Exploring the Reasons Behind the Surge in Gas Prices

We all know the feeling: you pull up to the station, and the numbers on the screen seem to have a mind of their own, rising higher than we ever expected. It’s become a common topic of conversation, sparking discussions at dinner tables, in offices, and even on social media. What exactly is happening in the world of fuel that has left so many scratching their heads?

Understanding the forces driving these increases is crucial. Several factors play a role, from market dynamics to geopolitical events. It’s not just about the visible dollar amount; it’s about what lies beneath the surface. How do supply and demand influence what we pay? What impact do global tensions and natural disasters have on our local stations? These questions have become more significant as expenses at the pump continue to climb.

Join us as we delve deeper into this pressing issue, exploring the mechanisms behind the current climate of fuel costs. By unraveling the complexities, we can gain a clearer picture of why filling up has become a substantial concern for many. In this journey, we’ll shed light on not just the numbers, but the broader implications for families, businesses, and the economy at large.

Factors Driving Current Fuel Prices

Understanding what influences the cost of fuel can often feel like deciphering a complex puzzle. Several interconnected elements play a role in determining how much you pay at the pump. Let’s take a closer look at the key factors that contribute to these fluctuations.

- Supply and Demand: Basic economics apply here. When demand outstrips supply, costs tend to rise. Seasonal changes and economic activity can shift levels significantly.

- Global Events: Geopolitical tensions or natural disasters can disrupt production and supply chains, leading to spikes in costs.

- Refinery Production: The efficiency of refineries directly impacts availability. If refineries undergo maintenance or face outages, it can create a ripple effect on overall supply.

- Import Costs: Fluctuations in shipping costs and tariffs can influence how much cheaper or more expensive fuels are once they reach local markets.

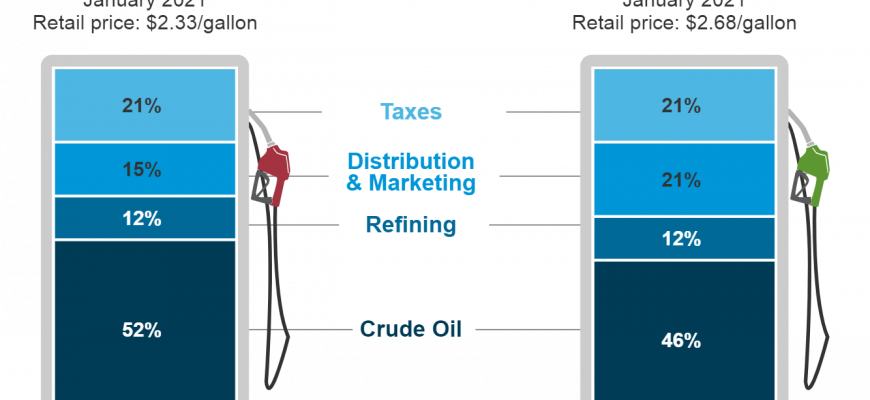

- Regulatory Factors: Government regulations and taxes can also affect end-user rates. These policies can vary widely from region to region.

- Crude Oil Prices: The price of crude oil is a primary determinant. As the global market changes, so too does the cost of refining and distributing fuel.

Each of these elements intertwines to create a dynamic situation in the fuel market. For consumers, it becomes crucial to stay informed about these shifts and understand how they can impact everyday expenses.

Impact of Global Market Trends

The fluctuations in fuel expenses extend far beyond local factors; they are deeply intertwined with international market dynamics. When we look at the broader landscape, it’s clear that various elements from around the globe play a significant role in shaping the overall costs we see at the pump. These elements can include trade policies, geopolitical tensions, and global supply and demand shifts.

For instance, when a major oil-producing country experiences unrest or changes its production levels, the effects can ripple through the market, affecting availability and ultimately influencing what consumers pay. Additionally, economic growth in emerging markets often leads to increased consumption, which can also drive up the entire market’s demands. This interconnectedness means that a crisis in one part of the world can lead to changes felt locally, even if the underlying events seem far removed.

Furthermore, innovations in energy production and shifts towards renewable resources are reshaping expectations and strategies across the industry. As countries commit to sustainable energy goals, the investment landscape is transforming, further influencing traditional fuel economics. Keeping an eye on these global market trends is essential for understanding not just current expenses but also future trajectories in this ever-evolving sector.

Local Economic Conditions and Fuel Costs

When we look at the expense of filling up our vehicles, many factors come into play that can influence our wallets. Various elements within the community’s economy can lead to fluctuations in what we pay at the pump. Understanding these influences can help consumers make sense of their fuel expenditures.

The local job market, average income levels, and overall economic health of a region directly impact how much residents are willing to spend on energy resources. Areas with thriving industries or high employment rates may experience different trends compared to regions facing economic challenges. Consequently, the demand for fuel can vary significantly based on these local conditions.

Additionally, infrastructure plays a key role. Regions with well-developed transportation networks may enjoy lower costs due to efficiencies in delivery and distribution. Conversely, areas that lack access to competitive suppliers could face inflated costs simply due to reduced options. Local taxes and regulations can also contribute to variations in what consumers see at the service station.

Climate and geography should not be overlooked either. For example, locations that endure harsher weather conditions may see an increase in demand for heating fuels during winter, affecting overall fuel economics. Understanding these nuances can shed light on why fuel expenses fluctuate from one place to another.