Top European Banks You Should Consider for Your Financial Needs

In today’s fast-paced world, choosing the right financial institution can feel overwhelming. With countless options available, navigating through them to find a service provider that meets your unique needs requires careful consideration. Factors such as customer service, product offerings, digital tools, and overall reputation come into play when determining which institution stands out in the financial landscape.

It’s essential to recognize that not all entities are created equal. Some excel in specialized services, while others shine through their innovative approaches to customer engagement. Every option brings something distinctive to the table, making it crucial to understand what differentiates one establishment from another.

In this exploration, we will delve into exemplary institutions that have garnered attention for their commitment to quality, reliability, and customer satisfaction. By examining their key attributes, we aim to guide you in making an informed decision that aligns perfectly with your financial goals.

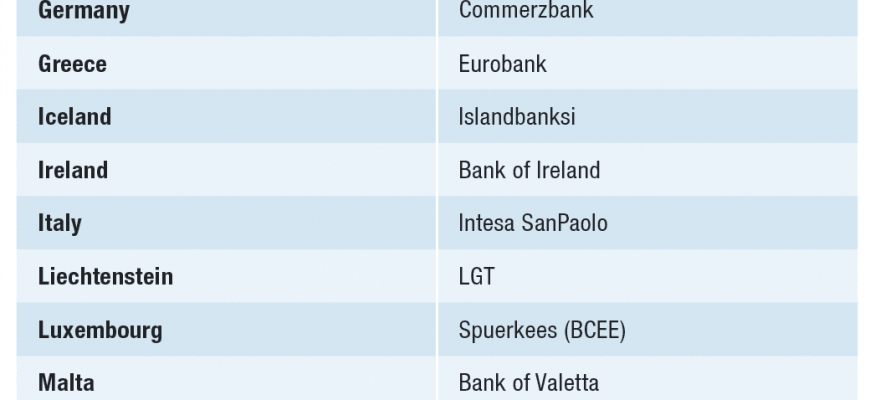

Top-rated Financial Institutions in Europe

When it comes to managing your finances, selecting the right institution is crucial for ensuring a seamless experience. Across the continent, there are numerous establishments that have earned stellar reputations for their services. From traditional establishments to modern digital platforms, clients are presented with a myriad of options tailored to meet diverse needs.

Among the standout names, certain institutions are recognized for their commitment to customer satisfaction, innovative solutions, and a broad range of financial products. Many feature user-friendly interfaces, making it easier for clients to handle everyday transactions and long-term investments. Additionally, these establishments often prioritize security, ensuring that personal information remains protected.

Furthermore, offerings like personalized financial advice, competitive rates, and diverse account types draw in individuals and businesses alike. The landscape is ever-evolving, with many adapting to technological advancements, highlighting the importance of finding an institution that aligns with your financial goals. With the right choice, you can enjoy peace of mind while managing your financial journey.

Criteria for Choosing a Leading Financial Institution

When it comes to selecting a premier financial establishment, several factors come into play that can significantly influence your decision. It’s not just about the services offered; there are various elements that determine the overall quality and reliability of a financial partner. Let’s dive into the essential criteria you should consider when making this important choice.

First and foremost, reputation is key. A trustworthy establishment with a solid track record can provide peace of mind. Look for institutions that are known for their exceptional customer service and reliability. Online reviews, ratings, and recommendations from friends can offer valuable insights into their standing in the community.

Next on the list is the range of services. Different establishments cater to various needs, so finding one that aligns with your financial goals is crucial. Whether you’re looking for personal loans, investment options, or straightforward saving accounts, ensure that they provide a comprehensive suite of offerings that meet your requirements.

Another important aspect is transparency. Clear communication regarding fees, interest rates, and terms is essential. A reputable institution will provide detailed information without hidden surprises, allowing you to make informed decisions.

Additionally, consider the technological capabilities of the establishment. In today’s digital age, convenient access to your finances through online and mobile platforms is invaluable. Choose one that embraces innovation and offers user-friendly solutions for managing your finances.

Lastly, don’t overlook customer support. Effective and friendly assistance can significantly enhance your overall experience. Whether it’s through in-person interactions, phone support, or online chat, quality service can make all the difference when navigating financial matters.

Innovative Banking Services in Europe

In today’s rapidly changing financial landscape, creativity and technology are revolutionizing the way we handle our finances. The rise of digital platforms has enabled a new wave of solutions that cater to the diverse needs of consumers, ensuring convenience and efficiency. Whether it’s mobile applications that allow real-time transactions or personalized financial advice powered by artificial intelligence, the evolution of financial services is here to stay.

One of the most exciting developments is the introduction of seamless payment solutions. Gone are the days of long queues and paperwork; now, users can make contactless payments, transfer money globally with ease, and even manage budgets utilizing advanced tracking tools. These services are designed to enhance user experience while maintaining security and reliability.

Additionally, financial institutions are leveraging data analytics to offer tailored products that meet specific consumer needs. By understanding spending habits and preferences, these entities can provide personalized recommendations, making financial management more intuitive. This shift towards customization not only empowers individuals but also helps in building loyalty and trust.

Moreover, many platforms are embracing blockchain technology to enhance transparency and reduce costs. The ability to execute transactions securely and efficiently without intermediaries is transforming traditional approaches, offering customers more control over their finances.

All in all, the landscape of financial services is witnessing an exciting transformation, driven by innovation that prioritizes user experience and security. It’s an exhilarating time for consumers who can now enjoy a wealth of options and accessibility at their fingertips.