Top Credit Card Deals Available in Singapore Right Now

When it comes to managing your finances, there are numerous tools that can help you make the most of your spending. Whether you’re planning a trip, making a major purchase, or simply looking to maximize your everyday expenses, having the right financial instrument can provide you with rewards, benefits, and ease of use. With an array of choices available, it’s essential to navigate this landscape wisely.

Unlocking the potential of these tools can lead to significant savings and perks. Imagine earning cashback on your everyday purchases or accumulating points that take you on your dream vacation. The key is to find solutions that align with your lifestyle and spending habits. Tailoring your financial decisions can significantly enhance your overall experience.

In a dynamic environment where options abound, knowing where to look for valuable resources is crucial. From introductory promotions to loyalty programs, there’s a wealth of opportunities waiting to be discovered. Equip yourself with the knowledge to choose the most advantageous tools, and you’ll be well on your way to smart financial management.

Top Features of Financial Cards in Singapore

When it comes to financial tools available in the market, there are some standout qualities that can greatly enhance your spending experience. These attributes not only provide convenience but also maximize the value you derive from your daily transactions. Let’s dive into the key characteristics that make these tools exceptional choices for consumers.

Rewards Programs: Many options available today come with attractive rewards schemes. You can earn points, cashback, or miles for every purchase, turning your everyday spending into exciting benefits. This not only incentivizes spending but also allows you to save on future purchases or enjoy travel perks.

Exclusive Promotions: Users often gain access to special deals and discounts at a variety of merchants. By taking advantage of these promotions, it’s possible to enjoy significant savings on dining, shopping, and entertainment, making your money go further.

Security Features: In today’s digital world, having robust security measures is crucial. Look for products that offer advanced protection against fraudulent activities, such as monitoring alerts and zero-liability policies. This ensures peace of mind while managing your finances.

Flexibility: The ability to customize your account settings according to your preferences is a significant advantage. Whether it’s adjusting spending limits or choosing payment due dates, having this level of control can help you manage your finances more effectively.

Travel Perks: For those who love to explore, certain financial instruments offer fantastic travel-related benefits. These may include complimentary travel insurance, airport lounge access, and no foreign transaction fees, making your journeys smoother and more enjoyable.

Understanding these essential features can help you make informed decisions when selecting your next financial companion. Embrace the myriad of advantages that these products bring to the table and enhance your overall financial management experience.

Comparing Rewards Programs on Financial Products

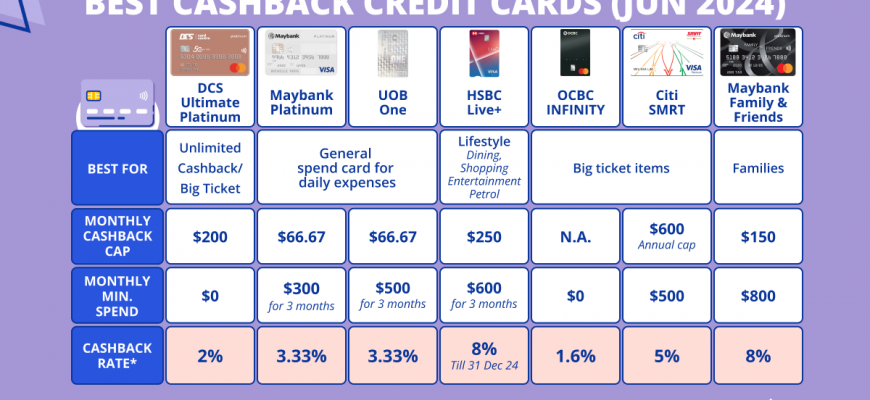

When it comes to choosing the right financial tool for your everyday spending, understanding the different reward structures can make a significant difference. Each provider has its own unique system to entice users, which can include cashback, points, or miles. It’s essential to take a closer look at these programs to find the one that aligns with your spending habits and lifestyle needs.

One of the first things to consider is how rewards are earned. Some programs offer higher returns for specific categories like dining or travel expenses, while others provide a flat rate across all purchases. This distinction can be crucial depending on where you spend most of your money. Additionally, pay attention to any limits or caps on earnings, as they can impact the total benefits you receive over time.

Another vital aspect is redemption options. A program may offer generous rewards, but if the redemption process is convoluted or if the options are limited, you may find it less appealing. Look for flexibility in how you can use your points or cash back–whether it’s for travel, shopping, or other experiences can really enhance the value of the program.

Lastly, it’s worth comparing any fees associated with maintaining these financial products. Sometimes, a slightly higher annual fee might be justified if the reward potential outweighs the cost, but other times, it could negate any benefits. Evaluating these factors will help you make a well-informed choice that maximizes your rewards potential.

Top Low-Rate Financial Solutions

When it comes to managing expenses, finding a solution with lower charges can really make a difference. For those who want to minimize the cost of borrowing, there are several options available that feature attractive interest rates. This section aims to explore the options that could lighten your financial load while still providing essential benefits.

Here are some features to consider when looking for favorable interest alternatives:

- Introductory Rates: Look for options that offer attractive initial rates for new clients, which can significantly reduce costs in the beginning.

- Balance Transfer Deals: Some options might allow you to transfer existing debt with lower rates, helping you manage and reduce your overall financial obligations.

- Annual Fees: Take note of solutions that offer low or waived annual charges, which can further decrease overall spending.

- Payment Flexibility: Look for solutions that allow various payment plans to help you manage your finances more easily.

By carefully evaluating the available options, you can choose a plan that aligns with your financial goals and offers relief from high rates. Remember that it’s crucial to read the fine print; understanding terms can help you make informed decisions and avoid unexpected surprises down the road.