Top Credit Options for Young Adults Looking to Build Their Financial Future

Entering the financial world can feel like navigating a maze, especially when you’re looking to establish a solid foundation for future endeavors. There are numerous alternatives available to assist you in managing your finances effectively while building a reputation in the marketplace. It’s not just about securing funds; it’s about understanding the tools that can empower you and enhance your financial journey.

As you venture into this phase of life, exploring various funding solutions can open doors to numerous opportunities. Whether aiming to finance education, make important purchases, or simply gain experience managing financial responsibilities, knowing your options is crucial. The right financial instruments can bring benefits that last a lifetime and help you grow into a responsible economic participant.

With that in mind, it’s essential to familiarize yourself with the choices tailored to meet the unique needs of those starting out. Knowledge is power, and understanding how to leverage these opportunities can significantly impact your financial health. So, let’s dive into the landscape of financial options that can set you on the path to success.

Understanding Financing Options for Young People

Navigating the world of financing can feel overwhelming, especially for those just starting out. It’s essential to grasp the various choices available, as these can significantly impact future financial health. With a bit of knowledge and the right mindset, anyone can make informed decisions that set the stage for a solid financial foundation.

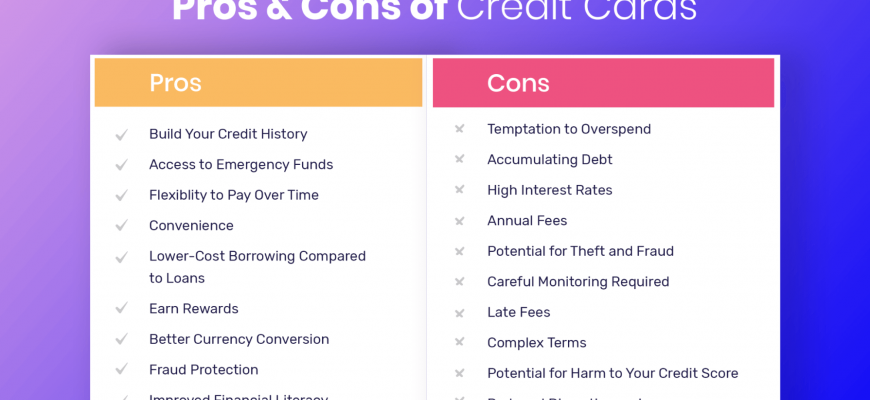

There are several avenues available to secure funds, each catering to different needs and circumstances. Some may prefer revolving accounts that offer flexibility, while others might opt for installment options that promote structured repayment. Understanding the pros and cons of each type can help in selecting what aligns best with personal goals.

Additionally, establishing a sound track record early on can open doors to better deals down the line. Factors like payment history and utilization can greatly influence future opportunities. Learning to manage these elements effectively can lead to enhanced financial possibilities in the future.

It’s also valuable to remain aware of the various institutions and their offerings. Some places may provide tailored products aiming to support novices in managing their finances. Being proactive in seeking options designed for those just embarking on their financial journey can make a significant difference.

Building a Strong Financial Reputation Early

Laying the groundwork for a solid monetary standing at a young age can significantly impact your future. Establishing a trustworthy record isn’t just about numbers; it involves creating habits that will benefit you long-term. When you start early, you set yourself up for better opportunities down the line, whether it’s securing a loan for a car or snagging that dream apartment.

One effective way to get started is through responsible management of small obligations, like a secured card or even a student loan. These ventures not only help you gain experience but also contribute positively to your track record. Remember, timely payments are key! They demonstrate reliability and build a favorable picture of your financial habits.

Additionally, keeping an eye on your report will help you understand how your actions affect your status. Regularly checking ensures that you’re aware of any discrepancies, and you can act quickly to rectify them. Being proactive shows lenders that you are engaged and serious about maintaining a healthy standing.

Lastly, don’t underestimate the power of good guidance. Having a trusted mentor can provide insights and strategies tailored to your situation. Learning from those who have navigated these waters can save you time and steer you clear of common pitfalls. The journey to building a strong financial foundation is continuous, and starting early makes all the difference.

Top Financial Products for Young Consumers

Navigating the world of personal finance can be daunting, especially when you’re just starting out. It’s essential to explore various financial offerings that cater to your needs, providing you with the tools to build a strong foundation. Let’s dive into some fantastic options available for those ready to take charge of their financial journey.

Here are some top-notch options worth considering:

- Checking Accounts: Look for accounts with no monthly fees and easy access to ATMs. Many banks offer special accounts tailored just for newcomers.

- Savings Accounts: A solid way to start saving money with features like competitive interest rates and minimal fees can boost your savings faster.

- Prepaid Cards: Great for managing your spending without the risk of overshooting your budget. They function like regular debit cards but with more control.

In addition to these basic offerings, there are specialized products designed to enhance your financial literacy and help you cultivate good habits:

- Budgeting Apps: These handy tools can help you track your expenses, set savings goals, and stick to a budget.

- Investment Platforms: For those interested in growing their wealth, look for platforms that allow small investments with user-friendly interfaces.

- Rewards Programs: Some financial institutions offer programs that give back cash or points for responsible spending, making every purchase more rewarding.

By choosing wisely among these options, you can create a strong financial profile that supports your aspirations and prepares you for future endeavors. The key is to stay informed and make choices that align with your unique situation.