Top Credit Cards Offering Generous High Limit Options for Savvy Consumers

In today’s fast-paced world, having access to enhanced purchasing power can be a game-changer. Many individuals are on the lookout for opportunities to expand their financial flexibility without the usual restrictions. Whether it’s for unexpected expenses, travel plans, or simply enjoying life without constantly worrying about available funds, knowing your options can make all the difference.

Finding the right options can open doors to exciting experiences and provide a safety net during challenging times. As you explore various financial tools, it’s essential to consider not just the convenience but also the benefits and rewards that come with them. Certain offerings stand out when it comes to granting larger amounts of capital to spend, making financial transactions smoother and more enjoyable.

With an array of choices available, understanding what to look for can empower you. From perks to interest rates, the landscape is rich with potential. Whether you’re a frequent traveler, a savvy shopper, or someone who appreciates the finer things in life, there’s something tailored just for you. Embrace the opportunity to elevate your economic journey and navigate the landscape with confidence!

Top Features of High Limit Credit Options

When it comes to premium financial tools, there are certain characteristics that set them apart from the regular offerings. These standout features not only enhance the user experience but also provide specific perks that cater to those with greater spending power. Understanding these attributes can help potential users make informed decisions about their financial choices.

Exclusive Rewards Programs play a significant role in attracting users. Many of these options offer generous points or cashback on purchases, especially in categories like travel, dining, and entertainment. This makes each transaction not just a payment, but a step towards exciting rewards.

Enhanced Security Features are another hallmark of these financial instruments. Robust fraud protection measures, such as real-time alerts and advanced monitoring systems, ensure that users’ financial information remains secure. Many providers also offer virtual account numbers for online purchases, adding an extra layer of safety.

Travel Benefits often come with premium cards, including complimentary travel insurance, access to exclusive airport lounges, and discounts on hotel bookings. These advantages make life easier for frequent travelers, providing convenience and peace of mind during their journeys.

Higher Spending Flexibility is a key selling point. Users can enjoy larger purchasing power without the need to worry about hitting a cap, allowing them to make significant investments or cover unexpected expenses conveniently.

Lastly, dedicated customer support is crucial. Many of these offerings provide round-the-clock assistance, ensuring that users have help whenever they need it. Having access to expert guidance can make all the difference when navigating complex financial situations.

In summary, these options are defined by various impressive features that enhance the overall user experience, making them appealing choices for those seeking more from their financial tools.

Eligibility Criteria for High Limit Accounts

When you’re looking to secure a financial product that offers substantial financial flexibility, understanding the requirements is essential. Different issuers have specific standards that potential users need to meet in order to qualify for larger borrowing capacities. It’s not just about your income; various factors come into play, and having a clear grasp of these can greatly enhance your chances of approval.

Firstly, your credit history plays a pivotal role. A solid track record of timely payments and responsible use of previous accounts indicates to lenders that you are a trustworthy borrower. They often evaluate your credit score, looking for signs of stability and financial responsibility.

Secondly, income levels matter significantly. Lenders want to ensure that you have the means to repay any balances. A steady flow of income can make a marked difference, as it shows significant financial capability. Documentation of your earnings may be required during the application process.

Additionally, existing debts can influence your application. If you have too many outstanding obligations, it might raise red flags for lenders. They typically analyze your debt-to-income ratio to gauge your financial health and ability to take on more responsibilities.

Lastly, the duration of your credit history is also scrutinized. A longer, stable history often improves your attractiveness as a candidate. New users or those without a diverse range of accounts may face challenges, as lenders prefer individuals with a well-established financial background.

Comparing Benefits Across Different Issuers

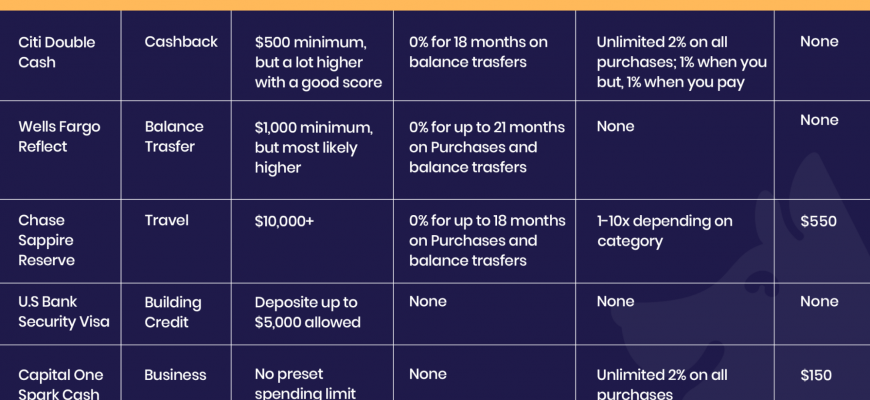

When it comes to selecting a suitable financial product, it’s essential to weigh the advantages offered by various providers. Each institution has its own unique set of features, rewards, and perks. Understanding these differences can significantly impact your experience and satisfaction.

Here are some key factors to consider when evaluating offerings from different issuers:

- Rewards Programs: Some issuers provide cashback, while others focus on travel points or exclusive discounts. Identifying what aligns with your spending habits can lead to better value.

- Fees: It’s crucial to examine any annual fees, foreign transaction charges, or late payment penalties. Lower fees can enhance overall benefits.

- Introductory Offers: Many institutions entice new users with promotional bonuses. Look for sign-up incentives, such as bonus points or cashback on your first purchases.

- Customer Service: Excellent support can make a difference. Consider institutions with responsive channels for assistance, whether it’s phone, chat, or app-based.

- Additional Perks: Many issuers offer extras like travel insurance, purchase protection, or access to exclusive events. Evaluating these perks can add substantial value.

By comparing these various attributes, you’ll be better positioned to choose an option that meets your needs and preferences. Don’t hesitate to dig deeper into what each issuer has to offer; it can make a significant difference in your financial journey.