Exploring Whether Revenue Should Be Classified as a Credit or Debit

When it comes to managing financial operations, the classification of different types of transactions plays a crucial role. There are various methodologies and principles that organizations adhere to when categorizing incoming and outgoing funds. This subject not only affects bookkeeping practices but also influences the overall financial health of a business.

One common area of confusion involves the categorization of different types of income and expenditure. People often find themselves wondering how to accurately label their financial activities. By gaining clarity on these distinctions, individuals and businesses alike can better navigate their financial landscapes and make informed decisions.

In exploring this topic further, it’s important to consider how various practices impact reporting and analysis. Understanding these classifications can lead to improved financial literacy and ultimately facilitate more strategic planning. Let’s delve deeper into these fundamental concepts and uncover what they truly mean for your financial strategies.

Understanding Income in Accounting

In the world of finance, grasping the essence of incoming funds is crucial for any business. This concept plays a vital role in evaluating the economic performance and long-term sustainability of an organization. It’s not merely about numbers on a balance sheet; it’s the lifeblood that sustains operations and fuels growth.

When businesses provide goods or services, the funds they receive contribute significantly to their overall financial picture. This income impacts various aspects, including investments, expansions, and even day-to-day expenses. Knowing how this inflow is categorized and managed can make a considerable difference in strategic planning and financial forecasting.

In accounting terms, there are specific principles that define how these funds are recorded and reported. Understanding how these transactions are interpreted is key to making informed decisions. For instance, the way income appears on financial statements can indicate the health of the business and inform stakeholders about its potential future performance.

It’s also important to differentiate between various types of incoming funds. Some inflows may be transient, while others represent stable revenue streams that contribute consistently to the bottom line. Recognizing these differences can help businesses allocate resources more effectively and strategize for the future.

Ultimately, comprehending the intricacies of these financial inflows empowers business leaders to make better choices, ensuring sustainability and growth in an ever-changing market landscape.

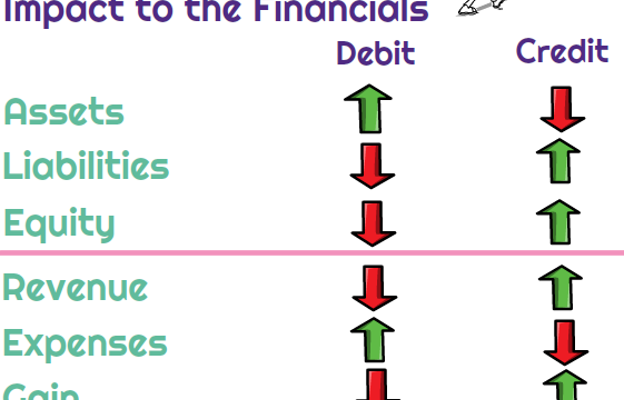

The Role of Debits and Credits

In the world of finance and accounting, understanding the dynamics of additions and subtractions is essential. These two fundamental concepts serve as the backbone of every transaction, allowing businesses to track their financial health accurately. Each entry has its own implications, influencing how we view performance and balance sheets.

Essentially, one side represents incoming value while the other side signifies outgoing value. This reciprocal relationship helps ensure that every financial activity is recorded accurately, ultimately maintaining the integrity of accounting systems. By grasping how these transactions interact, individuals and organizations can make informed decisions based on reliable data.

Moreover, the interplay between these elements is critical for ensuring that financial reports reflect the true state of affairs. When entries are recorded correctly, it paves the way for insightful analysis and strategic planning. Understanding this balance not only aids in compliance with regulations but also fosters greater transparency for stakeholders.

In summary, mastering the concepts of incoming and outgoing values is crucial for anyone involved in finance. It enables a clearer picture of economic realities and empowers businesses to thrive in a competitive landscape. Embracing this knowledge is not just beneficial; it’s necessary for sustained success.

Impact on Financial Statements

Understanding how income influences financial documents is crucial for anyone involved in business. Each transaction can lead to significant changes in the overall picture of financial health. It’s not just about the numbers; it’s about how they reflect the performance and potential of an organization.

The way gains are recorded will directly affect both the balance sheet and the income statement. When these amounts increase, they can enhance the overall value of the entity, providing a more favorable outlook for investors and stakeholders. Conversely, if the figures are on the low end, it could signal underlying issues that might need attention.

Moreover, the classification of incoming funds can influence cash flow. Positive adjustments in this area contribute to liquidity, enabling a company to meet its obligations while also reinvesting in growth opportunities.

In summary, the representation of incoming resources plays a pivotal role in shaping the perception of an organization’s financial standing. Accurate tracking and reporting not only bolster transparency but also pave the way for well-informed decision-making.

I’m completely blown away by your creativity! This video was amazing from start to finish.