Top Credit Card Options for Beginners in Building Their Financial Future

Starting your journey into the world of financial management can be both exciting and daunting. Finding the right resources and options can make a significant difference in how you navigate this new landscape. It’s essential to explore the various tools available that can help you build a strong financial foundation while also enhancing your buying power.

In this exploration, you’ll discover several options that cater specifically to those new to the scene. These selections not only offer convenience but also provide opportunities to establish a solid financial history. Understanding their features and benefits can empower you to make informed decisions as you embark on this path.

Whether you’re looking to manage your expenses effectively or earn rewards along the way, there are numerous choices out there. Each option has its unique characteristics, making it vital to find one that aligns with your individual needs and lifestyle goals. By taking the time to evaluate these possibilities, you can set yourself up for success in your financial endeavors.

Essential Features to Consider for Beginners

When diving into the world of plastic payments, it’s important to know what you should look out for. Many options can feel overwhelming, but understanding a few key elements can make your journey smoother and more rewarding.

Rewards Programs are among the first features to assess. Finding a program that aligns with your lifestyle ensures you earn benefits based on your spending habits. Whether it’s cash back, points, or travel perks, choose one that feels like it complements how you live.

Interest Rates play a crucial role in your financial journey. A lower rate can save you money in the long run, especially if you anticipate carrying a balance. Take the time to understand the terms and how they might affect you.

Annual Fees can sometimes be sneaky. Some options offer good perks, but if the fee is too high, it might not be worth it. Look for options with little to no annual cost, particularly when you’re just starting out.

Consider credit limit as well. A manageable limit can help you learn responsible spending without getting into trouble. It’s essential to find a balance that encourages good habits while not overextending your finances.

Lastly, look into customer support options. Having accessible help when you need it can provide peace of mind. Whether it’s chat services or phone support, knowing there’s someone to assist you can make a significant difference.

By focusing on these essential elements, navigating new financial pathways can become a more pleasant experience, setting a strong foundation for future decisions.

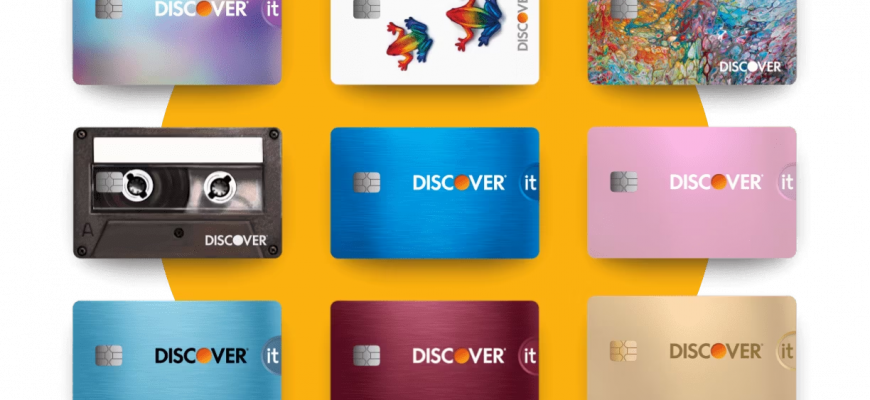

Top Credit Card Options for New Users

Embarking on the journey of managing finances can be exciting yet overwhelming. Selecting the right financial tools is crucial for establishing a solid foundation. In this section, we’ll explore some excellent selections designed for individuals just entering the world of personal finance, making it easier to navigate through various choices.

One option that many find appealing is a practical choice that often comes with rewards or cashback. These features allow users to earn benefits while making everyday purchases. For newcomers, this can be a great way to start building a positive financial history.

Another alternative includes options with low fees and straightforward terms. Such selections are perfect for those who prefer simplicity and clarity in their accounts. Opting for these can help avoid unexpected charges and cultivate responsible spending habits.

Furthermore, options that offer educational resources and support are worth considering. These tools can empower new users to learn more about effective financial management, budgeting, and using their chosen instrument wisely.

Lastly, keep an eye out for selections with minimal or no annual costs. This way, individuals can explore the benefits without worrying about recurring fees, making it easier to focus on developing good financial practices.

Building Credit History: Best Practices

Establishing a solid foundation in financial responsibility is crucial for future endeavors. Developing a reliable record of borrowing and repayment can open many doors, making it easier to secure loans, rent properties, or even land jobs that require a background check. It’s all about showing potential lenders that you can manage your finances wisely.

Start Small: One effective strategy is to begin with manageable obligations. This might mean taking out a small personal loan or using a revolving line of financing with a limit you can comfortably handle. Keeping your balance low relative to your limit shows that you’re using this tool responsibly.

Timely Payments: Consistently making payments on time is essential. Missing payments not only results in fees but can also damage your reputation. Set reminders or automate payments to ensure you never miss a due date.

Diverse Accounts: It’s beneficial to have a mix of different financial products. This can include loans, lease agreements, or other forms of agreements. Such diversity signals to lenders that you can manage various types of financial commitments effectively.

Regular Monitoring: Keep a close eye on your records. Regularly checking your reports allows you to spot any inaccuracies or signs of fraud early. You have the right to dispute any errors that may tarnish your standing.

Limit Applications: While it might be tempting to apply for multiple financing options, doing so can raise concerns among potential lenders. Each application generates an inquiry on your record, which can negatively impact your profile. Instead, be strategic and selective.

Educate Yourself: Knowledge is power. Take time to understand how financial systems work and the factors influencing your reputation. This insight can guide your decisions and help you build a stronger future.