Top Credit Card Deals to Look Out for in 2025

As we step into a new era of financial opportunities, many individuals find themselves on the lookout for advantageous solutions that can enhance their purchasing power and overall economic experience. With a variety of compelling alternatives available, it’s essential to understand how to navigate through the options that could elevate your financial strategy. Whether you’re aiming for rewards, low interest, or exclusive perks, this guide will help you make informed decisions.

There’s a wealth of tools designed to cater to diverse needs and preferences, and discovering the right one can feel a bit overwhelming. However, with a little insight, anyone can uncover the gems that align with their lifestyle and financial habits. It’s not just about selecting a product; it’s about finding the one that suits you perfectly and contributes to a brighter financial future.

In this exploration, we’ll dive deep into the available selections and highlight features that stand out. From cashback opportunities to travel incentives, understanding what’s out there and how each option can benefit you is crucial. Get ready to embark on a journey that aims to empower you financially and open doors to new possibilities!

Top Rewards Credit Cards for 2025

When it comes to maximizing your financial potential, choosing the right payment solution can make all the difference. Many options out there offer various benefits that can enhance your everyday spending experience. Whether you’re looking to earn cash back, travel perks, or exclusive discounts, there’s something to suit every lifestyle.

Rewards programs have grown increasingly competitive, providing enticing incentives for users to make the most of their transactions. These programs often come with features that can help you accumulate points or rewards faster than ever before. It’s all about finding the right fit that aligns with your habits and preferences.

Additionally, many of these solutions come with other attractive features, such as introductory bonuses or flexibility with redemption options. It’s essential to analyze the terms and conditions to ensure you’re getting the maximum benefits without incurring unnecessary costs. Keep an eye on annual fees, interest rates, and any foreign transaction charges that might catch you off guard!

As you navigate through the options, consider your spending patterns and the types of rewards you value most. With the right strategy, you can turn daily expenses into significant rewards that enhance your lifestyle. Remember, it’s not just about spending money; it’s about making every dollar work harder for you.

Low Interest Rate Options You Need

When it comes to managing finances, finding a solution with manageable rates can be a game changer. If you’re someone who often carries a balance, you understand how crippling high rates can be. The good news is, there are some fantastic options out there designed to ease the burden of interest while still providing flexibility for your spending needs.

These products typically offer lower rates, making it easier to pay down balances without accruing excessive charges over time. Whether you’re looking to make a large purchase or simply want to consolidate debt, opting for a plan with reduced rates can save you significant amounts in the long run. It’s all about making strategic choices to improve your financial health.

Many of these selections also come with perks, such as rewards programs or introductory offers, which can enhance their appeal. As you explore your financing possibilities, keep an eye out for features that not only lower your interest expenses but also add extra value to your everyday spending. Smart decisions now can lead to a more secure financial future.

Top Cash Back Choices of 2025

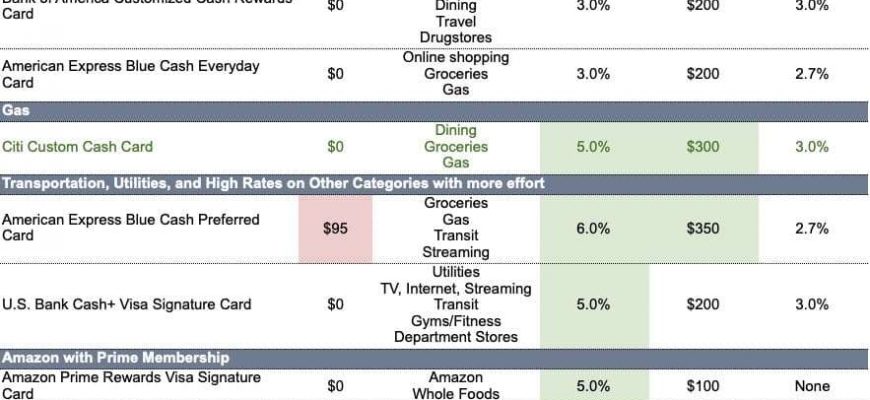

When it comes to maximizing your returns on everyday spending, there are a variety of exciting options available that make your money work harder for you. Many find joy in earning a little something back on routine purchases, and understanding these alternatives can lead to significant savings over time. Let’s dive into some of the most rewarding choices that will help you reap the benefits of your spending habits.

In today’s competitive landscape, numerous providers cater to those who love to earn rewards while maintaining a straightforward approach. Look for options that offer generous percentages on key categories such as groceries, gas, dining, and more. This way, you can easily boost your earnings with every transaction you make. Whether you’re a frequent traveler or someone who enjoys dining out, there’s likely an appealing selection tailored to your needs.

Another aspect to consider is how these rewards are structured. Some options provide a flat rate across all purchases, while others may focus on specific categories where you can earn even more. It’s worth evaluating your spending habits to determine what suits you best. And remember, many of these programs come with sign-up bonuses, offering an extra incentive to join the ranks of savvy spenders.

Ultimately, the key is to choose a solution that aligns with your lifestyle, allowing you to enjoy the perks of cash back without convoluted processes. With a little research and consideration, you’ll soon find an option that turns your everyday expenses into valuable rewards, making every purchase feel a bit more worthwhile.