Is a Surge in Oil Prices on the Horizon?

The energy sector is always full of surprises, leaving many to ponder what lies ahead. With numerous factors in play, the possibility of an increase in costs has become a hot topic among analysts and consumers alike. As we dive deeper into this discussion, it’s essential to examine various elements influencing this dynamic landscape.

Global events, shifting demand patterns, and geopolitical tensions seem to weave a complex web that can sway market sentiments. These elements can lead to fluctuations that many individuals and businesses cannot ignore. Today, we explore the potential impact of these transformations and what they might mean for everyone from casual consumers to large corporations.

Understanding the currents affecting the energy sector is more crucial than ever. With every slight change, there are ripples felt across economies, prompting everyone to reassess their budgets and strategies. Join us as we take a closer look at the forces that may be steering us toward a period of heightened energy expenses.

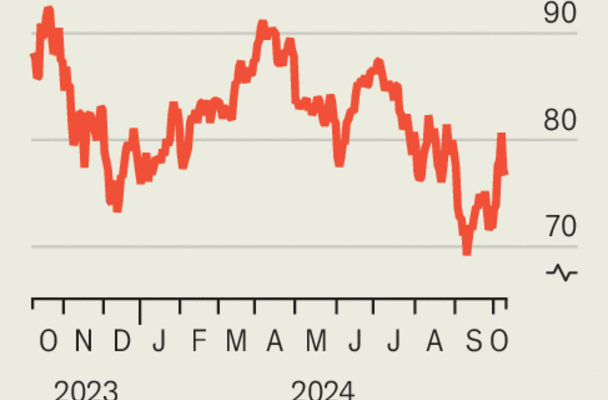

Current Trends in Oil Market

In today’s world, the landscape of energy resources is shifting rapidly. Various elements are influencing the dynamics of this sector, leading to fluctuations that can be felt globally. Factors such as geopolitical tensions, economic policies, and shifts in consumer behavior all play significant roles in shaping the trajectory of this essential commodity.

Recent events indicate a notable recovery in demand, driving the market’s momentum. Nations are gradually easing restrictions imposed during the global health crisis, leading to increased consumption across multiple sectors. In addition, supply chain challenges and production adjustments by leading producers further contribute to market variability.

Technological advancements also significantly impact the sector, enabling more efficient extraction and processing methods. This evolution opens doors to innovative practices, possibly shifting competitive advantages among various stakeholders. Meanwhile, environmental considerations remain at the forefront, as more countries commit to sustainable energy goals, which could reshape future demand patterns.

The interplay of these factors creates an intricate web, making precise predictions challenging. However, keeping an eye on emerging trends can provide valuable insights for stakeholders navigating this ever-evolving market.

Factors Influencing Price Fluctuations

Understanding the dynamics affecting the cost of crude can be quite fascinating. Numerous elements come into play, and they can significantly shift the market landscape. Let’s explore some of the key drivers.

- Geopolitical Tensions: Conflicts and political instability in key regions often lead to uncertainty, causing a spike in values.

- Supply and Demand: The basic economic principle applies here; when supply diminishes or demand surges, costs tend to increase.

- Natural Disasters: Hurricanes or earthquakes can disrupt extraction and distribution channels, leading to temporary shortages.

- Production Decisions: Choices made by major producing countries regarding output levels can drastically influence market rates.

- Technological Advances: Innovations in extraction methods or alternative energy sources can shift the balance and affect costs.

These factors interact in complex ways, creating a constantly changing environment. Staying informed can help individuals and businesses navigate these fluctuations more effectively.

Future Predictions for Crude Pricing

As we look ahead, the dynamics surrounding the global market for fossil fuels suggest a range of possibilities that could shape the economic landscape. Various factors, from geopolitical tensions to shifts in energy consumption patterns, are set to play significant roles in determining how benchmarks will fluctuate in the coming months and years.

One of the key influences is the ongoing transition towards renewable energy sources. While this shift aims to reduce dependency on conventional fuels, it also creates uncertainty for traditional sectors. Experts speculate that demand could surge intermittently, especially in regions still heavily reliant on fossil fuel consumption.

Moreover, production strategies employed by major extracting nations will likely influence market behavior. Decisions about output levels can either stabilize or unsettle the marketplace, depending on how they align with global consumption trends. Additionally, environmental regulations and technological advancements in extraction techniques could further complicate the landscape.

Lastly, economic indicators, such as inflation and currency strength, will remain critical in shaping the narrative for these commodities. Investors will be watching closely to gauge how these elements interact, which will ultimately guide their expectations and strategies. Overall, while no one can predict with absolute certainty, the forthcoming period is bound to be intriguing for those invested in this sector.