Exploring the Role and Importance of Credit Bureaus in Today’s Financial System

When it comes to managing personal finances, understanding the key players in the background can make a significant difference. These organizations play a crucial role in shaping the financial landscape, influencing everything from loan approvals to interest rates. Their presence is felt by nearly everyone, whether you are applying for a credit card or seeking a mortgage.

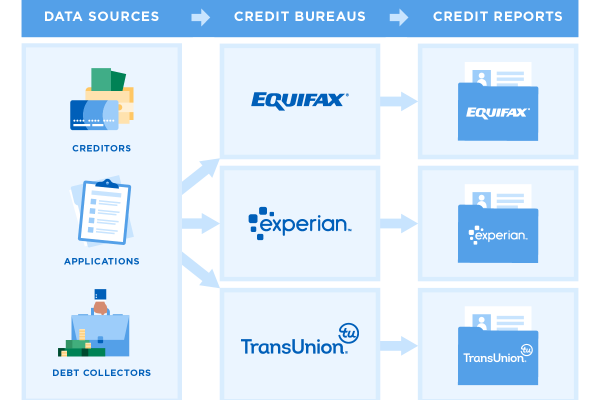

Many people may not realize how deeply intertwined these entities are with individual financial journeys. They gather vast amounts of information, generating reports that provide insights into borrowing histories and behaviors. This data helps lenders assess risk and make informed decisions, ultimately affecting the financial opportunities available to applicants.

In a world where financial literacy is vital, grasping the purpose and function of these organizations becomes increasingly important. By demystifying their role, individuals can take charge of their financial well-being and navigate their credit paths more effectively. Understanding the intricacies can empower consumers, helping them make smarter choices and avoid potential pitfalls.

Understanding the Role of Credit Bureaus

When it comes to managing your finances, there’s a team of behind-the-scenes players that help keep everything in check. These organizations play a crucial role in providing insights into an individual’s financial behavior, which can significantly influence many aspects of personal finance, from securing loans to determining interest rates.

Essentially, these institutions collect and maintain a detailed history of how individuals handle their financial obligations. They analyze various data points, including payment history, total outstanding debts, and the length of credit accounts. This information is compiled into reports that are accessed by lenders when making decisions about granting credit. Think of them as the storytellers of your financial journey, summarizing your habits and reliability in a way that helps others assess risk.

Moreover, these entities not only assist lenders but also empower consumers. By providing periodic reports, they allow individuals to monitor their financial footprint, helping to identify discrepancies and take corrective actions when necessary. This transparency fosters better financial health and promotes responsibility among borrowers.

In summary, these organizations serve as intermediaries in the financial landscape, ensuring that both lenders and consumers have access to essential information that drives informed decisions. Their role is indispensable in maintaining the balance between trust and risk in the world of finance.

How Financial Records Influence Economic Choices

Many individuals may not realize the significant role that financial histories play in shaping their economic decisions. These documents provide a snapshot of an individual’s financial behavior over time, affecting various aspects of life, from securing loans to applying for rental agreements.

A well-maintained record can open doors to better interest rates and favorable lending terms, as financial institutions often rely on these histories to assess risk. Conversely, negative entries can lead to challenges when seeking funding or even impact job opportunities, as some employers check these documents during the hiring process.

A clear understanding of one’s financial profile enables individuals to make informed decisions. Awareness of the information contained in these records can motivate individuals to manage their finances more responsibly, ensuring timely payments and reducing debt. Staying proactive can lead to a healthier economic situation, ultimately fostering a more secure future.

In conclusion, the significance of financial records cannot be overstated. They serve as a crucial tool in determining eligibility for various financial products and influence the terms attached to them. By prioritizing good financial habits, individuals not only improve their profiles but also enhance their overall economic well-being.

Differences Between Major Credit Agencies

When it comes to assessing financial trustworthiness, not all organizations are created equal. Each of the prominent entities in this space has its own methodology, focus areas, and unique features that set them apart from one another. Understanding these distinctions can empower individuals and businesses to make better decisions regarding their financial health.

First and foremost, one agency might prioritize payment history more heavily than another. This can lead to variations in the scores they produce, as different factors may weigh more significantly in their evaluations. For instance, one may consider debt utilization as a critical element, while another may emphasize the length of your credit history.

Moreover, the range of information provided varies as well. Some institutions offer additional services, like financial education and monitoring tools, which can be invaluable for consumers looking to improve their financial literacy. Others may focus purely on numerical assessments, without much emphasis on guidance or resources.

Lastly, regional differences and regulations can also influence how these organizations operate. Some may tailor their approaches to specific markets or demographic groups, providing insights that are more relevant to certain populations. Understanding these subtle yet impactful variations can make a significant difference in your overall financial strategy.