Top Credit Lines Available for Startups and New Businesses to Consider

Setting up a venture can be both exciting and challenging. Entrepreneurs often find themselves in need of financial resources to transform their innovative ideas into reality. With various alternatives available in the market, it’s crucial to understand which options can provide the most suitable support during those formative stages. Choosing the right solution can empower you to manage expenses efficiently while pursuing growth opportunities.

As you embark on this entrepreneurial journey, it’s essential to consider various funding avenues that cater to your unique needs. From traditional institutions to modern fintech solutions, the landscape offers an array of possibilities. Each option comes with distinct features, making it vital to evaluate how well they align with your objectives and operational model.

In this article, we will explore some of the most promising avenues of financial assistance tailored for those looking to establish or expand their ventures. By understanding the characteristics of each alternative, you can make informed decisions that will set your path to success. Let’s dive into some intriguing choices that might just be the ideal fit for you.

Choosing the Right Financing Option

When launching an entrepreneurial venture, selecting the most suitable method of financial support can feel overwhelming. There are numerous avenues available, each carrying its own set of benefits and potential drawbacks. It’s crucial to take the time to evaluate your specific needs and long-term objectives before making a decision. Understanding what options are out there can empower you to make informed choices that align with your goals.

Consider the fundamental aspects of your undertaking: how much financing you require, your anticipated timeline for repayment, and the level of risk you’re willing to embrace. These factors will guide you in narrowing down your choices. Additionally, think about whether you prefer flexibility in using the funds or a structured repayment plan. Assessing these elements is vital in determining which alternative will serve you best.

Don’t hesitate to explore various possibilities, including traditional lending institutions, alternative lenders, or even personal connections. Each route offers distinct advantages that might better suit your situation. Furthermore, seeking advice from financial experts or mentors can provide valuable insights, helping you to navigate the complexities of funding options efficiently.

Ultimately, the right choice hinges on aligning your financial strategy with your operational vision. Make sure to conduct thorough research and reflect on your circumstances. This thoughtful approach will position you to thrive as you embark on your entrepreneurial journey.

Understanding Credit Lines for Startups

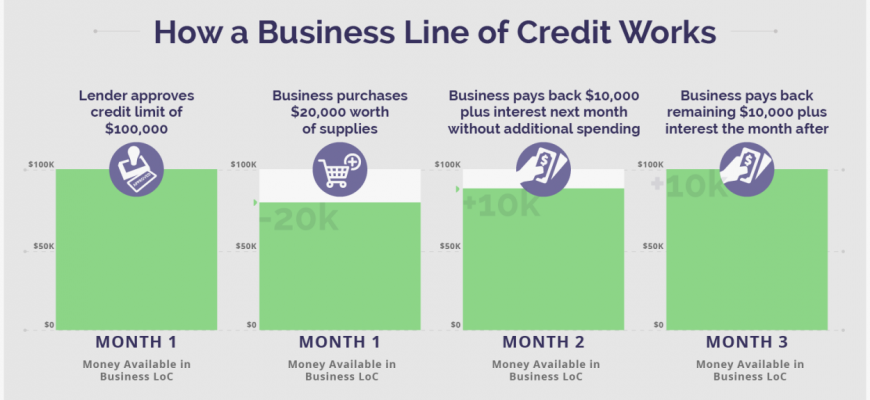

When embarking on an entrepreneurial journey, having access to resources that can provide financial flexibility is vital. Whether you are looking to cover initial costs or manage cash flow, it’s important to familiarize yourself with various options available to support your venture. This section will delve into the significance of these financial tools and how they can aid in navigating the early stages of your entrepreneurial efforts.

One of the appealing aspects of these financial instruments is their ability to give you a buffer during uncertain times. You don’t have to draw upon all available funds at once; instead, you can tap into resources as needed, which can help maintain liquidity. Understanding the terms and conditions associated with these offerings is essential to make informed decisions.

Additionally, establishing a good relationship with financial institutions from the outset can be beneficial. It builds trust and can lead to more favorable offers down the road. This relationship can also provide valuable insights and guidance as you navigate the complexities of financial management in your early days.

Ultimately, being well-informed about the types of support available allows you to plan effectively. Whether you’re considering specific facilities or just exploring options, ensure that you choose pathways that align with your goals and financial health. The right choices can set the foundation for a thriving venture.

Top Providers for Business Credit Solutions

When embarking on an entrepreneurial journey, having the right financial partnerships can make all the difference. Identifying organizations that offer flexible funding options tailored to your endeavor is crucial. The right solution will not only support your initiatives but also help you scale and respond to the ever-changing demands of the market.

Numerous institutions provide a variety of financial products designed to meet the unique needs of startups and growing enterprises. From established banks to innovative fintech companies, the landscape is diverse. Each of these options brings something different to the table, so it’s important to evaluate what aligns best with your objectives and financial strategies.

Some providers focus on traditional lending methods, offering secured options that might suit those with solid collateral. Others might specialize in alternative financing solutions, which can be particularly advantageous for those who prefer a more flexible approach. Understanding these offerings will empower you to make informed decisions that facilitate your growth journey.

In your search, consider factors such as repayment terms, interest rates, and customer service. Engaging with organizations that prioritize support can lead to a fruitful relationship. Ultimately, finding a match that believes in your vision will help you navigate the early stages of your venture with confidence.