Effective Strategies for Writing the Ultimate Credit Dispute Letter

In today’s financial world, understanding how to effectively address inaccuracies in reports is crucial for maintaining a healthy fiscal profile. When you find yourself facing misleading information, the ability to articulate your concerns becomes an essential skill. Crafting your approach with precision can lead to positive outcomes that align with your financial goals.

Whether you are looking to rectify a misunderstanding or seeking acknowledgment for errors, the way you present your case can significantly impact the results. A well-structured approach not only conveys your points clearly but also demonstrates your commitment to resolving issues. Being direct, yet polite, is often the key to establishing a constructive dialogue.

In this journey, having a clear framework for your communication can make a world of difference. Exploring effective methods and templates can empower you to advocate for your rights with confidence. Maintaining an organized attitude while expressing your experiences can facilitate a smoother resolution process and foster a better relationship with financial institutions.

Crafting an Effective Credit Dispute Letter

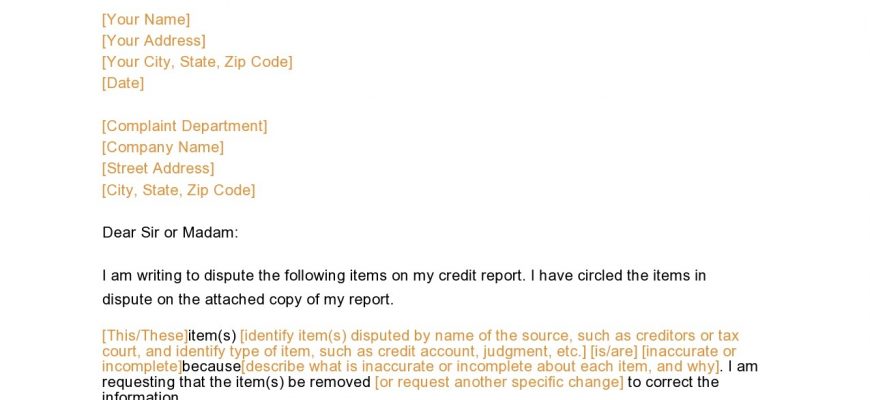

When you find inaccuracies in your financial record, addressing the issue promptly is crucial. Writing a well-structured communication can make a significant difference in how your concerns are perceived and handled. A clear, professional approach can expedite the resolution process and put you one step closer to correcting any misleading information.

Start by including your personal details, such as your name and address, at the top. This ensures that the receiving agency knows exactly who they are dealing with. Next, specify the inaccuracies you wish to contest–provide as much detail as possible, including account numbers and dates. This clarity helps to eliminate any confusion and provides a solid foundation for your case.

Supporting your claims with evidence is key. Attach any relevant documents that substantiate your position. This might include bank statements, letters from creditors, or any forms that validate your argument. Make sure you reference these documents in your communication to guide the recipient’s review of your situation.

Also, express your expectation clearly. Whether you seek a correction, removal, or clarification, being direct about your desired outcome can facilitate a smoother process. Lastly, don’t forget to include a polite closing statement. A courteous tone can open doors, often leading to more favorable responses.

By following these steps, you’ll create a compelling message that stands a better chance of achieving your desired results. Remember, clarity and professionalism are paramount when addressing these matters, ensuring that your rights and information are treated with respect.

Common Mistakes to Avoid in Disputes

Engaging in a process to correct inaccuracies in your financial statements can feel overwhelming, and it’s easy to make missteps along the way. Understanding what pitfalls to avoid can save you time and frustration, while also improving your chances of a favorable resolution. Here are some common errors you should be aware of when addressing discrepancies.

One frequent mistake is failing to gather all necessary documentation before initiating the process. It’s crucial to have clear evidence supporting your claim, whether it’s receipts, account statements, or communications with creditors. Without this information, your argument may lack credibility.

Another issue is not being specific enough in your communication. Generic statements or vague requests can lead to confusion and, ultimately, a rejection. Instead, focus on presenting detailed information about the inaccuracies and what corrections you seek.

Mistakenly overlooking deadlines can also jeopardize your efforts. Each organization has its own timelines for reviewing and responding to inquiries. Staying on top of these dates ensures that your case remains active and doesn’t fall through the cracks.

Lastly, staying emotionally charged can cloud your judgment. Approaching the situation with a calm, collected demeanor facilitates clearer communication and increases the likelihood of a productive outcome. Remaining professional, regardless of the frustrations you face, will serve you well in this challenging process.

Understanding Your Rights in Credit Corrections

When it comes to managing your financial reputation, knowing your entitlements is crucial. Mistakes in your records can significantly affect your financial future, and that’s where your rights come into play. It’s essential to grasp how you can address inaccuracies and ensure your information is accurate.

Here are some key points to consider regarding your entitlements in correcting financial inaccuracies:

- Right to Review: You are entitled to review your financial reports regularly. This allows you to spot any errors or discrepancies that may affect your credibility.

- Right to Correct: If you notice any inaccuracies, you have the right to request corrections. Institutions are obligated to investigate and rectify genuine errors.

- Right to Dispute: If you disagree with any item in your reports, you can challenge it. Ensure you provide necessary documentation to support your claim.

- Right to Be Informed: After disputing an entry, you should receive updates regarding the status of your correction requests.

Understanding these entitlements empowers you to take an active role in maintaining the accuracy of your financial details. Being informed not only helps in rectifying issues but also sets the groundwork for a healthy financial standing.