Top Credit Options Available in Kuwait

When it comes to managing your finances, having the right options can make a world of difference. In today’s ever-evolving economic landscape, individuals and families are constantly on the lookout for innovative ways to make their financial dreams a reality. From personal loans to flexible payment plans, there are countless avenues to explore that can truly enhance your financial well-being.

Whether you’re planning a major purchase, looking to consolidate existing obligations, or simply seeking a safety net for unexpected expenses, understanding the diverse offerings available in the market is crucial. The landscape is rich with opportunities that cater to various needs, preferences, and income levels. It’s all about finding the right fit for your unique situation.

In this article, we will dive into some of the most appealing options you can consider, providing insights into what sets them apart. Knowledge is power, especially when it comes to financial choices, so let’s unpack the various alternatives that can help elevate your financial journey.

Top Financial Options in Kuwait

When it comes to managing your finances, having a variety of choices can make all the difference. In this section, we’ll explore some of the most popular avenues available for individuals seeking assistance with their monetary needs in this vibrant Gulf nation. Whether you’re looking for flexible packages or tailored solutions, there’s something for everyone here.

One of the first things to consider is personal loans, which are often favored for their straightforward application process and competitive rates. Institutions typically offer various sums, allowing you to borrow what you need while enjoying manageable repayment terms.

Another appealing alternative is installment plans. This option enables individuals to acquire goods and services without the need to pay the full amount upfront. By spreading out the payments into smaller, more manageable installments, you can easily budget your expenses and avoid financial strain.

For those looking to invest, options like Islamic finance products can provide a Sharia-compliant way to grow your assets. These financial instruments are designed to align with ethical principles while offering potential returns that can enhance your wealth over time.

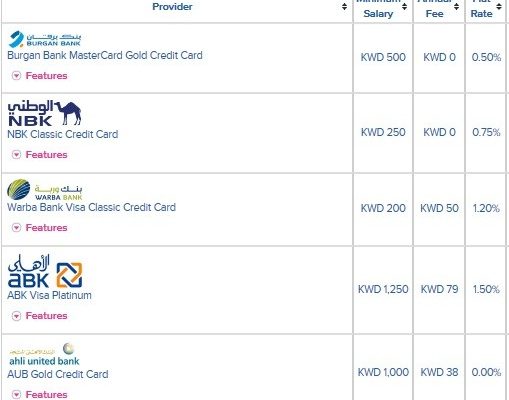

Lastly, credit cards remain a staple for many, providing convenience and rewards. With countless options to choose from, users can find a card that aligns perfectly with their lifestyle, allowing for both spending flexibility and bonus benefits.

Exploring different financial services can empower you to make informed decisions tailored to your specific needs. With so many options at your fingertips, taking the time to research and compare will certainly pay off in the long run.

Understanding Kuwait’s Credit Score System

When it comes to navigating the financial landscape, knowing how evaluation systems work can be crucial. These systems play a significant role in determining one’s ability to access loans, insurance, and other financial products. Grasping the mechanics behind these assessments can empower individuals to make informed decisions and manage their finances effectively.

In this particular region, the assessment process incorporates various elements, including repayment history, existing debts, and overall credit behavior. Organizations analyze this information to create a numerical value that reflects a person’s reliability in handling financial obligations. A solid understanding of this numerical representation can help in predicting how likely someone is to receive favorable terms on financial agreements.

Each institution may have its own criteria for what constitutes a good score, but generally speaking, higher figures indicate a lower risk to lenders. This can translate into better interest rates and opportunities for additional financing. Therefore, maintaining a healthy financial profile not only benefits individuals but can also enhance their chances of securing necessary support in the future.

It’s essential to stay proactive by regularly checking personal records and ensuring all payments are made on time. Addressing any discrepancies quickly can make a notable difference. By fostering a positive relationship with financial responsibilities, anyone can navigate this system more effectively.

Advantages of Managing Financial Resources Smartly

Making informed choices when handling borrowed funds can greatly enhance your financial well-being. Understanding the perks of strategic management allows individuals to navigate their monetary responsibilities more effectively. This approach not only aids in achieving immediate goals but also paves the way for a stable financial future.

Firstly, utilizing resources judiciously helps in building a solid reputation with lenders. A positive track record opens up more opportunities, such as lower interest rates and higher borrowing limits. This credibility can come in handy during emergencies or for larger investments down the line.

Additionally, wisely managing expenses can contribute to better budgeting. Regularly monitoring spending habits promotes awareness and enables individuals to allocate funds to essential needs, while minimizing unnecessary costs. This not only helps in maintaining a balanced budget but also encourages saving for future aspirations.

Moreover, having a well-thought-out plan can reduce stress associated with financial commitments. By anticipating payments and setting priorities, individuals can avoid last-minute scrambles and late fees, leading to a more relaxed and enjoyable life.

Lastly, harnessing the potential of borrowed sums can facilitate investment in personal growth. Whether it’s education, skill development, or launching a business, a well-executed financial strategy can create valuable opportunities that enhance one’s overall quality of life.