Top Credit Cards to Consider as We Approach 2025

As we approach the coming year, many individuals are reassessing their financial strategies and seeking ways to maximize their benefits. With numerous options available in the realm of financial tools, it’s crucial to understand which ones can truly enhance your purchasing power and provide valuable rewards. This exploration goes beyond simple transactions; it delves into how these financial instruments can significantly impact your overall financial health.

In an ever-evolving marketplace, consumers must stay informed about the various features and advantages that different financial solutions offer. From building credit history to enjoying exclusive perks, selecting the right option can lead to significant long-term gains. It’s not just about convenience; it’s about making informed choices that align with your lifestyle and spending habits.

Join us as we navigate through some standout options that can help you unlock rewards, save on expenses, and elevate your financial experience in the year to come. Whether you’re a seasoned user or exploring these opportunities for the first time, there’s something valuable waiting for everyone.

Top Features of 2025 Financial Tools

As we step into the new era of personal finance, the landscape of payment options is evolving rapidly. The tools that help manage our spending and rewards are becoming increasingly sophisticated, offering a range of exclusive perks and innovative functionalities. Let’s explore some of the standout characteristics that these financial solutions will bring to consumers in the year ahead.

One of the most anticipated upgrades is enhanced rewards systems that align more closely with individual spending habits. Instead of cookie-cutter points systems, expect personalized offers that cater to specific preferences, whether it’s dining out, travel experiences, or online shopping. This shift towards tailored benefits makes it easier for users to maximize their returns on everyday purchases.

Improved security measures are also at the forefront. Advanced technology such as biometric authentication, real-time fraud alerts, and virtual card numbers promise to deliver peace of mind when transacting online or in-store. As concerns about data breaches grow, these enhancements will become essential for consumers looking to safeguard their financial information.

Additionally, seamless integration with digital wallets and payment platforms is set to revolutionize ease of use. Expect a more fluid experience across devices, making it simpler to manage and monitor spending. This connectivity is not just about convenience; it also allows for smarter budgeting tools that help keep expenses in check.

Lastly, sustainability initiatives will be a significant focus. Many issuers are incorporating eco-friendly practices, such as using recycled materials for physical products or offering incentives for sustainable purchases. This shift reflects a broader commitment to social responsibility, appealing to environmentally-conscious consumers looking to make a positive impact.

Comparing Rewards Programs and Benefits

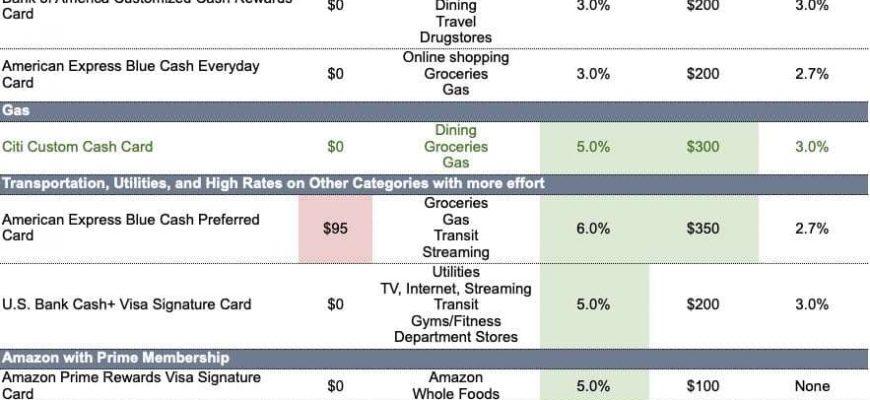

When it comes to maximizing your spending, understanding the different incentive structures can make a world of difference. Each option offers unique perks that can cater to various lifestyles and preferences. By delving into these programs, individuals can find which aligns best with their financial habits and goals.

Generally, there are two main types of value offerings: cash back and points or miles. Cash back is straightforward–earn a percentage of what you spend back into your pocket, making it an appealing choice for those who value simplicity. On the other hand, points and miles programs can lead to more substantial rewards through travel or merchandise, but they often require more effort to maximize their worth.

Another aspect to consider is the bonus opportunities that emerge from various activities. Some schemes may provide higher returns on specific categories like dining or groceries, while others might offer lucrative sign-up bonuses. It’s crucial to evaluate where you spend the most to ensure that the incentives match your lifestyle.

Additionally, look into the versatility of the rewards. Can they be redeemed easily for travel, gifts, or other experiences? The ease of redemption can significantly impact your overall satisfaction. A program that offers a rich array of options might just outweigh another that seems more generous on the surface.

Finally, keep an eye on any associated costs. Annual fees can sometimes counterbalance the benefits offered, so it’s essential to calculate whether the rewards you earn outweigh what you’ll spend on maintaining the account. Knowledge is power when it comes to making informed decisions that will ultimately enhance your financial journey.

Tips for Choosing the Right Card

When it comes to selecting the perfect financial tool for your needs, there are several factors to keep in mind. Understanding your spending habits, rewards potential, and fees associated with different options can make a huge difference in your overall experience. Let’s explore some helpful hints to navigate this process smoothly.

First and foremost, assess how you spend your money. If you frequently travel or dine out, look for options that offer enhanced rewards in those categories. On the other hand, if your expenses are more everyday-oriented, prioritize choices that maximize cash back on groceries or utility bills.

Next, don’t overlook the importance of fees. Annual charges, foreign transaction fees, and interest rates can significantly impact your financial situation. Aim for options that align with your budget and avoid those that can lead to unexpected costs.

Additionally, consider the introductory offers available. Many providers entice new users with bonuses or special promotions. These can kickstart your rewards journey, but be sure to understand the terms and conditions so there are no surprises down the line.

Finally, read reviews and gather opinions from trustworthy sources. Personal experiences can provide invaluable insights into how a particular option works in real life, allowing you to make a more informed decision tailored to your preferences.