Optimal Credit Score Requirements for Securing the Best Mortgage Rates

When it comes to securing a home loan, many factors come into play that can significantly influence the terms you’re offered. Navigating the world of financing can be daunting, especially when you realize how much various indicators can affect your overall experience. It’s essential to understand what influences the offers from lenders and how you can position yourself to receive the most favorable conditions possible.

One key element that lenders consider involves a specific numerical representation of your financial health. This figure, which reflects your ability to manage and repay debt, plays a crucial role in the application process. Prospective homeowners should be aware that achieving a healthy status in this area can unlock doors to appealing interest levels and repayment terms, ultimately saving them money over the life of the loan.

In this discussion, we’ll explore the optimal range of that particular numerical indicator that can help you secure advantageous financing options. By understanding what is required to reach those desirable figures, you can take actionable steps toward improving your financial standing and enhancing your chances of success in securing your dream home.

Understanding Credit Score Ranges

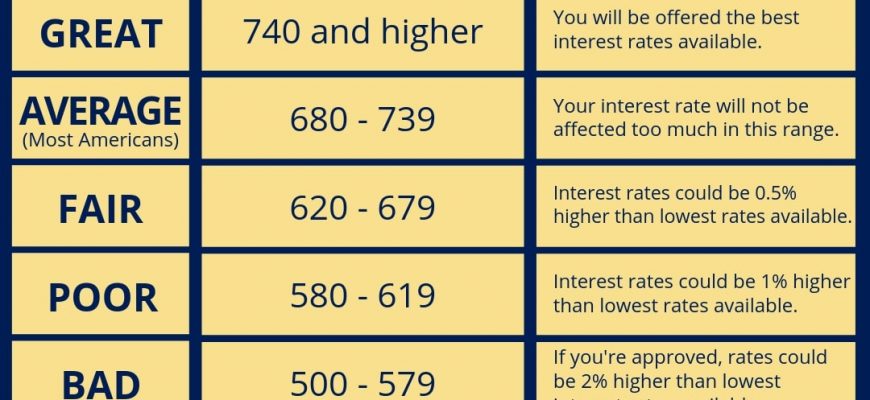

When diving into the world of financing, especially when considering home loans, it’s essential to familiarize yourself with numerical classifications that indicate financial reliability. These numbers serve as a vital metric for lenders, as they provide insight into a borrower’s history and trustworthiness regarding repayments. Understanding the spectrum of these values helps borrowers gauge where they stand and what they might expect in terms of loan conditions.

The spectrum typically spans from low to high, with various segments reflecting different levels of risk. At the lower end, individuals with limited repayment history or past issues may face challenges in securing favorable terms. As you move up the scale, confidence in repayment capability increases, which often translates to more advantageous conditions. Each category not only highlights borrower reliability but also influences the overall financing experience.

In this journey, it’s crucial to pinpoint your position within these classifications. Improving your standing, if necessary, can open doors to better opportunities. Small actions, like timely payments or reducing outstanding dues, can have a significant impact over time. Ultimately, being informed about these ranges empowers you to navigate the lending landscape with greater ease and assurance.

Factors Influencing Home Loan Interest Rates

When it comes to borrowing money for your new home, several elements come into play that can impact the amount of interest you’ll pay over time. Understanding these influences can help you make informed decisions as you navigate the lending landscape. Lenders look at various personal and market-based factors, each playing its unique role in determining the final interest you’ll be offered.

One significant aspect that can affect the cost of your loan is the overall economic environment. Fluctuations in the economy, such as inflation rates or central bank policies, can lead to changes in the interest rates that financial institutions set for their products. When the economy is booming, rates might rise due to increased demand for loans; conversely, during downturns, lenders may lower rates to stimulate borrowing.

Your personal financial portfolio is another vital factor. Lenders assess income stability, existing debts, and savings habits to gauge creditworthiness. A solid financial foundation can lead to more attractive borrowing conditions, as lenders feel more secure in their investment. It’s all about understanding the risk associated with lending to an individual.

The type of loan you choose also matters significantly. Fixed-rate options tend to carry different conditions compared to adjustable-rate alternatives, which can offer lower initial fees but fluctuate over time. Your choice here can play a critical role in how much you pay over the life of the loan.

Lastly, local housing markets can influence interest constructs. Areas with high demand and low supply may see increased costs associated with loans because lenders are trying to balance out risks. Staying informed on your region’s market conditions can give you insights into the best times to secure financing.

Tips to Improve Your Credit Score

Enhancing your financial reputation can open doors to better loan options and favorable interest charges. Focusing on a few practical strategies can pave the way toward a healthier financial standing, making it easier to achieve your goals. Let’s dive into some effective methods to elevate your financial profile.

Firstly, always pay your bills on time. Setting up reminders or automatic payments can ensure you never miss a deadline. This habit reflects positively on your profile and showcases reliability to lenders.

Next, keep an eye on your existing obligations. Try to reduce the balances on your revolving accounts, particularly credit lines. Aim to use less than 30% of your available credit limit to maintain a favorable perception.

Review your reports regularly for errors or inaccuracies. If you discover discrepancies, disputing them promptly can help improve your overall standing. Requesting your records annually can uncover valuable insights into your financial habits.

Avoid opening multiple accounts in a short span of time. Each application may result in an inquiry that could impact your reputation negatively. Instead, consider maintaining the accounts you already have and displaying responsible management.

Lastly, consider becoming an authorized user on a responsible person’s account to benefit from their positive management history. This strategy can provide a boost without putting you at risk.

Implementing these practical steps will gradually lead to a noticeable enhancement in your financial standing. Stay consistent, and over time, you will reap the rewards of your efforts!

I’m completely captivated! Your elegance and grace shine through in every moment!