Top Master’s Programs in Quantitative Finance Across Europe for Aspiring Professionals

When it comes to pursuing higher education in the realm of numbers, analytics, and strategy, Europe offers an impressive array of programs that cater to aspiring professionals. These academic paths are designed for those looking to deepen their understanding of the intricacies of monetary systems and investment tactics. The appeal lies not only in the rigorous curriculum but also in the opportunity to be part of a vibrant international community.

In this section, we’ll explore some highly regarded institutions that stand out for their comprehensive training and cutting-edge research. These offerings go beyond just theoretical knowledge, emphasizing practical skills that are essential in the fast-paced world of commerce. Students are encouraged to engage with real-world scenarios, equipping them with tools necessary to navigate the complexities of today’s economic landscape.

For many, the choice of a program is a significant step towards a rewarding career, providing a solid foundation in analytical thinking and problem-solving. It’s important to consider factors such as faculty expertise, industry connections, and alumni success when evaluating options. Let’s delve into some of the most notable choices out there, assisting you in making an informed decision for your educational journey.

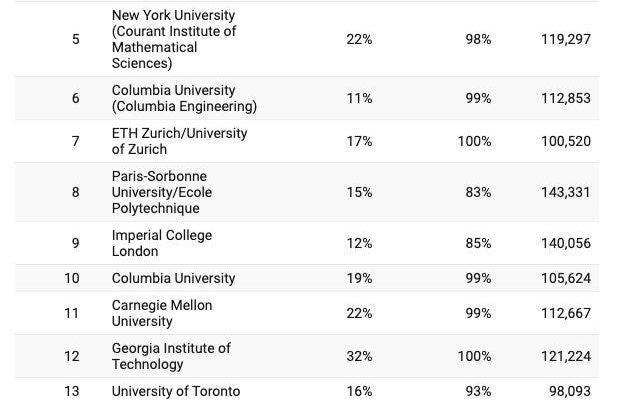

Top Universities for Quantitative Finance

When it comes to pursuing advanced studies in the realm of mathematical and analytical approaches to financial markets, certain institutions stand out for their exceptional programs. These universities provide a rich blend of theoretical knowledge and practical application, equipping students with the necessary skills to thrive in a competitive environment. Aspiring professionals often seek out these esteemed schools for their renowned faculty, innovative research, and robust industry connections.

Several prominent establishments have garnered a reputation for excellence in this specialized field. They offer comprehensive curriculums that cover a wide range of topics, from statistical analysis to risk management strategies. Students benefit from cutting-edge technology and resources, enabling them to engage deeply with real-world scenarios and data interpretation.

Moreover, the diverse student body at these institutions fosters an enriching environment where collaboration and networking flourish. Many of these universities boast strong ties with leading firms, providing students with unique internship opportunities and pathways to successful careers. For those looking to make their mark in this ever-evolving landscape, pursuing an education at one of these top-tier universities can be a transformative experience.

Key Program Features to Consider

When exploring advanced programs in the realm of numerical analysis and risk management, there are several crucial aspects to keep in mind. Focusing on the right elements can significantly impact your learning experience and career opportunities. Understanding what to prioritize ensures you choose a curriculum that aligns with your professional aspirations.

Curriculum Rigor is essential. Look for a program that offers a comprehensive mix of theoretical foundations and practical applications. A balanced approach equips you with the necessary skills to tackle real-world challenges effectively.

Another aspect to consider is Industry Connections. Programs that have strong ties with financial institutions can provide invaluable networking opportunities and internships, creating pathways for employment post-graduation.

Additionally, check for Faculty Expertise. Engaging with experienced professionals can enhance your learning journey. Their insights and practical experiences often enrich class discussions and provide a deeper understanding of complex topics.

Also, evaluate Program Flexibility. Some individuals prefer part-time options or online classes to balance work and studies. Flexibility in course delivery can make a significant difference in managing your time and commitments.

Finally, consider the Location of the institution. Being in a major financial hub can expose you to a wealth of resources and opportunities. Proximity to influential firms and industry events can be a game-changer for your career.

By taking these factors into account, you can make an informed decision that aligns with your goals and sets you up for a successful future in this dynamic field.

Career Opportunities After Graduation

Upon completing a challenging academic program, graduates often find themselves at a crossroads, eager to dive into the professional world. The skills and knowledge gained during their studies open doors to a variety of exciting paths in the job market. It’s an exhilarating time, filled with possibilities for those ready to apply their expertise.

Financial Institutions constantly seek talented individuals who can analyze data and make informed decisions. Positions such as risk analysts, asset managers, or even quant developers are readily available in banks and investment firms. These roles require a deep understanding of statistical methodologies and market trends, making graduates highly valued.

In addition, consulting firms are on the lookout for those who possess strong analytical skills. Working as a consultant allows one to tackle diverse problems across different industries, providing insights that drive business strategies. It’s a dynamic environment where no two days are alike.

Moreover, technology companies increasingly desire professionals who can bridge the gap between finance and data science. Positions in algorithm development, machine learning, and data analysis are prominent at leading tech firms. Graduates with a solid foundation in programming and analytical techniques can thrive in this fast-paced sector.

Another promising avenue is the government and regulatory bodies, where one can contribute to policy-making or compliance. Understanding complex economic models and risk assessments plays a crucial role in shaping effective regulations in the financial landscape.

Lastly, entrepreneurship beckons many ambitious individuals. With an entrepreneurial spirit, graduates can harness their insights to start their own ventures or offer specialized advisory services. The ability to identify market opportunities can lead to rewarding careers as business leaders or innovators.

In summary, the landscape after graduation is rich with options, whether in traditional sectors or emerging fields. The right mix of analytical prowess and adaptability will ensure a fulfilling career journey.