Top Choices for CDA Accounts in 2025 to Maximize Your Savings and Investment Potential

In today’s fast-paced world, making informed financial decisions is more critical than ever. As individuals seek to secure their futures, one of the pivotal aspects to consider is how to effectively manage your savings. With a wide array of options available, it’s essential to identify a suitable plan that aligns with your goals and aspirations.

Your choice can significantly influence how you grow your funds, and as the landscape evolves, staying ahead of the curve becomes paramount. Many factors come into play, from interest rates to accessibility and the overall security of your investments. Therefore, understanding the various alternatives is crucial for achieving optimal growth.

As we explore the most appealing choices available, we’ll examine key features, benefits, and potential drawbacks to help you make a sound decision. Whether you’re new to savings strategies or looking to refine your existing approach, this guide will provide valuable insights into navigating the financial options that are likely to make an impact in the near future.

Top Features of CDA Accounts in 2025

As we navigate through the evolving financial landscape, it’s crucial to recognize the standout attributes that make certain savings options truly appealing. These features not only enhance user experience but also provide robust benefits that align with the needs of modern savers.

One major characteristic to look out for is the flexibility offered. Customers appreciate the ability to manage their funds seamlessly, whether it’s through mobile applications or online platforms. This convenience allows individuals to monitor their financial growth on-the-go, ensuring they’re always in the loop.

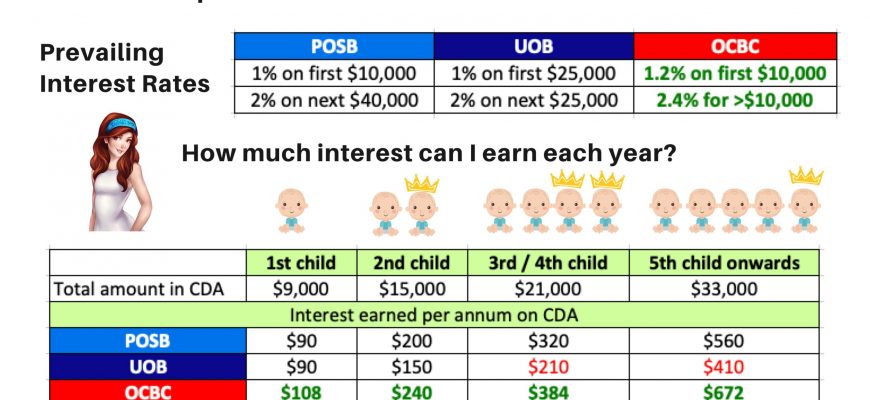

Another noteworthy aspect is competitive interest rates. The potential for higher returns on deposits can significantly impact savings goals. Financial institutions are striving to attract customers by offering appealing rates that can help grow their wealth over time.

Additionally, some options come with zero or minimal fees, which is a considerable advantage. By reducing the cost of maintaining a savings plan, individuals can maximize their earnings without the worry of hidden charges eroding their funds.

Security features also play a vital role; the peace of mind that comes with knowing your savings are protected is invaluable. Advanced encryption and fraud detection systems are essential in safeguarding personal information and finances.

Lastly, personalized customer service is becoming increasingly important. Access to expert guidance when needed can make a significant difference, helping individuals navigate their financial journeys with confidence and ease.

Comparing Providers This Year

As we dive into the landscape of savings options, it’s crucial to evaluate the available institutions that cater to your financial needs. Each provider has its unique features, offerings, and benefits that can influence your decision. By examining various features like interest rates, minimum balance requirements, and additional perks, you can make an informed choice that aligns with your financial goals.

First off, consider the interest rates being offered. Some financial institutions provide attractive rates that can significantly boost your savings over time. It’s wise to compare these figures across several options to ensure you get the best returns.

Furthermore, liquidity is an essential factor. Some establishments may impose restrictions on withdrawals or require maintaining a certain balance, which can affect your accessibility to funds. Assessing these terms is vital for long-term planning.

Don’t forget about the added benefits that come with different providers. Some may offer features like online banking, mobile apps, or even personalized financial advice, making your experience more convenient and tailored to your needs.

In conclusion, taking the time to compare these institutions will empower you to choose the one that best fits your financial aspirations for the upcoming years.

Maximizing Benefits from Your CDA Account

Making the most out of your savings strategy involves understanding how to effectively manage its features. This approach not only enhances your financial wellness but also sets you on a path toward achieving your goals more efficiently. Incorporating smart practices into your routine can significantly elevate the rewards you reap from this financial tool.

First and foremost, it’s essential to stay informed about the benefits available to you. Different types of resources offer unique advantages, so take the time to explore what’s included. This knowledge will empower you to make informed decisions that align with your personal objectives.

Utilizing automation can also be a game changer. Setting up automatic deposits ensures that you consistently contribute to your savings without having to think about it. This not only helps with building a healthy balance but can also leverage compound growth over time.

Don’t forget to regularly review your progress and adjust your strategies as needed. Life circumstances change, and the financial landscape evolves as well. By routinely evaluating your plan, you can identify areas for improvement and stay on track toward your aspirations.

Lastly, consider seeking advice from financial experts. Professional insights can provide clarity and guidance tailored to your situation, giving you access to strategies that you may not have previously considered. Engaging with knowledgeable individuals can open doors to new opportunities for maximizing your financial gains.