Current Trends in Oil Prices – Analyzing Whether They Are Rising or Falling

In the world of commodities, the ebb and flow of certain assets can have a profound impact on economies and everyday life. Whether it’s the increase in costs at the pump or the effects on global markets, tracking these movements offers essential insight into both current events and future forecasts. Grasping the underlying factors that influence these variations helps us make sense of the bigger picture.

So, what’s going on in the marketplace right now? Various events, from geopolitical tensions to seasonal demand, play a significant role in shaping the trajectory of these essential goods. Monitoring these shifts requires not just awareness of immediate changes, but also an understanding of broader economic indicators. Let’s delve deeper into the recent trends and try to decipher whether we’re witnessing a surge or a decline in this volatile sector.

Stay tuned as we explore what influences these shifts and how they can impact our daily lives and the global economy!

Current Trends in Oil Pricing

In the ever-evolving landscape of the energy sector, fluctuations in value have become a hot topic among analysts and enthusiasts alike. Understanding the currents that drive these changes is essential for stakeholders and consumers. With numerous factors at play, the dynamics of the market can shift rapidly, impacting economies and daily life.

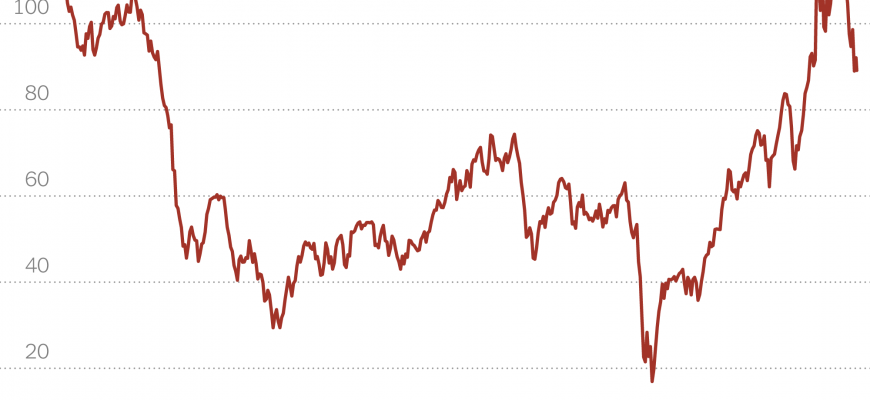

Recent developments indicate a blend of supply constraints and geopolitical events that have been influencing market behavior. For instance, production adjustments by key players have led to notable effects on market conditions. Additionally, global demand patterns have been shifting, influenced by seasonal changes and emerging technologies.

Investors are closely monitoring these shifts, as they play a critical role in determining the equilibrium. Furthermore, external influences such as regulatory changes and environmental considerations have also begun to take center stage, adding layers of complexity to forecasting future trends.

As we continue to track these movements, it becomes clear that staying informed is key. Whether one is involved in trading, policymaking, or just curious about the market, being aware of the prevailing currents is crucial for navigating the future of the energy landscape.

Factors Influencing Market Fluctuations

The energy market is a dynamic realm, influenced by a variety of elements that can cause shifts in values. Understanding these factors is crucial for anyone looking to navigate the complexities of this sector. Let’s delve into some of the key aspects that play a significant role.

- Geopolitical Events: Tensions in resource-rich regions can lead to uncertainty and volatility. Disputes, wars, or political changes often result in supply disruptions.

- Supply and Demand Dynamics: The balance between what is available and what consumers desire can lead to fluctuations. An increase in production or a decrease in consumption can impact the market.

- Natural Disasters: Hurricanes, earthquakes, and other natural events can disrupt extraction and transportation, impacting availability.

- Technological Advances: Innovations in extraction methods or alternative energy sources can shift market trends and affect reliance on traditional resources.

- Economic Indicators: Factors like inflation rates, unemployment, and GDP growth affect consumption patterns, thus influencing market behavior.

- Regulatory Changes: Government policies and international agreements regarding energy practices can significantly impact market trends.

These influencing elements create a landscape that is ever-changing, making it vital for stakeholders to stay informed. By keeping an eye on these aspects, one can better understand the fluid nature of the energy market.

Global Economic Impact of Oil Prices

Fluctuations in the value of crude affect various sectors and economies around the globe. These changes can have a ripple effect that influences consumer behavior, investment strategies, and even governmental policies. Understanding the interconnectedness of these markets is crucial for grasping the wider implications of shifts in energy valuation.

When the cost of energy sources rises, consumers often face increased expenses, leading to changes in spending habits. This can create a domino effect, where reduced consumer spending impacts businesses, further influencing employment rates and overall economic growth. Conversely, when costs decrease, it can stimulate consumer spending and bolster economic activity.

Additionally, nations that rely heavily on energy exports can experience significant changes in their revenue streams. A decline in value may lead to budget constraints, impacting public services and development projects. On the flip side, increases can provide much-needed funds for infrastructure and social initiatives, potentially enhancing quality of life.

Investment flows and stock market performance are also closely linked to movements in energy costs. Investors often react quickly to changes, with sectors like transportation and manufacturing showing notable volatility. Understanding these patterns can provide insights into broader economic trends and help stakeholders make informed decisions.

In conclusion, the fluctuations in energy valuation carry profound implications for economies worldwide. The effects span consumer spending, government revenues, and investor behavior, making it essential to keep a close watch on these shifts for a clearer view of the economic landscape.