Top Credit Card Options for Entrepreneurs Launching New Businesses

Starting a venture is an exciting journey that often comes with its own set of challenges and decisions. One crucial aspect that can significantly influence your path is how you manage your finances, especially when it comes to choosing the right tools to support your growth. Having the right financial resource at your fingertips can make a world of difference in your day-to-day operations and overall success.

With so many alternatives available, it’s essential to find the perfect fit for your unique situation. Whether you’re looking to earn rewards, manage expenses, or establish a solid financial foundation, selecting an appropriate option can help streamline your operations and enhance your cash flow management. In this exploration, we’ll delve into various offerings that cater to the needs of entrepreneurs eager to thrive in a competitive landscape.

Understanding the specific features, benefits, and potential drawbacks of these financial solutions is vital. Each selection can offer distinct advantages, from cashback incentives to travel perks, all aimed at optimizing your spending and supporting your ambitions. Let’s navigate through some outstanding choices that can pave the way for your enterprise’s success.

Top Features to Look For

When venturing into the world of financial tools for your entrepreneurial journey, it’s crucial to keep an eye on the specific attributes that can truly make a difference. Opting for the right options can not only help manage expenses but also streamline operations. Here are a few elements that can enhance your experience and offer the support your endeavor requires.

One valuable trait to seek is generous reward programs. These can add significant value by providing cashback or points that can be redeemed for various expenses. Additionally, consider whether the service offers flexible payment options. Having the ability to choose your payment schedule can help you maintain cash flow more effectively during fluctuating periods.

Another important factor is the level of customer support provided. Quick and helpful assistance can alleviate any potential issues, allowing you to operate with peace of mind. Furthermore, look into any promotional offers or introductory bonuses. These can give you a solid start by providing extra funds or benefits during initial stages of growth.

Lastly, don’t overlook the significance of low fees and competitive interest rates. Keeping costs down will provide more room for reinvestment into your venture, bolstering your chances for success. Remember, it’s all about finding the combination that aligns with your unique financial landscape.

Popular Financial Solutions for Startups

When launching a venture, having the right financial tools at your disposal can make a world of difference. Many startups find themselves exploring various options that not only provide flexibility but also help grow their resources. Let’s take a closer look at some options that are particularly appealing to those stepping into the entrepreneurial landscape.

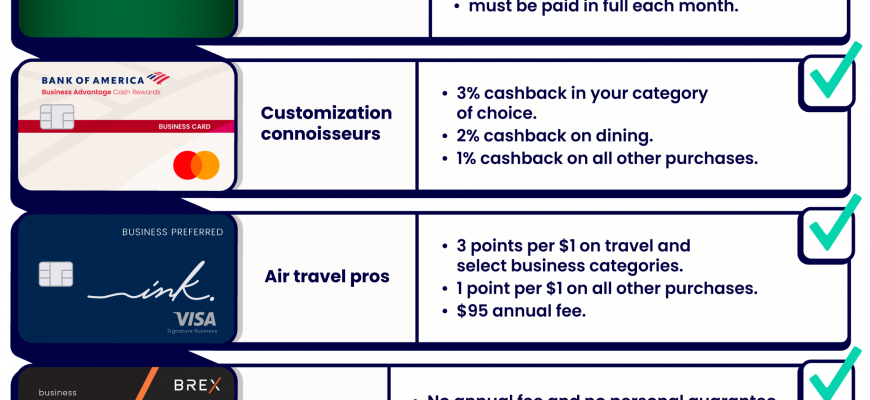

One notable choice among entrepreneurs is a solution that offers generous rewards on everyday purchases. This can be especially useful for covering initial expenses, allowing startups to earn while they spend. Additionally, some options may provide bonuses for meeting specific spending thresholds, giving an extra financial boost when it’s most needed.

Another attractive feature often highlighted by founders is the user-friendly management tools. Many of these financial products come with easy-to-navigate online platforms or mobile applications, which make tracking expenses and budgets a breeze. This saves valuable time and helps owners focus on growing their enterprises.

Furthermore, it’s crucial to consider the perks associated with each financial option. Some may offer benefits like no annual fees or introductory offers that provide discounted rates for an extended period. Others could present additional services, such as travel insurance or purchase protections, which can provide peace of mind as entrepreneurs embark on their journey.

Ultimately, choosing the right financial solution requires careful consideration of the unique needs and goals of your venture. It’s worth investing time to explore the various avenues available, ensuring that your choice aligns well with your aspirations and can support you in achieving your vision.

Advantages of Utilizing Business Charge Options

Choosing a financial solution designed for enterprises can greatly enhance your operations. These tools offer a variety of perks that can streamline expenses, simplify accounting, and even provide rewards that contribute to growth. By leveraging these features, entrepreneurs can effectively manage their finances while reaping additional benefits that support their objectives.

One of the most significant advantages is the ability to separate personal and company expenses. This distinction not only helps with transparency but also simplifies tax season, as transactions are neatly organized. Additionally, many institutions provide valuable rewards programs that allow users to earn cash back, points, or travel perks, transforming everyday purchases into potential savings or experiences.

Another noteworthy aspect is the access to credit limits that may exceed personal options, providing businesses with the flexibility to handle larger expenditures without immediate impacts on cash flow. Moreover, reporting to commercial credit bureaus can help establish and improve a company’s credit profile, paving the way for future expansions or financing opportunities.

Lastly, enhanced security features are often included, such as fraud protection and employee cards with customizable limits. This ensures better oversight of spending, allowing for more secure and controlled financial management. Overall, tapping into these financial offerings can be instrumental in achieving stability and growth for any venture.