Is Financial Aid Through Grants Subject to Taxation? Exploring the Tax Implications of Financial Aid Grants

When it comes to pursuing higher education, numerous types of assistance can ease the financial burden on students. However, a common question arises: how does this help affect your tax situation? With various forms of support available, it’s crucial to grasp the potential implications they might carry when tax season rolls around.

Many individuals often wonder if receiving such support means they must pay additional taxes. This uncertainty can lead to confusion and anxiety, especially for those already navigating the complexities of student debt and educational expenses. Clarifying these concerns can pave the way for more informed decisions and better financial planning.

In this discussion, we’ll break down the essential aspects surrounding these funds, examining their nature and the rules that govern them. By shedding light on what you need to consider, you can make more confident choices as you pursue your academic goals.

Understanding Financial Aid Grants

When it comes to funding education, various resources can help lighten the financial load. Many students rely on support that assists in covering tuition, books, and other related expenses. This type of assistance can significantly influence a student’s academic journey and provide the necessary boost to achieve educational goals.

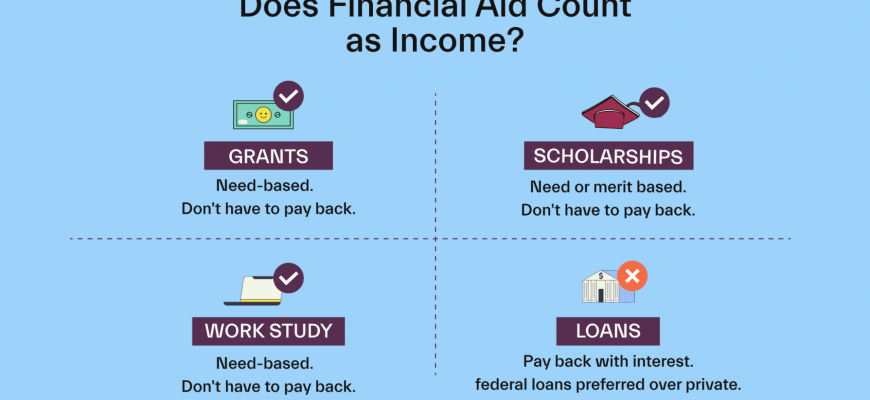

It’s essential to explore the different kinds of support available, particularly those that do not require repayment. Such funding is often aimed at helping individuals in need, allowing them to focus on their studies without being burdened by significant debt. Navigating through these options can be quite beneficial for students aiming for academic success.

However, as with any financial support, comprehension of the implications is crucial. One important aspect is understanding how this money affects personal finances, particularly concerning any obligations that may arise during tax season. Knowing what to expect can help avoid surprises and enable better planning, ensuring that students and their families are prepared for what lies ahead.

Tax Implications of Educational Grants

When it comes to funding your studies, many programs provide financial support that can ease the burden of tuition and related costs. However, understanding how these funds interact with tax laws is crucial for anyone receiving such assistance. Some forms of support might come with strings attached, and it’s important to navigate these waters carefully to avoid unexpected financial surprises.

Generally, the nature of the support received plays a significant role in determining whether it impacts your tax situation. In many instances, if the assistance is used solely for qualified educational expenses such as tuition, fees, and required materials, it may not count as income. On the flip side, other types of support that go beyond these costs could lead to potential taxable income, creating a need for careful bookkeeping.

It’s essential to stay informed about any specific requirements or limitations that apply to the type of assistance you’re receiving. This knowledge can help you ensure compliance with regulations while maximizing the benefits of the support you have secured. Consulting with a tax professional can also provide tailored advice suited to your unique circumstances and help clarify any uncertainties you may have.

Managing Your Support Wisely

Understanding how to handle your educational funding can make a significant difference in your overall experience. Being strategic and intentional in your approach not only helps you get the most out of your resources but also reduces stress in the long run. It’s all about making informed decisions that will benefit you now and in the future.

First off, it’s crucial to create a budget that reflects your expenses and income. By mapping out your finances, you can allocate your resources effectively and avoid overspending. Break down your costs, including tuition, housing, and daily living expenses, so you have a clear picture of where your money is going.

Consider the importance of documentation as well. Keep track of all your financial resources, whether they’re scholarships, loans, or other types of support. This way, you’ll have a detailed history to reference, making it easier to manage your obligations and understand what needs to be repaid later on.

Engaging with financial literacy programs can also be a game-changer. Many institutions offer workshops or resources to help students navigate their finances. These tools can empower you with knowledge about budgeting, saving, and even investing, which can be invaluable throughout your life.

Finally, don’t hesitate to seek advice when you’re unsure. Speaking with a financial advisor or a trusted mentor can provide clarity and direction as you navigate through the complexities of your funding options. A little guidance can go a long way in ensuring that you make wise choices along your educational journey.