Exploring the Safety and Security of Banks in Singapore

In today’s world, understanding the reliability of financial institutions is crucial for anyone looking to manage their wealth effectively. As we explore the intricacies of the financial landscape in an urban hub known for its robust economy, it becomes essential to delve into various aspects that contribute to a sound monetary environment.

Many individuals often wonder about the protective measures institutions implement to safeguard their assets. Is presence in such a vibrant economic setting indicative of a reliable organizational structure? These are pertinent questions that deserve thorough evaluation, considering the stakes involved when it comes to our hard-earned resources.

Furthermore, assessing the practices and regulations governing financial entities reveals insights into their operational integrity. A deep dive into how these organizations maintain trust and confidence among their clientele can illuminate the broader picture, showing just how well-positioned they are to manage potential risks.

Evaluating the Security of Financial Institutions in a Global Hub

When it comes to safeguarding your resources, understanding the protective measures in place at financial institutions is crucial. This segment delves into the various layers of security that ensure customer assets are well-guarded and how these establishments maintain trust through robust protocols. Let’s explore the mechanisms that contribute to the reliability of these institutions.

The framework begins with regulatory oversight that mandates stringent compliance measures. Authorities implement comprehensive guidelines that institutions must follow, promoting transparency and risk management. Regular audits and assessments help identify vulnerabilities, ensuring that establishments are always prepared to counter potential threats.

Additionally, advanced technologies play a pivotal role in fortifying defenses. Cybersecurity systems are continuously upgraded to fend off evolving digital threats. With state-of-the-art encryption and monitored transactions, customers can feel more secure in their digital interactions and fund movements.

Moreover, employee training is vital. Staff members are equipped with knowledge about best practices and the importance of vigilance in detecting fraudulent activities. This level of awareness contributes significantly to overall institutional security.

Lastly, customer engagement cannot be overlooked. Financial institutions actively promote practices such as two-factor authentication and secure password management. A well-informed clientele is a critical component in the larger picture of security, reinforcing the collective effort to protect asset integrity.

Regulatory Framework Ensuring Financial Stability

When it comes to the financial landscape, a robust structure is crucial for maintaining confidence and resilience. This foundation is built upon a series of well-defined guidelines and practices aimed at fostering a secure environment for both institutions and consumers. It’s not just about rules; it’s about creating a balanced system where risks are managed effectively, and the interests of all parties are protected.

In many regions, authorities work tirelessly to design regulations that adapt to evolving market dynamics. These regulations often encompass a range of measures from capital requirements to consumer protection standards, ensuring that financial entities operate within safe parameters. By continuously monitoring institutions and implementing necessary adjustments, regulators play a pivotal role in sustaining a stable economic ecosystem.

Moreover, transparency and accountability are emphasized in this framework. Regular audits and assessments help maintain trust, allowing stakeholders to have a clear view of an organization’s health. This openness not only promotes ethical behavior but also empowers individuals to make informed decisions about their financial dealings.

In essence, the intricate tapestry of regulations is meticulously woven to shield the economy from potential threats and maintain stability. The collective effort of regulators, institutions, and consumers together strengthens the trust placed in the financial system, fostering an atmosphere where growth and innovation can flourish.

Risk Management Practices in Banking Sector

In the financial world, institutions face a range of uncertainties that can threaten their stability. To navigate these challenges, robust strategies are essential. Understanding how these entities manage potential risks is crucial for anyone interested in the industry’s dynamics.

Effective risk management involves identifying, assessing, and mitigating various threats. Here’s a closer look at some common practices:

- Risk Assessment: Regular evaluations help institutions identify vulnerabilities, enabling proactive measures to be taken.

- Diversification: Spreading investments across different asset classes minimizes exposure to market fluctuations.

- Compliance Procedures: Adhering to regulations and standards ensures that institutions stay within legal frameworks, reducing legal risks.

- Stress Testing: Simulating adverse conditions assesses an institution’s resilience, helping to prepare for potential downturns.

- Monitoring Systems: Continuous oversight of financial activities allows for early detection of anomalies or threats.

Ultimately, these practices not only safeguard the institutions but also contribute to the overall health of the financial ecosystem. A solid risk management approach fosters confidence among clients and stakeholders alike.

Comparative Analysis with Global Banking Systems

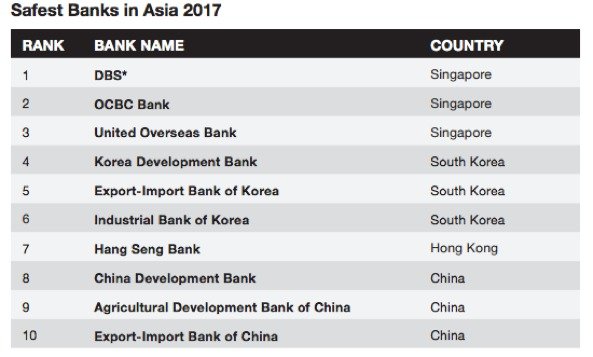

In today’s interconnected financial landscape, examining the solidity of financial institutions across different nations reveals intriguing insights. By evaluating the protocols, regulations, and overall trustworthiness of these establishments, we can understand how they stand up against one another. This exploration helps to highlight not only strengths but also vulnerabilities within varying systems, guiding consumers in their choice of financial partners.

A key factor in this comparison is the regulatory environment. Some regions operate under stringent guidelines that enhance consumer protection, while others may have more lenient approaches that could potentially expose clients to higher risks. For instance, jurisdictions with robust supervision often demonstrate lower rates of financial misconduct, fostering a more reliable atmosphere for individuals and businesses alike.

Another important aspect is the capital adequacy of these institutions. Different regions enforce varying capital requirements that directly influence the resilience of these entities during times of economic strain. Systems with higher capital buffers tend to weather financial storms better, boosting confidence among depositors and investors.

Additionally, public perception plays a crucial role in determining the trustworthiness of a financial institution. Customer satisfaction, historical performance, and the institution’s response to crises can significantly affect overall confidence. Comparatively analyzing reputations in distinct regions provides valuable insight into how individuals might feel about placing their funds within different financial frameworks.

Ultimately, a thorough examination of these diverse financial environments sheds light on their respective strengths and weaknesses. Such analyses not only empower consumers to make informed choices but also encourage institutions to pursue best practices, enhancing the overall stability of the global financial system.