Top Credit Card Options to Maximize Benefits for Small Business Owners

When navigating the world of entrepreneurship, having the right financial instruments can make all the difference. With a multitude of options available, selecting an ideal solution tailored to your company’s unique needs can seem daunting. Different alternatives come with varying benefits that can enhance your operations and streamline your spending.

It’s crucial to identify what features matter most to you. Whether you prioritize rewards programs, low interest rates, or expense tracking capabilities, understanding your requirements will guide your selection process. Additionally, keeping an eye on terms and conditions is vital, as these can significantly impact your financial health over time.

In the end, the right financial companion can empower you to effectively manage your expenditures, facilitate growth, and ultimately contribute to your success. Exploring the landscape of available options will not only equip you with knowledge but also provide peace of mind as you make informed choices for your venture.

Essential Features of Business Credit Cards

When managing a venture, having the right financial tools can make all the difference. Certain qualities can enhance your experience and help streamline your operations. Understanding what to look for can empower you to make informed choices that suit your unique needs.

Rewards Programs are often a standout feature. Many financial products come with points or cashback incentives, allowing you to earn benefits on your everyday spending. This can translate into valuable savings or perks that align with your company’s goals.

Expense Tracking is another significant aspect. A good option provides clear reports and categorization, simplifying how you manage finances. This feature can save time and reduce headaches during tax season or when creating budgets.

No Annual Fees can be a game-changer. Some choices come with zero yearly costs, which can help maintain a healthier budget. Eliminating unnecessary expenses allows for better resource allocation within your organization.

Introductory Offers frequently attract attention. Promotional rates on interest can give you breathing room to pay off initial purchases. These enticing deals can offer great advantages when starting or expanding your venture.

Flexibility and Usability are paramount as well. A suitable option will be widely accepted across different platforms and locations. This versatility can ease transactions, ensuring you have what you need when you need it.

Finally, Customer Support should not be overlooked. Having responsive help available can resolve issues promptly and keep operations running smoothly. Reliable service can enhance your experience and provide peace of mind.

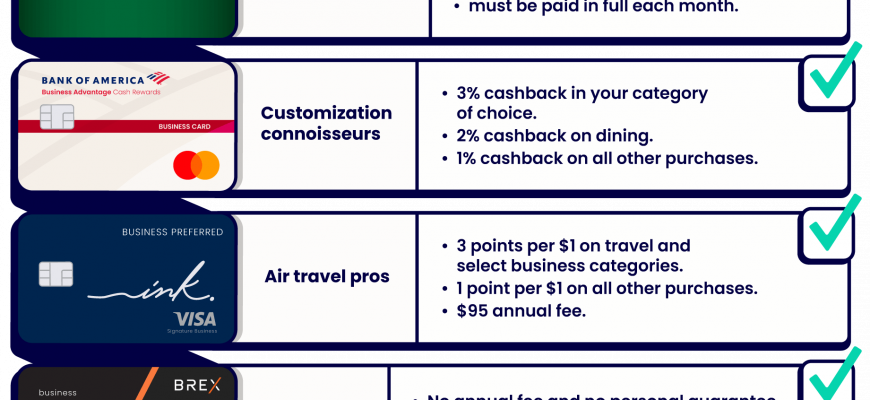

Comparing Top Business Credit Card Options

When it comes to choosing the right financial tools for enterprises, it’s essential to evaluate various alternatives thoroughly. Different offerings provide unique features that cater to the diverse needs of various organizations. Making an informed decision can significantly enhance your financial management and benefits.

Some key factors to consider include rewards programs, interest rates, annual fees, and additional perks that might ease the management of expenses. For instance, certain options may offer cashback on specific purchases, while others might present travel rewards or enhanced reporting tools.

Moreover, it’s crucial to assess any introductory promotions that can give you a head start. Understanding how each option aligns with your financial goals and spending habits will empower you to select an option that suits your operational requirements.

In conclusion, comparing different financial products carefully allows you to identify which one will align with your company’s vision and support its growth effectively. Whether you’re looking to maximize rewards or streamline expense tracking, there’s likely a suitable choice waiting for you.

Maximizing Rewards for Your Company

When it comes to enhancing your company’s spending power, finding ways to earn more from every dollar spent can make a significant difference. This approach not only contributes to your bottom line but also provides extra benefits that can be utilized for various needs, from travel to office supplies.

First things first: understanding the different reward structures available is essential. Some programs focus on cash back, while others offer points that can be redeemed for travel or merchandise. Choosing a program aligned with your company’s spending habits can lead to greater returns. For instance, if your team spends a lot on travel, selecting an option that offers travel rewards could help save on future trips.

Next, don’t overlook the power of sign-up bonuses. Many programs offer attractive rewards for new users who meet certain spending requirements within the first few months. Taking advantage of these promotions can significantly boost your overall benefits right off the bat.

Additionally, consider utilizing multiple rewards platforms. By strategically dividing your expenditures among them, you can maximize the rewards earned across different categories, ensuring that every purchase you make contributes to your cumulative benefits.

Lastly, staying informed about promotional offers is key. Many programs run limited-time promotions that can amplify the rewards earned on specific purchases. Keeping an eye on these opportunities can provide your company with unexpected advantages that enhance your financial strategy.

You’ve done it again! This was so captivating from start to finish. You’re incredibly talented!

Her confidence and grace are so inspiring. She radiates beauty inside and out;and this video captures it all perfectly. Just wow!