Top Recommended Credit Cards for Making Insurance Payments Effectively

When it comes to managing your expenses related to various types of coverage, choosing the right financial solution can make a significant difference. The market is flooded with options, each offering unique features that might suit your needs. It’s all about identifying what works best for your financial habits and preferences.

Many people overlook the potential benefits that certain financial products can bring to their monthly obligations. With the right selection, you can not only ensure a smooth and hassle-free transaction process but also gain rewards or perks that add extra value to your contributions. Understanding these options can empower you to make informed decisions that cater to your financial goals.

As you explore different alternatives, consider aspects such as rewards programs, interest rates, and additional benefits like travel perks or cashback offers. It’s essential to weigh your options carefully, ensuring that your choice aligns with your lifestyle and priorities. After all, being strategic with your finances means you can take full advantage of what’s available out there.

Top Features to Consider in Credit Cards

When selecting a financial tool for your everyday expenses, it’s essential to look beyond just rewards or low interest rates. There are several key aspects that can enhance your experience and provide additional benefits that meet your personal or professional needs. These features can make a significant difference in maximizing your financial strategies.

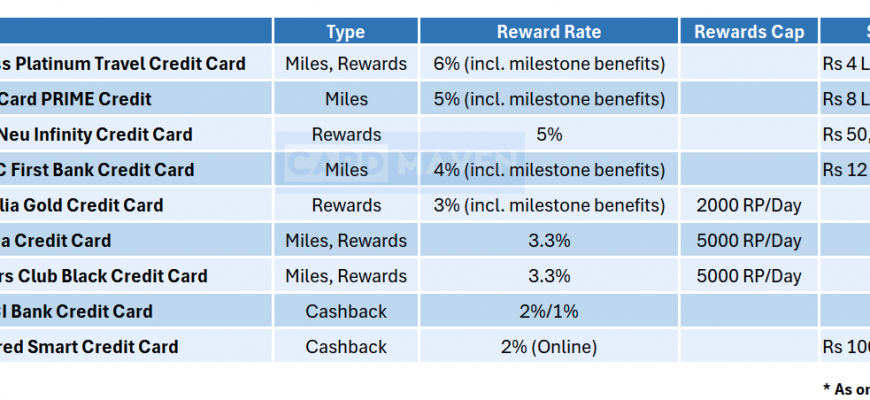

Rewards Programs are often a highlight. They come in various forms, from cashback to travel points. Depending on your spending habits, you might prefer a system that gives you more value in categories you frequently use, such as groceries, gas, or dining out.

Fees can also play a crucial role in your decision-making process. It’s vital to understand any annual service charges, foreign transaction costs, or other hidden fees that may apply. A tool with minimal fees might save you a lot over time, especially if you tend to carry a balance.

Introductory Offers can be enticing and may include bonus points or 0% interest for a limited time. These promotions can significantly enhance your initial experience and provide a perfect opportunity to test the waters before fully committing.

Customer Support should not be overlooked. Reliable assistance can be invaluable, especially during emergencies or when you encounter issues. Look for options that offer 24/7 help through multiple channels, including chat, phone, and email.

Security Features are more important than ever in today’s digital age. Consider options that provide advanced protection against fraud, such as real-time alerts, virtual numbers, and identity theft monitoring services.

Lastly, examine the Flexibility offered. Some tools allow for customizable spending limits or easy adjustments to payment due dates, catering to your financial management style and preferences.

By keeping these essential features in mind, you can find the perfect financial companion that aligns with your needs and helps you navigate your financial journey with ease.

How Rewards Can Offset Insurance Costs

When it comes to managing your expenses, every bit helps, especially those recurring charges that seem to pile up. One way to alleviate some of this financial burden is through the perks and benefits offered by certain financial tools. These programs can provide rewards that you might not even realize can play a significant role in reducing your overall costs.

Imagine using your everyday purchases to earn points or cashback that can then be applied toward those larger annual fees. This can transform the way you view necessary expenditures. Instead of just seeing them as fixed costs, you start recognizing the potential to relieve some of that financial weight through smart spending habits.

Each point or dollar earned can translate into real-world savings. Whether it’s a percentage back on your utility bills, travel rewards, or cash bonuses, these incentives can add up quickly. Not only do they enhance your purchasing power, but they also contribute to a more manageable budget when planning for recurring expenses.

Furthermore, utilizing a rewards program effectively means keeping track of your spending and ensuring you’re maximizing your earning potential. This attention to detail can yield significant dividends, allowing you to channel more resources into other areas of your financial life.

Ultimately, embracing this approach can lead to a win-win situation: enjoy the benefits of purchasing what you need while simultaneously building a cushion against inevitable costs. It’s all about being strategic with your spending and reaping the rewards that come from it.

Comparing Interest Rates for Insurance Payments

When it comes to managing your expenses, understanding the various financial tools available can make a significant difference. Different options can offer varying interest rates that impact your overall financial health. It’s essential to take a closer look at these rates, especially when handling larger bills. Not every option is created equal, and knowing how these rates work can help you save money in the long run.

Interest rates play a vital role in determining how much you’ll end up paying over time. A lower rate means less money going out of your pocket, while a higher one can add up quickly. By evaluating different options, you can find the one that suits your needs best. This doesn’t just help with your budget; it also provides you with flexibility in managing your finances.

Additionally, the terms and conditions surrounding these rates can vary widely. Some might offer promotional rates for a limited time, while others could have variable rates that change with market conditions. It’s crucial to read the fine print and understand what you’re signing up for. This will provide clarity and ensure that you make an informed decision that aligns with your financial goals.

Ultimately, the key to minimizing costs lies in thorough research. Comparing various offerings empowers you to identify the most favorable situations. By approaching this task with a clear mindset, you’ll find ways to streamline your expenditures while benefiting from the available options.