Top Recommendations for Securing the Best Loan Credit Options

In today’s world, managing expenses can be a juggling act. Whether you’re planning to renovate your home, purchase a new vehicle, or need funds for unexpected bills, understanding the various avenues for financial support is crucial. With so many choices available, it can feel overwhelming to sift through different offerings and determine which ones truly suit your needs.

Exploring various types of financial solutions can help you make informed decisions that align with your unique situation. There are numerous providers out there, each with their own terms and conditions, interest rates, and repayment plans. With a little research and the right information at your fingertips, you can navigate this landscape and find what works best for you.

Let’s dive into the options available, explore key factors to consider, and empower you to secure an arrangement that supports your financial goals without unnecessary stress. After all, knowledge is power when it comes to making decisions that will impact your financial future.

Top Considerations for Loan Approval

When it comes to getting the green light for financial assistance, there are several key factors that play a significant role in the decision-making process. Understanding these elements can greatly enhance your chances of receiving a favorable outcome. Let’s dive into what you should keep in mind as you navigate this journey.

Income Stability is often the first thing that lenders look at. They want to know if you have a reliable stream of earnings that can support your repayment plan. It’s not just about the amount; consistency matter too. If you’ve been in the same job for a while or have a steady income source, it can work in your favor.

Credit History is another essential aspect. Lenders assess your past borrowing behavior to gauge your reliability. This is where maintaining a good payment record comes into play. If you’ve been punctual with payments and kept debts at manageable levels, you’ll likely leave a positive impression.

Debt-to-Income Ratio (DTI) is crucial as well. This number shows how much of your income goes toward existing responsibilities. A lower ratio indicates you have more capacity to take on additional financial obligations without overextending yourself, which is a reassuring sign for lenders.

Purpose of the Loan can make a difference too. Whether you’re looking to finance a home, pay for education, or cover emergencies, each reason has its own set of implications. Lenders may be more willing to assist when they understand the intended use of the funds clearly.

Lastly, Collateral plays a role if you’re considering a secured option. Providing assets can reduce the lender’s risk and may lead to better terms for you. Understanding these components can help you present a stronger case when seeking financial support. Being well-prepared is the key to achieving your goals.

Understanding Interest Rates and Fees

When it comes to borrowing money, it’s essential to grasp how the costs associated with it can impact your financial journey. The amount you repay doesn’t solely depend on the initial sum you receive. Various factors come into play, including how much extra you’ll end up paying over time. Let’s break down these aspects to help you make informed choices.

Interest rates are typically a percentage of the amount borrowed, representing the cost of taking on that money. They can vary significantly based on numerous variables, such as your financial history and the specific type of borrowing arrangement you opt for. Understanding how these rates fluctuate can help you plan effectively and manage your expenses better.

In addition to interest, you might encounter fees throughout the borrowing process. Some lenders charge an arrangement fee at the beginning, while others might impose penalties for late payments. It’s important to read the fine print and know what additional costs might arise, as these can greatly affect the overall expense of borrowing.

By staying informed about interest rates and fees, you position yourself to make savvy financial decisions and minimize the burden of repayment down the line.

Comparing Different Types of Financing Options

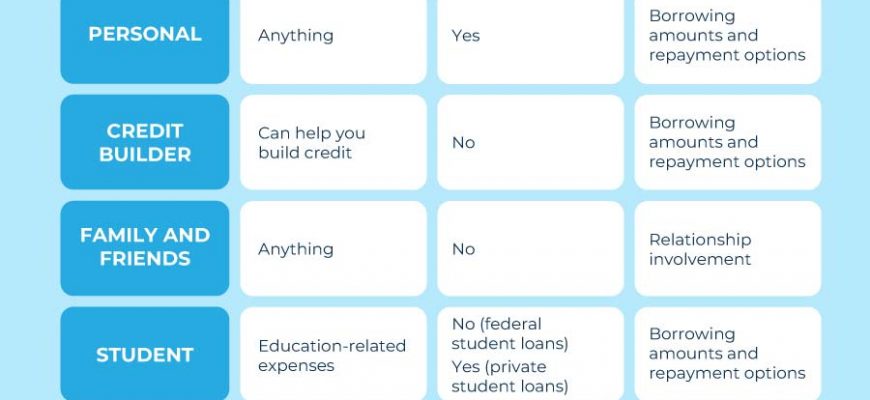

When it comes to exploring avenues for borrowing, understanding the various choices available can be a real game-changer. Each option comes with its unique features, advantages, and potential downsides, making it essential for individuals to weigh them carefully based on their personal circumstances and goals.

Personal loans are often a popular go-to. They can offer a lump sum amount which can be used for a variety of needs ranging from home renovations to consolidating debt. What’s great about them is the fixed interest rate, which allows for predictable monthly payments.

On the other hand, credit cards provide a revolving line of funds, giving users the flexibility to spend as needed up to a certain limit. This option can be suitable for smaller purchases or emergencies, but be mindful of potential high-interest rates if balances aren’t paid off quickly.

Home equity lines of credit (HELOCs) offer a way to leverage the value of your property. This option tends to have lower interest rates, as it’s secured by your home. However, it’s important to remember that failing to repay can put your house at risk.

Lastly, installment loans can also be appealing, particularly for those who prefer a structured repayment plan. These loans are typically disbursed in fixed amounts and paid back over a predetermined period, making budgeting a bit easier.

Ultimately, the best way to choose the right financing alternative is to consider your financial habits, the purpose of the borrowing, and how repayment will fit into your overall budget.