Understanding the Nature of Refundable Tax Credits and Their Benefits

Diving into the world of financial incentives can feel overwhelming, but it’s essential for anyone wanting to make the most of available benefits. When you think about the ways the government supports individuals and families, one area stands out – the ability to reduce overall financial obligations through various means. This concept has evolved over time, and today, many are curious about how much benefit they can truly reap from these programs.

In this discussion, we’ll explore the nuances of these financial aids that can either reduce what you owe or, in some cases, even result in a payout. It’s crucial to understand the different types of support available and how they impact your finances. Whether you’re filing for the first time or looking to maximize your returns, knowing the ins and outs is key to making informed decisions.

So, let’s break down how these incentives work and examine what it truly means to benefit fully from them. In the end, the goal is to empower you with knowledge that might lead to a more favorable financial outcome. After all, everyone deserves to take advantage of the systems in place to help ease their monetary burdens.

Understanding Refundable Tax Credits

When it comes to navigating the world of financial benefits from the government, there are distinct types that can significantly impact your annual filing. Some of these benefits can help reduce the amount you owe, while others might come back to you even if your liability is lower than the amount offered. This section will demystify the idea of receiving more back than what you initially paid, shedding light on how it operates and its advantages.

Essentially, certain financial incentives are designed to provide support that goes beyond merely lowering your liability. These benefits can put money directly in your pocket, creating an opportunity for many individuals and families to enhance their financial situation. Understanding how to leverage these opportunities can lead to a more favorable outcome when tax season rolls around.

To truly grasp the impact of these attractive financial supports, it’s essential to recognize the eligibility criteria and application processes involved. These factors will determine whether you qualify and how much you may receive. Knowing the ins and outs can help you optimize your benefits effectively.

Ultimately, the essence of these financial propositions lies in their ability to assist those in need, helping to alleviate some of the burdens of everyday expenses. By gaining insight into how these work, you can make informed decisions that may lead to a healthier financial future.

Differences Between Refundable and Non-Refundable Credits

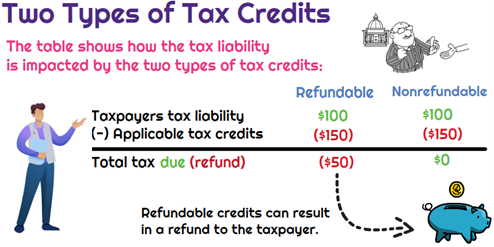

Understanding the distinctions between various types of financial benefits can make a significant difference in personal finances. When it comes to government incentives aimed at easing the burden of expenses, not all offers are created equal. Some provide immediate cash relief, while others merely reduce future liabilities.

-

Nature of Benefit:

One category allows individuals to receive money back even if their overall contributions aren’t sufficient to claim the full amount. This means that people can potentially gain a cash benefit exceeding what they initially paid.

-

Limitations:

The other category only reduces the amount owed, without facilitating any direct payout. In this case, participants can see a decrease in what they need to pay, but they will not receive cash in hand if their previous contributions do not cover the total benefit available.

-

Impact on Budgeting:

Receiving a refund can greatly enhance short-term financial situations, allowing for reinvestment or spending on necessities. Conversely, just reducing obligations may not have the same immediate positive effect on cash flow.

-

Eligibility Criteria:

Qualification requirements can vary significantly. Some benefits may depend on income levels, while others are available to a wider range of individuals.

-

Application Process:

The procedure to claim these financial incentives can also differ. Some might require detailed documentation to demonstrate eligibility, while others are simpler to obtain.

In summary, distinguishing between these financial options is essential for maximizing potential benefits. Knowing what each offers and the implications for personal finance can help individuals make informed decisions for themselves and their families.

Benefits of Claiming Refundable Tax Incentives

Utilizing financial benefits provided by the government can significantly enhance your personal finances. When you take advantage of these incentives, you not only lower your tax burden but also potentially receive funds back, which can be a game changer for many. This kind of support is particularly valuable for low to moderate-income individuals and families, allowing them to gain some extra cushion in their budgets.

One of the standout advantages of these incentives is the possibility of receiving money even if your liability is zero. This means that you can actually see a direct cash benefit in your pocket, which can be used for various essential needs, from paying bills to saving for future goals. This feature fosters a sense of financial stability and opens doors for investments in education, home ownership, or even starting a small business.

Moreover, accessing these financial rewards often encourages people to engage more with their finances. By understanding the eligibility and requirements, individuals become more informed, making confident choices about their financial health. Ultimately, these supports not only alleviate immediate financial stress but also promote long-term financial planning and empowerment.