Top Credit Card Options for Individuals with a $120,000 Annual Income

In today’s fast-paced world, navigating the waters of personal finance can often feel overwhelming. With numerous options available, it’s crucial to find a financial tool that aligns with your lifestyle and income. Making an informed choice can lead to rewards that enhance your purchasing power and help you manage expenses more effectively.

The right financial instrument can offer you various advantages, from cashback on daily purchases to travel rewards that turn your adventures into something more affordable. Understanding what fits your unique financial situation is the key to maximizing the potential benefits that modern financial instruments can bring.

In this article, we’ll explore different types of these tools that cater to individuals with a higher earning potential. With careful consideration, you can find the perfect match that not only complements your financial habits but also elevates your overall spending experience. Let’s dive into the options available and discover what works best for you.

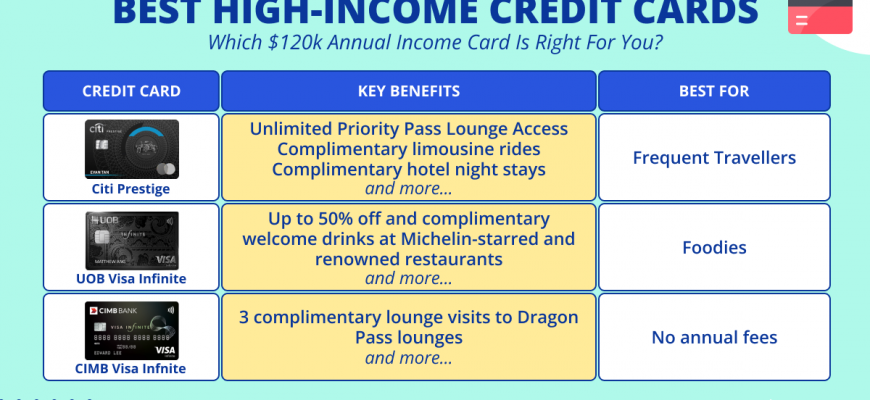

Top Financial Tools for High Earners

When you’re earning a significant income, it’s essential to find the right financial solutions that can enhance your spending power and rewards. This section will guide you through some of the most advantageous options available, specially designed to cater to those who enjoy a higher lifestyle. These offerings can provide exceptional perks, tailored benefits, and generous rewards systems to maximize your financial experience.

For individuals with substantial earnings, looking into offerings that feature premium rewards on various purchases is crucial. Whether you travel extensively or prefer dining out, many of these selections provide tailored bonuses that can add significant value to your everyday expenses. Moreover, some of these options come with added features like travel insurance, concierge services, and exclusive access to events, making them appealing to affluent users.

Additionally, consider options that reward you for responsible spending habits. Many of these financial instruments offer cashback or points systems that allow you to earn rewards for purchases you already make. This way, you can leverage your income to enjoy added benefits, enhancing your overall financial strategy. It’s all about making your earnings work for you in the best possible way.

Lastly, keep in mind the importance of choosing tools that align with your lifestyle. Look for offerings that not only provide attractive incentives but also maintain reasonable fees. Finding the right match can significantly impact your financial landscape and ensure you’re maximizing the advantages available to you.

Maximizing Rewards with Your Income

When it comes to making the most out of your earnings, there are plenty of strategies to consider. Many individuals overlook the potential benefits that come from utilizing various financial tools effectively. By choosing wisely, you can unlock a world of perks and bonuses that can enhance your everyday spending. It’s all about aligning your financial habits with the right options to make your money work harder for you.

Understanding your spending patterns is the first step. Take a moment to reflect on where you typically allocate your funds–be it dining out, traveling, or shopping. Once you’re aware of your habits, you can select options that provide the most advantageous returns based on those categories. This personalized approach ensures that you aren’t just earning rewards, but you’re doing so in a way that enhances your lifestyle.

Also, don’t underestimate the power of promotional offers. Many institutions roll out special deals that allow you to maximize your earnings for a limited time. By keeping an eye on these promotions and utilizing them strategically, you can accumulate rewards much faster. Pair this with a solid understanding of your lifestyle, and you’ll find yourself reaping the benefits sooner than you think.

Additionally, consider how often you pay off your balances. Staying on top of your financial obligations not only helps you avoid unnecessary fees but also strengthens your financial profile. A good history encourages more lucrative opportunities to present themselves, allowing you to capitalize on them even further.

In summary, turning your income into a source of ongoing rewards is simpler than you might imagine. By being mindful of your spending, taking advantage of promotional offers, and maintaining a healthy financial routine, you can effortlessly elevate your experience and enjoy a richer lifestyle. Why not start today?

Understanding Fees and Benefits

When it comes to managing your finances, it’s essential to weigh the costs against the rewards you’ll receive. Knowing what you’ll pay for services and what perks are on offer can significantly impact your choices. Many people overlook these aspects, but they play a crucial role in optimizing your financial experience.

Fees can come in various forms, such as annual charges, transaction fees, or foreign exchange costs. It’s vital to understand these expenses fully before committing. Some offerings may boast attractive features but hide hefty fees that can outweigh any potential gains. By keeping a close eye on these costs, you can avoid unpleasant surprises.

On the flip side, benefits can drastically enhance your financial journey. Whether it’s cashback rewards, travel points, or exclusive access to events, understanding these perks allows you to leverage them to your advantage. Look for options that align with your lifestyle and spending habits, ensuring that you maximize your gains.

In conclusion, staying informed about both fees and benefits can empower you to make decisions that best suit your needs. Taking the time to research and compare various offerings is well worth the effort, as it can lead to better financial outcomes in the long run.