Top Credit Card Options Available in Qatar for Your Financial Needs

Finding the right financial tool can significantly enhance your purchasing power and provide various benefits tailored to your lifestyle. Whether you’re planning a lavish getaway or just looking to make everyday purchases more rewarding, making an informed choice can truly transform your experience. Numerous options out there offer unique features, making it essential to understand what each has in store.

Local offerings play an important role in determining which financial products align with your needs. Considerations such as rewards programs, cashback incentives, and travel perks can be game-changers. As you navigate your options, keep in mind the specific features that resonate most with your financial behavior and personal preferences.

Beyond just financial transactions, these tools can also simplify your budgeting and expense tracking. Whether you’re an avid traveler, a food enthusiast, or someone who enjoys shopping, there’s something out there designed just for you. It’s all about discovering the right fit that not only meets your goals but also adds value to your everyday spending.

Top Rewards Options in Qatar

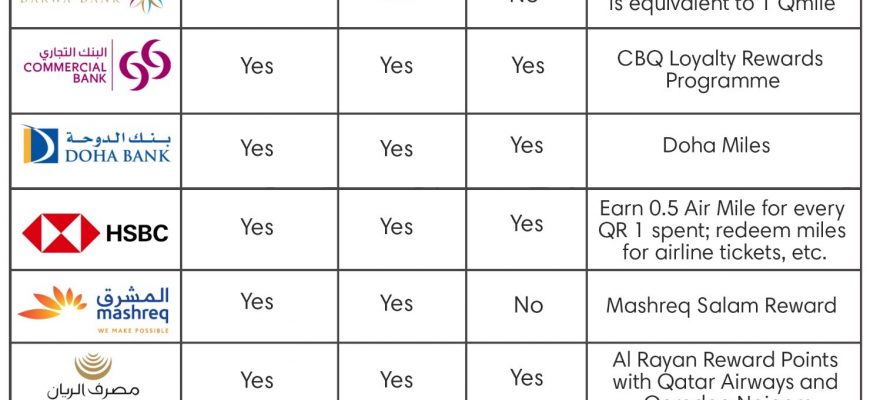

If you’re looking to maximize your benefits while spending, exploring the various reward programs available can be a game-changer. These financial products often come loaded with perks that can turn everyday purchases into exciting opportunities for savings, travel, or exclusive experiences. Understanding what’s out there will help you choose an option that aligns with your lifestyle and spending habits.

Many enthusiasts appreciate loyalty schemes that allow them to earn points on every transaction. These points can be redeemed for a wide range of rewards–from cashback to travel perks or even gifts. Depending on your preferences, you may find options that cater specifically to your lifestyle, whether you travel frequently, dine out often, or shop at particular retailers.

Furthermore, some of these offerings include additional benefits such as travel insurance, access to airport lounges, or special discounts at popular establishments. The key is to assess which features resonate with your needs while also providing excellent value over time.

As you navigate through the many offerings available, be sure to consider factors like annual fees, interest rates, and additional charges. This ensures that you choose a package that not only suits your spending patterns but also provides rewards that truly enhance your financial experience.

Travel Benefits of Qatari Banking Options

When embarking on journeys, having the right financial tools can significantly enhance your experience. Many financial offerings in Qatar come packed with perks tailored for travelers, making adventures both enjoyable and convenient. These perks often include exclusive access to lounges, travel insurance, and enticing rewards that can make your wanderlust even more fulfilling.

One of the standout advantages includes airport lounge access, which transforms the waiting experience into a relaxing escape. Imagine reclining in a comfortable environment with complimentary refreshments before your flight. This little luxury can set the tone for your entire trip.

Additionally, numerous offerings provide travel insurance, ensuring you’re covered for unforeseen events like delays or cancellations. This peace of mind allows you to focus on creating wonderful memories rather than worrying about the “what-ifs.”

Moreover, accumulating reward points for every purchase can lead to significant savings on flights, hotel stays, and even dining experiences in your favorite destinations. Over time, these rewards can turn into exciting travel opportunities, making your experiences even richer.

In summary, embracing the financial products available in Qatar opens doors to a world of benefits that can elevate your travel experiences, offering both comfort and security. So, whether you’re planning a quick getaway or a grand adventure, exploring these options is certainly worth your time.

Fees and Interest Rates Comparison

Understanding the costs associated with various financial products is crucial for making informed decisions. It’s not just about interest rates; fees can also significantly impact your overall experience. In this section, we’ll break down the different charges and rates you might encounter, helping you gauge which options align with your financial habits.

First off, let’s talk about annual fees. Some options come with a yearly charge, while others may be free of such costs. If you’re someone who values perks that come with certain accounts, it could be worth considering those with a higher annual fee, as they often offer more rewards or benefits. However, make sure the rewards justify the expense.

Next, we have transaction fees. Depending on where and how often you use your financial tool, these charges can add up quickly. Look out for foreign transaction fees if you travel frequently. Some offers waive these fees, making them more suitable for international use.

Of course, interest rates are another key factor. Lower rates mean you’ll spend less on borrowed funds, which can be a significant advantage if you carry a balance. It’s wise to compare the annual percentage rates (APRs) of different products to find the most favorable terms. Stay aware of introductory offers, too, as they can change after a specific period.

Lastly, always check for hidden costs. Some institutions may have various fees related to late payments, balance transfers, or even inactivity. Being aware of these can help you avoid those unexpected charges and manage your finances more effectively. By carefully considering all these elements, you can choose the option that best fits your financial goals.