Top Choices to Enhance Your Credit Score

When it comes to managing our finances, maintaining a healthy standing is crucial. Many of us may not realize how important our financial reputation is and how it can influence our daily lives. From securing loans to renting an apartment, this standing often plays a significant role in various transactions.

In a world where trust and reliability are paramount, it’s essential to explore the avenues that can enhance this aspect of our financial lives. Let’s dive into the strategies and options available, allowing you to make informed decisions and improve your financial profile. After all, having a solid reputation can open doors to better opportunities and offers.

Whether you’re looking to simplify your monetary management or seeking to boost your overall standing, understanding the various paths you can take is the first step. Join us as we uncover the options that can help you achieve the financial recognition you desire.

Top Strategies to Improve Your Credit

Enhancing your financial standing can sometimes feel overwhelming, but it doesn’t have to be. There are several strategies that can help you boost your financial reputation over time. By understanding and implementing these techniques, you pave the way to a healthier relationship with your financial resources.

Stay Consistent with Payments: One of the most crucial actions is to pay your bills on time. Late payments can significantly damage your reputation and linger for years. Setting up reminders or automatic payments can be a game-changer.

Maintain Low Balances: It’s wise to keep your outstanding amounts low compared to your overall available resources. This ratio reflects responsible borrowing habits and positively influences how others perceive your financial reliability.

Diversify Your Accounts: Having a mix of different types of accounts, such as loans and revolving credit, can enhance your profile. However, always manage them responsibly to avoid taking on more than you can handle.

Regularly Check Your Reports: Mistakes can happen, and your financial report isn’t immune. Regularly inspecting it allows you to spot inaccuracies, and addressing them timely can prevent unwarranted harm to your reputation.

Avoid Opening Too Many Accounts: While it may be tempting to apply for several financial products, doing so in a short span can raise flags. Aim for gradual growth instead of a sudden influx of new accounts.

Seek Professional Advice: If you’re feeling lost or overwhelmed, consider consulting a financial expert. They can provide tailored guidance, helping you navigate obstacles while optimizing your financial situation.

Implementing these strategies consistently will yield positive results over time. Remember, improving your financial health is a journey, and every step counts!

Understanding Credit Score Factors

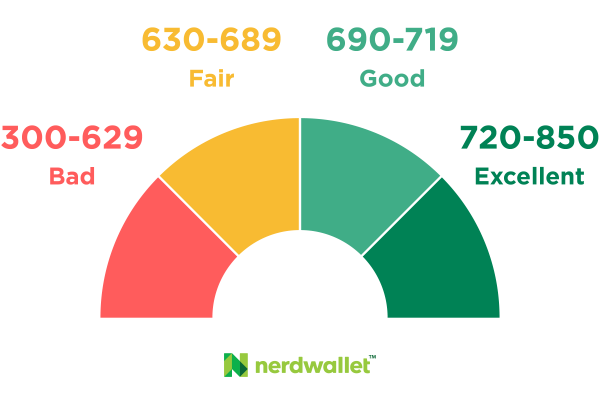

When it comes to navigating the world of personal finance, getting a grasp on what influences your financial rating is crucial. This rating plays a significant role in various aspects of your financial life, impacting everything from loan approvals to interest rates. Let’s break down the elements that contribute to this numerical value, so you can manage your financial health more effectively.

- Payment History: This is the most significant factor. It’s all about whether you’ve paid your bills on time. Late payments can hurt your standing.

- Amounts Owed: This aspect considers the total balance you carry on your accounts compared to your available credit. Keeping balances low can positively influence your situation.

- Length of Credit History: The time since you opened your accounts matters. A longer history with responsible usage tends to reflect positively.

- Types of Credit Used: This category looks at the mix of credit accounts you have, such as credit cards, mortgages, and installment loans. A diverse range can be beneficial.

- New Credit: Applying for multiple new accounts in a short period can raise red flags. It’s often best to limit these inquiries.

Understanding these components is essential for anyone looking to improve their situation. By managing each factor wisely, you can work towards a healthier financial profile that opens doors to better opportunities.

Top Financial Tools to Improve Your Credit Well-being

Maintaining a solid financial foundation is crucial for anyone looking to enhance their monetary reputation. A range of tools and services can help individuals navigate their financial journeys more effectively. By choosing the right options, you can cultivate a healthier financial image and prepare yourself for a brighter financial future.

First up are secured cards, which require a cash deposit that often acts as your credit limit. They’re great for individuals looking to establish or rebuild their monetary image. Using them responsibly can eventually lead to uncollateralized options with better terms.

Next, consider personal loans designed specifically for those seeking to improve their financial standing. Some lenders offer products that report to different agencies, helping you demonstrate reliable repayment habits over time.

Another effective option is a credit-builder account. These accounts allow you to save money while simultaneously reporting positive payment history, giving your financial footprint a significant boost as you build savings.

Lastly, consider debt management services if you’re juggling multiple obligations. They can assist in consolidating and negotiating terms that work for your budget, allowing you to focus on timely payments and gain control over your responsibilities.

Each of these options offers unique benefits tailored to support your financial journey. The right tools can empower you to enhance your situation and unlock future opportunities.