Exploring the Pros and Cons of Secured Credit Cards

In the world of personal finance, various options exist for managing expenses and building trustworthiness. One such tool has gained popularity among individuals looking to strengthen their purchasing power while safeguarding their financial future. However, opinions differ widely on the effectiveness of this financial instrument and its impact on one’s economic profile.

Many people wonder if this method is truly beneficial or if it brings its own set of challenges. To navigate through the uncertainties, it is essential to explore both the advantages and disadvantages that accompany this financial solution. Understanding the nuances can illuminate whether it serves as a stepping stone toward better financial health or poses potential drawbacks that one should be wary of.

Ultimately, knowing the facts allows individuals to make informed decisions that align with their unique financial goals. By dissecting the elements and implications of this approach, we can better grasp whether it’s a worthy consideration or a path filled with pitfalls. Join me as we delve deeper into this intriguing subject!

Understanding Secured Credit Tools

When diving into the world of financial products designed for building or restoring a strong borrowing history, it’s important to know how these particular options work. They blend the benefits of traditional borrowing methods with an added layer of security, making them accessible for individuals starting out or working to improve their standing.

These financial instruments require a deposit, which serves as collateral, reducing the risk for lenders. This means that users can access a line of credit up to the amount they initially put down. As you make purchases and repay the borrowed funds, you can demonstrate responsible financial behavior, often leading to increased creditworthiness over time.

The beauty of these tools lies in their ability to help individuals transition from limited options to broader financial opportunities. By managing your spending and timely repayments, you can eventually qualify for more conventional offerings. It’s a journey towards financial independence backed by a measured approach.

While they offer significant advantages, it’s crucial to take note of fees and terms before committing. Understanding the specifics can help you avoid pitfalls and ensure that you’re making the most of this stepping stone towards better financial health.

Pros and Cons of Secured Financial Options

When it comes to building or rebuilding your financial profile, certain choices stand out with their unique benefits and drawbacks. These options can offer a bridge for individuals looking to enhance their purchasing power while also requiring an upfront deposit to back their available limit. Let’s delve into the advantages and disadvantages of these financial tools.

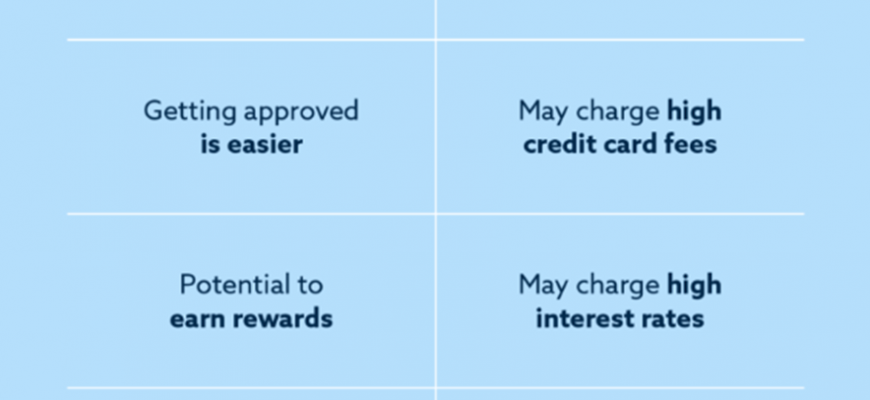

On the positive side, one of the significant benefits is the accessibility they provide. Individuals with limited or poor financial histories often find these options easier to obtain, making it a solid choice for those aiming to improve their financial standing. Additionally, responsible usage can lead to credit score enhancements, opening doors to more favorable financial products in the future.

However, there are also downsides to consider. The requirement of an initial deposit can be a barrier for some, tying up funds that could be used for other expenses. Furthermore, interest rates tend to be higher compared to traditional alternatives, which could lead to increased costs if balances are not managed effectively. It’s crucial to weigh these factors carefully before deciding if this route aligns with your financial goals.

Navigating Your Financial Future with Secured Cards

Embarking on a journey towards financial stability can often come with twists and turns. One tool that can serve as a safety net during this path involves a specific type of financial product designed to help individuals build or rebuild their monetary reputation. By understanding how to utilize this option effectively, you can take significant strides towards achieving your fiscal goals.

Using this financial instrument strategically could pave the way for enhanced spending power. It’s particularly beneficial for those who may have faced past challenges in managing their finances. By making timely payments and demonstrating responsibility, individuals can not only improve their standing but also unlock greater opportunities in the future.

Importantly, maintaining awareness of the fees and terms associated with this option is crucial. Unlike traditional financial products, these alternatives often come with unique conditions. Being informed and making wise choices can genuinely affect your journey, allowing you to steer toward a more secure financial horizon.

Additionally, the experience gained while utilizing this tool can foster a sense of confidence. As you navigate through your financial landscape, each responsible transaction contributes to a stronger reputation, opening doors for more favorable options down the line. In essence, this approach can be a stepping stone towards a brighter financial future.