Top Credit Cards That Offer Exceptional Cash Back Rewards for Savvy Shoppers

Have you ever wondered how some people manage to get extra perks just by spending money? It’s a fascinating world where everyday purchases can yield tangible benefits, making your shopping experience not just about the items you buy but also about what you can gain in return. This article explores various avenues that allow individuals to maximize their spending, turning routine expenses into rewarding opportunities.

Imagine a scenario where your typical expenditures on groceries, dining out, or even online shopping come with bonuses. You can discover innovative financial tools that facilitate this process seamlessly. These options not only provide a simple way to save but also enhance your overall spending strategy.

Whether you’re a savvy shopper or someone just looking to get more from your purchases, understanding these reward mechanisms can significantly impact your financial journey. Let’s dive into the various alternatives that help you reap the benefits of your financial decisions while keeping your budget in check.

Top Cash Back Credit Cards

When it comes to maximizing your spending, there are certain financial tools that can really help you make the most of your purchases. These options offer rewards that can significantly enhance your budget. They essentially allow you to earn a portion of your expenses back in a convenient and rewarding way, making your everyday shopping a little more enjoyable.

First up, we have options that cater to everyday spending. These selections typically provide strong rewards for categories like groceries and gas, ensuring that routine purchases become an opportunity to earn. If you’re always at the store picking up essentials, these cards could be right up your alley.

Next, let’s look at those that shine during special promotions. Some offerings feature elevated rewards during particular periods or for specific categories, meaning you can often earn more when you plan your expenses around their offers. This can be a great way to leverage seasonal spending, especially during holidays or significant sales events.

Finally, there are options ideal for the world traveler. If you frequently find yourself booking flights or hotel stays, certain selections provide attractive incentives for travel-related expenses. Not only do you earn rewards on your travels, but you can also redeem them in ways that can enhance your adventures.

Choosing the right financial option really depends on how you plan to use it. Assessing your spending habits and preferences can help you select the perfect match for your lifestyle, ensuring you reap the most rewards possible.

How to Maximize Your Rewards

Getting the most out of your spending is all about strategy. By being smart about where and how you use your resources, you can significantly boost the perks you earn. It’s like playing a game where every decision counts; the more you think ahead, the better your results will be.

One effective approach is to identify categories that yield higher returns. Many programs offer enhanced points for specific types of purchases, such as dining, groceries, or travel. Tailoring your spending habits to align with these categories can lead to impressive returns.

Another tip is to always keep an eye on promotions. Sometimes, issuers run special campaigns that provide extra rewards for particular spending. Signing up for notifications can keep you in the loop, ensuring you don’t miss out on opportunities to earn more.

Additionally, consider consolidating your spending. Using one or two selected programs instead of spreading purchases across multiple options can help you reach bonus thresholds faster. Loyalty often pays off, so accumulating points in a single program can lead to more significant benefits.

Finally, don’t overlook the importance of paying your balance in full every month. Avoiding interest charges allows you to really enjoy the perks you earn, instead of seeing them eaten away by fees. A little diligence in managing your finances can turn your everyday purchases into a rewarding experience.

Understanding Rewards Programs

When it comes to making the most of your everyday spending, there’s a popular trend that many people are tuning into. Picture this: you make purchases you would normally buy, and in return, you receive a percentage of those expenses back in the form of rewards. Sounds appealing, right? These incentives encourage users to engage with certain financial options while providing added benefits along the way.

At their core, these programs are designed to help individuals earn extra value on what they spend. Whether it’s grocery shopping, filling up your gas tank, or dining out, the opportunities to accumulate rewards abound. As shoppers become more savvy, understanding how these systems work can really set you apart and elevate your financial game.

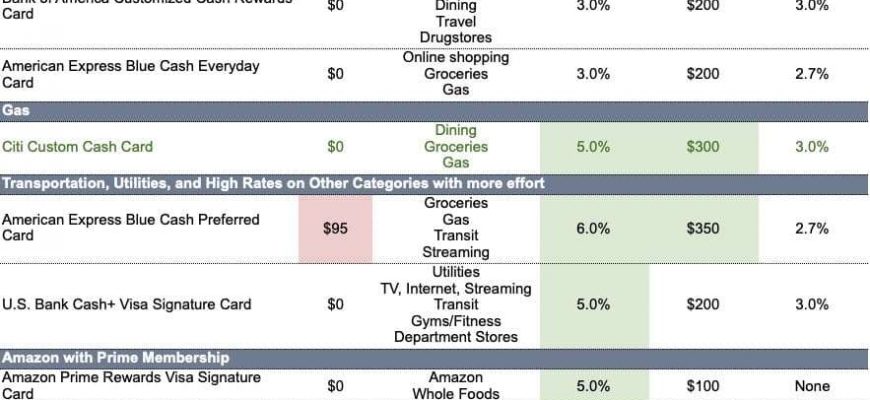

Diving deeper, it’s essential to recognize the varying options available. Programs can differ significantly from one provider to another, each offering unique terms and conditions. Some may feature higher percentages on select categories, while others provide flat-rate returns across all purchases. Being aware of these distinctions can help you select an option that aligns with your spending habits and maximizes your gains.

Additionally, keep an eye out for any caps or limits that might affect your earnings. Certain schemes might have monthly or annual thresholds, which could influence how much you can ultimately receive. Knowing these factors in advance can prevent any surprises when it’s time to redeem your rewards.

In the end, the key to optimizing your earnings lies in understanding how the system operates, recognizing your personal spending habits, and selecting the right program to fit your lifestyle. By keeping an informed approach, you can turn your routine purchases into a rewarding experience.