academic career. By pursuing these resources, you can maximize your educational experience without the looming threat of debt hanging over your head.

Student Loans: Pros and Cons

When it comes to pursuing higher education, many individuals consider borrowing money to help cover the costs. While this option can provide much-needed support, it’s essential to weigh the benefits and drawbacks carefully before making a commitment.

On the positive side, student loans can open doors to opportunities that might otherwise be inaccessible. They often allow students to focus on their studies without the immediate burden of financial strain. Some loans come with lower interest rates or flexible repayment plans, which can ease financial worries after graduation. Additionally, the ability to build credit history through responsible borrowing can be a long-term advantage.

However, there are significant challenges associated with taking on debt. Repayment can become overwhelming, particularly if a graduate struggles to find a well-paying job after completing their studies. Interest can accumulate, leading to a potentially daunting total owed. Furthermore, the long-term financial impact of repaying loans may limit future choices, including career options and home ownership.

Ultimately, the decision to borrow stems from balancing immediate educational needs with future financial responsibilities. Being well-informed about both sides of the equation can help individuals make the best choice for their unique situation.