Top Credit Cards for International Travel to Maximize Your Benefits

Traveling to new countries opens up a world of possibilities. Whether you’re exploring ancient ruins, tasting exotic cuisines, or enjoying breathtaking landscapes, having the right financial tool can enhance your experience significantly. Many travelers find themselves wondering which payment method to select that maximizes convenience and minimizes fees while roaming abroad.

When you’re away from home, it’s essential to ensure that your funds are easily accessible. Not all payment solutions are created equal; some can leave you with unexpected charges that eat into your travel budget. That’s why it’s crucial to seek options that provide favorable exchange rates and low transaction costs. Exploring the market for the most suitable financial instrument can save you time and money during your adventures.

By understanding the features and benefits of various payment options available, you can make informed decisions that align with your travel habits. Don’t let hidden pitfalls disrupt your journey; instead, equip yourself with the knowledge to select the most advantageous solutions tailored to your international escapades.

Top Features to Consider for Travel Cards

When it comes to choosing a financial tool for your adventures, certain characteristics can make all the difference. You want something that enhances your experiences, keeps your funds secure, and offers valuable perks along the way. Let’s explore the key aspects that can elevate your journeys without breaking the bank.

First up, look for options that come with minimal or no fees for transactions in foreign currency. This feature can save you a significant amount every time you make a purchase abroad. Additionally, the ease of accessing your funds through global networks is essential; make sure your selection is widely accepted in various regions.

Another crucial aspect is the rewards system. Some selections provide points or cashback for every dollar spent, which can add up over time and help you enjoy more perks during future travels. Furthermore, comprehensive travel insurance included with your choice can offer peace of mind while you explore new destinations.

Consider security features as well. Options that provide real-time alerts or the ability to freeze your account instantly can protect you against unauthorized transactions. Finally, look into customer support availability. Having assistance when things don’t go as planned is invaluable, especially when you’re far from home.

Benefits of No Foreign Transaction Fees

When you venture beyond your borders, the last thing you want is to be hit with extra costs on every purchase. It can be frustrating to realize that your overseas adventures are accompanied by unexpected charges every time you buy a souvenir or enjoy a meal. That’s why avoiding those pesky fees can make your travels not only smoother but also more enjoyable.

First off, eliminating foreign transaction fees directly boosts your available spending money. Every dollar saved is another opportunity for exploring, dining, or indulging in local experiences. Instead of watching your budget shrink with every exchange, you can truly savor your getaway without the worry of hidden costs.

Additionally, having this advantage simplifies budgeting while away. It’s easier to keep track of expenses when there’s no need to calculate extra charges into the mix. You can simply focus on enjoying your destination and immersing yourself in different cultures without the nagging concern of how fees might impact your finances.

Furthermore, many options that waive such fees often come with added perks. Benefits may include rewards on purchases or travel insurance, which enhance your overall experience. You get more than just a means of payment; you gain a tool that actively supports your travel goals.

Lastly, the peace of mind that comes from knowing your purchases won’t incur additional charges is invaluable. You can shop, dine, and explore without constantly worrying about the exchange rate penalties that can add up quickly. Embracing this feature empowers you to make the most of your travels, allowing you to enjoy every moment.

Top Rewards Programs for International Spending

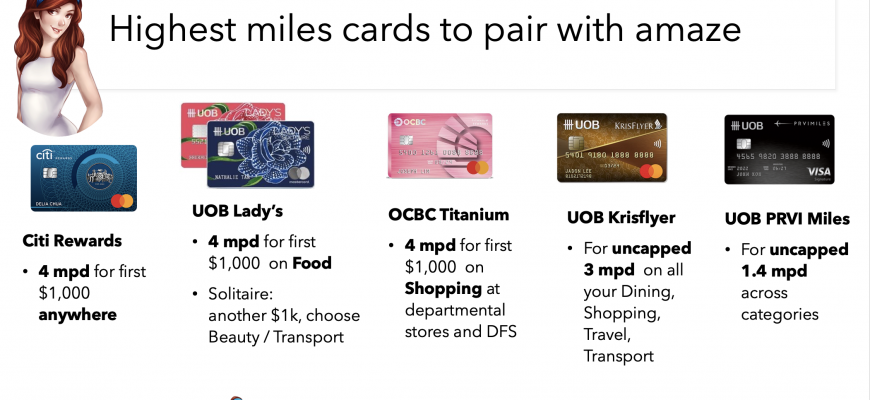

When traveling the globe, maximizing the benefits of your purchases can greatly enhance your experience. The right rewards systems allow you to rack up points or miles every time you spend, turning your routine expenses into exciting opportunities for redemption. Whether it’s for flights, hotel stays, or even dining, exploring various programs can significantly elevate your journey.

Flexible Points Systems offer great versatility, allowing you to accumulate rewards on a range of expenses while traveling. With these programs, you can also transfer points to different airline and hotel partners, optimizing your options based on your travel preferences. This flexibility can lead to incredible savings or upgrades.

Cashback Programs are another popular choice among globetrotters. These plans often provide a percentage of your spending back as a statement credit or deposit, making every purchase work in your favor. When combined with no foreign transaction fees, these rewards can lead to significant savings on your adventures abroad.

Additionally, some travel-oriented schemes provide exclusive perks such as complimentary travel insurance, access to airport lounges, and priority boarding. These enhancements can make your journey more comfortable while delivering extra value on those expenditures.

Lastly, consider partnerships with local businesses in your destination. Some systems offer enhanced rewards for purchases made at specific merchants, allowing you to earn more points while indulging in local cuisine or shopping. This not only enriches your travel experience but also maximizes your benefits effortlessly.