Top Cash Back Credit Cards You Should Consider for 2025 to Maximize Your Rewards and Savings

In the world of personal finance, finding ways to make your transactions work in your favor has never been more appealing. Whether you’re purchasing daily necessities or splurging on a treat, there are strategies available to ensure that you’re getting a little something back with every swipe. The right financial tools can turn routine spending into rewarding experiences, allowing you to enjoy perks that elevate your purchasing power.

As we look toward the future, the market is teeming with enticing opportunities designed to put a little more money in your pocket. With a variety of offerings available, it’s essential to understand how you can maximize your benefits. From straightforward percentages to enticing promotional features, the landscape is rich with options that can suit different lifestyles and spending habits.

Embarking on a journey to discover the most suitable solutions means considering what matters most to you. Whether it’s travel perks, grocery discounts, or even cashback on everyday purchases, the possibilities are vast. By exploring these financial instruments, you can transform your ordinary spending into extraordinary rewards and elevate your financial game.

Top Rewards Credit Options for Savings

When it comes to maximizing your earnings while spending, a selection of remarkable financial tools can make a significant difference. These options not only offer fantastic incentives for your everyday purchases but also allow you to accumulate rewards that can translate into real savings. Let’s explore a few standout choices that can elevate your financial game, providing you with enticing returns on your expenditures.

Many of these options come with various perks, from travel points to exclusive discounts, adding value to your transactions. Whether you’re a frequent traveler, a foodie, or someone who enjoys shopping, there’s likely an option tailored to your lifestyle. With the right strategy and a bit of diligence, leveraging such programs can lead to substantial benefits over time.

It’s important to evaluate each offering based on your spending habits and preferences. Some programs may provide higher rewards on specific categories, while others offer flat rates across all purchases. Understanding your lifestyle will help you choose the options that yield the greatest returns. No matter your choice, embracing these rewards can lead to a more enriched experience every time you swipe.

Maximize Your Cash Back Benefits

When it comes to making the most of your rewards, understanding how to optimize your spending can lead to significant gains. Many individuals overlook simple strategies that allow them to enhance their earnings on everyday purchases. It’s all about knowing where to focus your spending and taking full advantage of the perks available to you.

Start by identifying the categories that provide higher returns. Some programs offer increased rewards in specific areas like groceries, dining, or gas. By directing your spending toward these categories, you can quickly accumulate more rewards. Additionally, pay attention to promotional offers that can amplify your returns during certain periods, allowing you to make the most out of special events or seasonal sales.

Don’t forget about sign-up bonuses! Many providers give attractive incentives for new members. This often means that your initial purchases can yield substantial rewards, giving you a solid head start. Keep an eye out for limited-time promotions that may offer even greater benefits for a short period.

Lastly, always review your statements. Many people inadvertently miss opportunities to earn additional rewards. Regularly checking your accounts can ensure that you are not leaving money on the table. This habit can also help you spot any unauthorized transactions, giving you peace of mind while maximizing your benefits.

Comparative Analysis of 2025 Offers

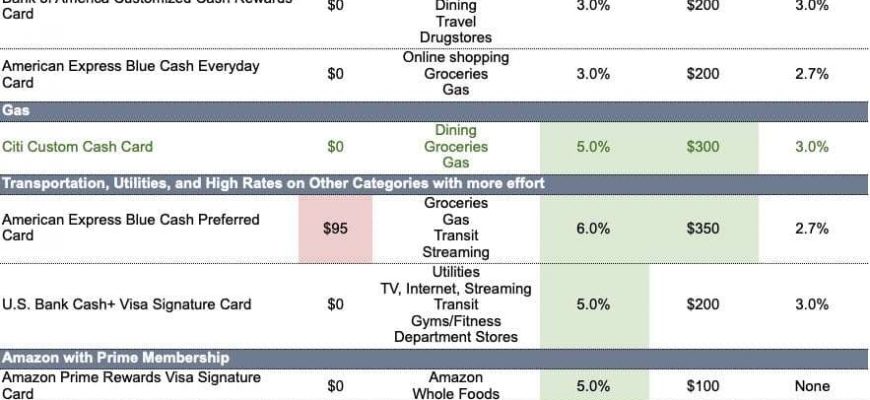

When diving into the world of financial rewards, it’s essential to explore all available options in order to make an informed choice. Each offering comes with its unique set of features and benefits that cater to different spending habits and lifestyles. Here, we’ll break down the key aspects to consider when evaluating these enticing deals.

To make the most of your rewards program, pay attention to the following factors:

- Reward Rate: Different products offer varying percentages of returns based on spending categories. It’s important to identify which categories align with your purchasing habits, whether it’s groceries, gas, or dining out.

- Annual Fees: Some options may have an upfront cost. Weigh the fee against the potential returns to see if it’s worth the investment for your situation.

- Sign-Up Bonuses: Many programs offer attractive incentives for new customers. These bonuses can significantly boost your initial rewards and should factor into your decision-making process.

- Redemption Flexibility: Consider how easy it is to redeem your rewards. Some programs offer various options, including statement credits, gift cards, or travel perks.

- Foreign Transaction Fees: If you travel internationally, find programs that eliminate fees on purchases made abroad. This can save you a considerable amount while exploring new destinations.

As you evaluate these offerings, remember that often the most appealing option depends on your individual needs. Analyzing these elements will help you pinpoint the most fitting solution that maximizes your perks.