Top Fixed Deposit Rates for December 2025

As we approach the close of another year, the world of finance presents a myriad of options for those looking to grow their savings. With increasing interest in various financial instruments, many are on the lookout for the most advantageous ways to secure their funds. It’s essential to explore the landscape of investment choices to make informed decisions for the future.

In this ever-evolving environment, understanding the mechanics of various financial products can pave the way for better returns. With a bit of research, you can uncover which offerings stand out, providing optimal benefits tailored to your financial goals. It’s like searching for a hidden treasure–knowing where to look can lead to significant gains.

Join us as we delve into the exciting world of savings opportunities that can help maximize your financial potential. Whether you’re a seasoned investor or just starting, our insights aim to illuminate the path to making your money work harder for you.

Top Fixed Deposit Offers in December 2025

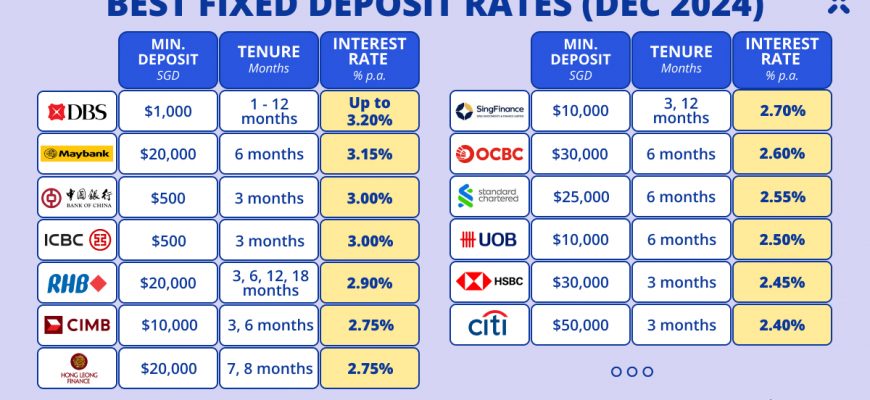

As the year winds down, many individuals are considering their financial options for secure investments. Fixed deposits have always been a popular choice, offering a safe haven for those looking to grow their savings over time. With various banks and financial institutions rolling out enticing plans, it’s essential to explore what’s available in the market right now.

In this month, several banks are showcasing attractive options that cater to different investment amounts and durations. Whether you’re a seasoned investor or just starting out, understanding the unique features of these offers can help you make an informed decision. From competitive returns to flexible terms, there’s something for everyone.

Don’t overlook the importance of reading the fine print. Each provider has distinct terms that can affect your overall earnings and withdrawal capabilities. It’s wise to compare the key elements of each choice, ensuring that the one you select aligns with your financial goals and timeline.

Stay tuned as we delve into the most intriguing fixed deposit opportunities currently on the market, highlighting their benefits and helping you navigate the options. With so many possibilities, you’re bound to find an investment solution that suits your needs!

Comparative Analysis of FD Interest Rates

When it comes to choosing a secure investment option, the differences in offerings can make a significant impact on potential earnings. Understanding how various institutions compare in their yield provisions can help you make well-informed decisions. An insightful examination of these financial products allows you to weigh your options effectively.

Several factors influence the returns on fixed deposits, and it’s essential to consider them when evaluating your choices. Here’s a breakdown of aspects you might want to keep in mind:

- Type of Institution: Different banks and financial entities might present contrasting possibilities, influencing how much you can earn.

- Tenure Options: The length of the deposit often plays a crucial role, with specific durations attracting different benefits.

- Promotional Offers: Some institutions might provide temporary boosts, drawing in customers with special incentives.

- Customer Status: Existing customers or those with higher balances may enjoy preferential terms.

Furthermore, comparing yields can also involve looking into the types of accounts available. Here are some alternatives:

- Regular Fixed Deposits

- Tax-Saving Fixed Deposits

- Recurring Deposits

- Special Fixed Deposit Schemes

Ultimately, conducting a thorough analysis will equip you with the necessary insights to select the option that aligns best with your financial goals. Remember to keep an eye on the evolving landscape, as offerings can change and what may be suitable today might not be in the future.

Factors Influencing Deposit Offers This Month

This month, numerous elements play a critical role in shaping the financial landscape for savers. Understanding these components can help individuals make informed decisions about where to place their funds. Various economic indicators, policies from central banks, and competitive actions among financial institutions can significantly affect the returns offered on savings.

Economic Conditions: The current state of the economy is one of the primary drivers of how financial institutions formulate their offerings. If the economy is thriving, banks tend to increase incentives to attract more deposits. Conversely, in slower conditions, the focus may shift to maintaining liquidity rather than enhancing deposit options.

Central Bank Policies: Interest rates set by the central authority heavily influence how banks operate. Changes in the benchmark rates can lead to adjustments in the terms offered to consumers. When the central bank raises rates, it often results in a ripple effect across various financial products.

Market Competition: Financial institutions are constantly in a game of attracting customers. If a competitor launches a compelling offer, others may need to respond to maintain their market share. This competitive environment can lead to more favorable terms for depositors.

Consumer Demand: The preferences and behaviors of savers also impact available opportunities. If there is a heightened demand for certain types of savings vehicles, banks may adjust their offers accordingly to meet customer expectations.

Staying aware of these influences can empower individuals to maximize their savings. By keeping an eye on economic shifts, policy changes, and market dynamics, savers can navigate their options more effectively and secure more advantageous opportunities for their finances.