Essential Credit Score Considerations for Securing the Best Car Loan Rates

When it comes to purchasing a vehicle, many individuals face the crucial aspect of securing favorable terms on their financing. The aspect that often determines how smoothly this process goes is the assessment given to one’s financial health. It can significantly influence the amounts offered and the conditions attached, making it essential to understand the nuances involved.

Acquiring a new set of wheels can be an exciting endeavor, but navigating the world of monetary agreements can be daunting. A key element that lenders focus on is the history of your financial dealings. This history not only reflects your reliability in repayment but also shapes the options available to you in your pursuit of vehicle ownership.

Understanding what numerical representation lenders use can empower you to make informed decisions. Having insight into how different values impact your purchasing power can ultimately lead to better choices and more advantageous agreements down the line. After all, who doesn’t want to drive off with the ideal car at the most appealing terms possible?

Understanding Ratings for Auto Financing

When it comes to securing financing for your vehicle acquisition, there’s an underlying factor that plays a vital role in determining the terms and conditions you’ll encounter. This aspect reflects your financial history and behavior, ultimately influencing how lenders perceive your reliability as a borrower. Let’s dive into what influences this numerical representation and why it matters in the realm of vehicle financing.

Altering Factors

Several elements contribute to this numerical value, including payment history, amounts owed, length of credit history, types of credit in use, and new credit inquiries. Each of these components adds depth to your financial profile, and understanding their individual impacts can empower you to make informed decisions when seeking funding.

Significance of a Favorable Rating

A high numerical value can open doors to competitive interest rates and better repayment terms. Lenders view individuals with solid financial backgrounds as lower risk, making them more likely to approve applications and offer favorable conditions. Conversely, those with less favorable numbers may face higher costs and restricted options, which can complicate the borrowing process.

Actionable Steps

Improving your financial rating is certainly achievable through effective strategies. Regularly checking your reports for errors, maintaining low utilization of available credit, consistently making payments on time, and avoiding unnecessary credit inquiries are all proactive steps you can take. By nurturing these practices, you set yourself up for enhanced opportunities when it comes time to finance your desired vehicle.

In summary, understanding this pivotal aspect of your finances is crucial when navigating the vehicle financing landscape. By taking the time to improve your financial standing, you position yourself for favorable outcomes and a smooth borrowing experience.

Factors Influencing Your Credit Rating

Your financial health is shaped by several elements that come together to form a personal profile. Understanding these components is essential, as they play a significant role in how lenders view you. Let’s break down what contributes to that all-important number that can impact your borrowing options.

Firstly, payment history is crucial. Consistently meeting your financial obligations demonstrates reliability and instills confidence in lenders. On the other hand, missed or late payments can adversely affect your standing, making it vital to prioritize timely bill settlements.

Secondly, your overall debt load matters. How much you owe compared to your total available credit is a critical metric. Keeping this ratio low signals to lenders that you are not overextending yourself, which can positively influence their perception.

Next up is the length of your financial history. Older accounts tend to boost your standing, as they provide a more extensive background of your financial behavior. Maintaining long-standing accounts can be beneficial, so think twice before closing those older cards.

Types of credit accounts also play a role. A diverse mix of borrowing options, such as installment loans and revolving credit, can be favorable. This variety showcases your ability to manage different forms of debt responsibly.

Lastly, inquiries into your financial background can impact your profile. When you apply for new credit, it often triggers a hard inquiry, which can slightly lower your rating temporarily. Being strategic about when and how often you seek new borrowing options can help maintain your standing.

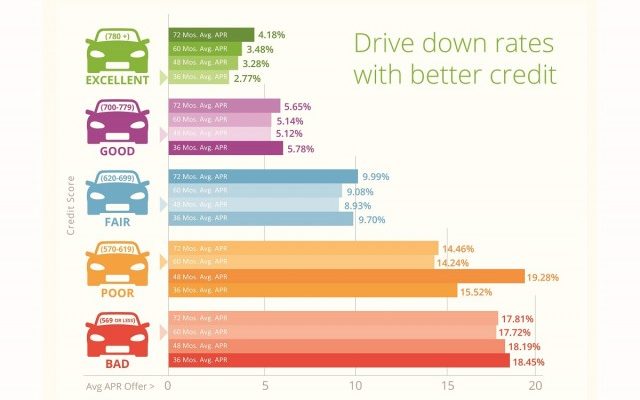

Impact of Ratings on Financing Conditions

Your financial reputation can greatly affect the terms of your financing agreements. When looking to secure funds for a vehicle, lenders often look closely at how you’ve handled credit responsibilities in the past. A strong financial background generally opens up opportunities for more advantageous conditions, while a weaker history might lead to higher costs and less favorable terms.