Comprehensive Guide to Understanding Your Financial Aid Award Letter

Navigating the world of academic funding can often feel overwhelming, especially when it comes to deciphering the documents that accompany your eligibility. This section aims to break down the details typically included in such communications, ensuring you have a clear understanding of what they mean for your education journey.

When you receive a notification regarding your support options, it essentially outlines the resources available to help you pursue your academic goals. These documents are crucial as they provide insights into how much support you might expect, what requirements you need to meet, and the next steps in accessing those resources.

In this guide, we will highlight the essential elements contained within these notifications, clarify any jargon you might encounter, and offer tips on how to make the most of the assistance available to you. By the end of this discussion, you’ll feel more confident in interpreting this important correspondence and taking charge of your educational finances.

Understanding Your Financial Assistance Offer

Receiving a notification about your support options can feel overwhelming, but it’s important to take a moment to digest the details. The information you get will play a significant role in shaping your educational journey and ensuring you have the necessary resources to succeed in your studies.

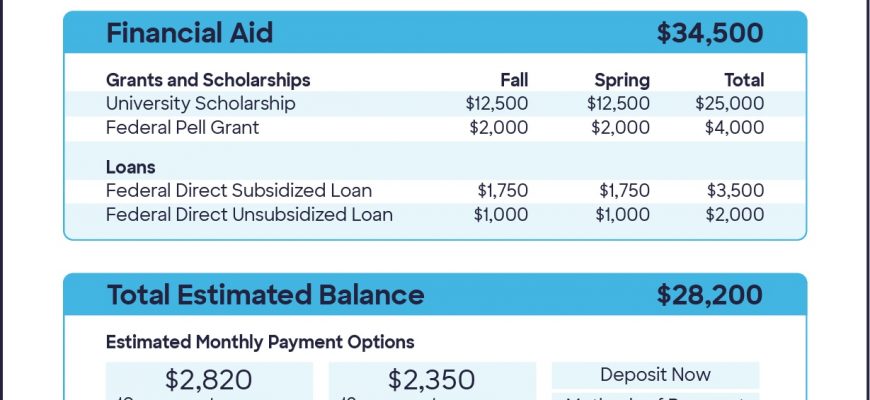

First things first, you’ll want to look closely at the types of support being presented. There are often grants, which you won’t have to repay, and loans, which will need to be settled after graduation. Understanding the difference between these can help you make informed decisions about your funding strategy.

Now, think about the total amount you’re being offered. This figure might include various components, each intended to cover specific expenses like tuition, books, or living costs. It’s crucial to calculate whether this sum fully meets your needs or if you may need to explore additional resources or options.

Once you have a grasp of the numbers, it’s time to consider the terms and conditions attached to your options. Some forms of assistance may have specific requirements, such as maintaining a particular GPA or completing a certain number of credit hours. Make sure you’re aware of these stipulations, as they can impact your eligibility down the line.

Lastly, don’t hesitate to reach out for clarification. If anything seems unclear or confusing, contacting the appropriate offices can provide you with the guidance you need. Navigating through these offerings can be tricky, but understanding your options ensures you are better prepared for your upcoming academic adventure.

Steps to Accept or Decline Support

When you receive an offer of assistance, it’s essential to take specific actions to indicate whether you wish to accept or decline it. This process ensures that you can secure the resources you need or free up opportunities for others. Here’s how to navigate this important decision.

- Review the Terms:

Before making a decision, read through the details carefully. Understand what is being offered and any obligations it entails.

- Consider Your Needs:

Reflect on your financial situation and whether the support aligns with your goals. Is it enough? Will it benefit you in the long run?

- Gather Necessary Information:

Ensure you have all the required documents ready. This might include your student ID, proof of income, or other supporting materials.

- Decide Your Path:

Make your choice based on your review and personal circumstances. Are you ready to accept the support, or do you think it’s best to pass?

- Communicate Your Decision:

Follow the outlined procedures to notify the administration of your choice. There may be a specific form to fill out or online portal to use.

By following these steps, you can confidently manage your options and make the best decision for your situation.

Common Terms in Funding Notifications Explained

When you receive a notification about funds to help pay for your education, it often includes several key phrases that might be a bit confusing at first. Understanding these terms is crucial, as they provide vital information about what support you can expect. Let’s break down some of the most commonly used jargon you may encounter.

Cost of Attendance (COA) refers to the total amount it will take to go to school, including tuition, living expenses, and other fees. This figure gives you an idea of your overall financial picture.

Expected Family Contribution (EFC) is a calculated number that estimates how much your family is expected to contribute towards your education costs. The lower this amount, the more assistance you may qualify for.

Grant is a type of funding that does not need to be repaid, making it one of the most desirable forms of assistance. It is usually awarded based on financial need or specific achievements.

Loan refers to borrowed money that you must repay, often with interest. While loans can help cover costs, it’s essential to understand the terms and how they may impact your finances after graduation.

Work-Study is a program that allows you to earn money through part-time work. This can help reduce your financial burdens while providing valuable work experience.

Net Cost indicates the actual amount you will need to pay out of pocket after other forms of funding like grants or scholarships are applied. Knowing this number is vital for budgeting.

Understanding these terms can empower you to make informed decisions about your education financing and help you navigate the process with confidence.