Understanding the Placement of Credits in Document Formatting

When it comes to visual layouts, positioning can make a significant difference. Discussions often arise around how certain components should be arranged within a design. This aspect can influence not just aesthetics but also usability and viewer engagement. The choice we make can lead to various interpretations and even dictate how information is absorbed by an audience.

One common debate focuses on which side displays specific elements more effectively. There are strong opinions on either option, with advocates citing feelings of balance or imbalance depending on personal experiences or cultural contexts. Each arrangement has its proponents who passionately defend their stance based on observations and preferences.

Exploring this topic leads us to examine various scenarios where placement plays a critical role. By considering practical examples and analyzing outcomes, we can delve into why these decisions matter and how they contribute to a seamless experience for users. Whether it’s in printed materials or digital interfaces, understanding this dynamic can elevate our design choices.

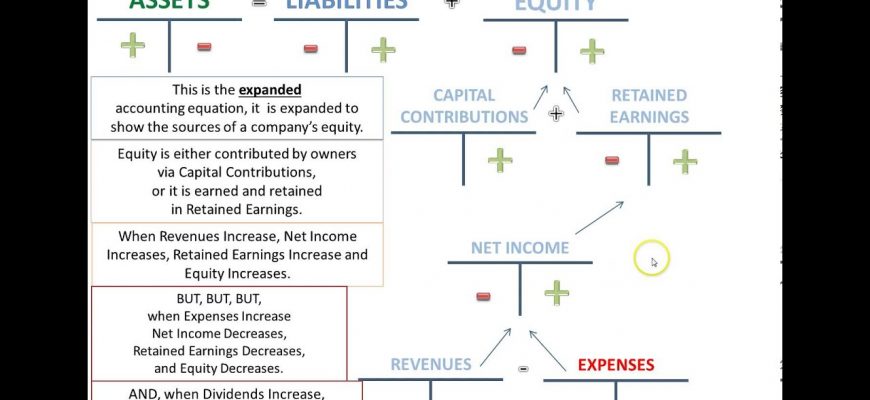

The Placement of Credits in Accounting

In the realm of finance, determining where to position certain elements is crucial for clarity and accuracy. This aspect plays a significant role in how businesses maintain their financial records and present them to stakeholders. Understanding the nuances of these placements can enhance overall comprehension of financial statements.

Proper alignment serves as a foundation for effective bookkeeping. It has implications on how transactions are interpreted, ensuring that the financial narrative accurately reflects the true state of affairs. Individuals engaged in account management often grapple with these placements, striving for a clear representation of their financial activities.

From a practical standpoint, adhering to established conventions can streamline processes and foster better communication among financial professionals. Knowing where to assign various transactions not only aids in compliance but also enhances the overall efficiency of the accounting system. As businesses navigate through complex financial landscapes, mastering this aspect is essential for sound fiscal management.

Cultural Differences in Credit Notation

When it comes to how acknowledgments are displayed in various cultures, there’s quite a fascinating array of practices. Depending on where you find yourself, you might notice that the placement of these recognitions varies significantly. This can lead to some interesting conversations, especially for those involved in international projects or collaborations.

In certain regions, you may see that notes of appreciation appear prominently at the end, while in others, they take center stage from the start. This difference often reflects deeper cultural values regarding recognition and appreciation. Some societies prioritize communal acknowledgment, while others may emphasize individual contributions, showcasing those in distinct formats.

Understanding these nuances not only enriches your knowledge of global customs but also enhances collaboration with international partners. As you explore these variations, you’ll likely discover how local traditions influence the overall design and presentation of these attributions, adding yet another layer to the beauty of cultural diversity.

The Impact on Financial Reporting

Understanding where certain entries appear in financial statements can significantly shape how businesses communicate their financial health. Navigating these conventions often leads to confusion among stakeholders, but grasping this aspect ultimately empowers users to make informed decisions.

Accurate representation of financial activities is crucial for transparency. When organizations follow a consistent methodology, it fosters trust and reliability in their reports. Investors, creditors, and other interested parties heavily rely on this information, seeking clarity on performance and stability.

Moreover, financial metrics can be interpreted differently based on how these entries are displayed. A deeper comprehension aids analysts in evaluating profitability and risk. Thus, recognizing the implications of placement becomes essential for meaningful analysis and operational success.

In conclusion, a solid grasp of how financial information is arranged in reports not only bolsters accountability but also enhances strategic decision-making throughout an organization.