Top Credit Cards in Australia for Maximizing Reward Points

In today’s world of finance, many people are looking for ways to enhance their purchasing power while enjoying various benefits. The market offers a plethora of options designed to help individuals get more bang for their buck, providing exciting avenues to earn rewards through their everyday spending. This section delves into the options that allow savvy consumers to leverage their buying habits into enticing rewards.

Imagine being able to turn your routine purchases into amazing rewards like travel experiences, generous discounts, or exclusive offers. With the right tools in your wallet, you could embark on journeys, indulge in gourmet dining, or simply enjoy the satisfaction of knowing you’ve made wise choices in your financial dealings. Let’s explore the features and perks that can elevate the everyday purchasing experience into something truly rewarding.

From enticing bonus opportunities to unique redemption options, the landscape of rewards schemes is both vast and varied. Understanding the nuances of each alternative can significantly impact your ability to earn and redeem effectively. Join us as we navigate through the various offerings that promise not just utility, but also a touch of luxury in everyday life.

Top Rewards Options in Australia

When it comes to maximizing your spending, selecting the right financial tool can make a significant difference. Many individuals seek opportunities to earn valuable rewards, and there are various alternatives available in the market that cater to this desire. These offerings not only provide a way to earn perks but also come with different benefits tailored to diverse lifestyles and spending habits.

Among the array of choices, some stand out due to attractive bonuses, flexible redemption options, and additional features. Whether you’re a frequent traveler or someone who enjoys dining out, finding the right fit can enhance your experience and help you gain more from every purchase. It’s essential to consider your own preferences and how you plan to make the most of these offerings.

Additionally, many of these options come with added advantages such as travel insurance, purchase protection, and no foreign transaction fees, which can further elevate their appeal. By understanding the various available options, you can choose one that aligns perfectly with your financial goals and lifestyle aspirations.

Maximizing Points Accumulation Strategies

When it comes to enhancing your rewards experience, there are several tactics to consider. These methods allow you to make the most of your spending habits and unlock exciting perks or experiences more quickly. By following a few simple strategies, you can increase your earning potential significantly.

Utilize Bonus Offers: Many institutions provide promotional deals that can substantially boost your overall yield. Keep an eye out for limited-time opportunities that award extra rewards for specific purchases or for reaching certain spending thresholds within a designated timeframe.

Everyday Spending: Make it a habit to use your rewards program for regular expenses, such as groceries or gas. This way, you are not only accumulating rewards on necessary purchases but also leveraging every dollar you spend.

Strategic Categories: Some programs offer higher returns on specific categories. Familiarize yourself with these and align your spending accordingly. This often includes frequent purchases, such as dining or travel-related expenses, where you can capitalize on enhanced rewards.

Combine Programs: If you have multiple rewards systems, think about how you can combine them to maximize your benefits. Transfer your accumulated rewards between different programs, or consider using one program for specific purchases while utilizing another for various expenditures.

Monitor Expiry: Keep track of your accumulated rewards and any expiration dates. Staying aware of this can prevent you from losing out on valuable perks that could enhance your experience.

Referral Bonuses: Take advantage of bringing in friends or family. Many plans offer bonuses when you refer new members. This can significantly add to your total rewards over time.

By implementing these strategies, you can supercharge your rewards journey and enjoy the many benefits that come along with it.

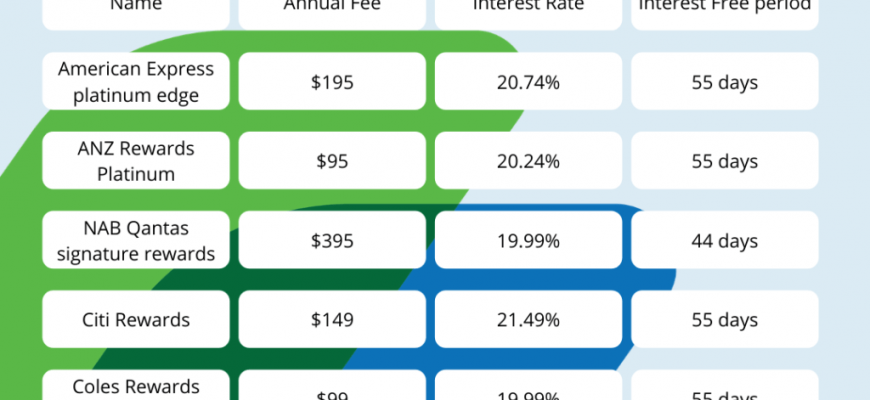

Comparing Fees and Interest Rates

When it comes to selecting the right financial product, understanding the various charges and interest implications is crucial. Each option comes with its own set of fees that can affect your overall experience and savings. The goal is to find something that not only rewards you but also aligns with your spending habits without draining your wallet.

Annual fees can vary significantly among offerings. Some options may present a low initial fee, while others might carry a higher charge but offer substantial rewards in return. It’s essential to weigh these costs against the potential benefits you’ll receive to ensure you’re making a wise choice.

Next, interest rates play a pivotal role in determining how much you might pay if you carry a balance. A lower rate can save you a considerable amount in the long run, especially if you’re planning on using the service frequently. Always look at the introductory rates as well; they often attract customers with appealing offers that can change after a certain period.

It’s also worth considering any additional charges such as foreign transaction fees or penalties for late payments. These extras can add up quickly, so get familiar with all possible costs associated with each alternative. Being informed about these elements will steer you towards making a well-rounded and financially sound decision.