In-Depth Analysis of Amazon’s Latest Financial Report and Its Implications

In today’s fast-paced digital marketplace, understanding the dynamics of a certain tech behemoth’s financial landscape is crucial for stakeholders and curious minds alike. The latest performance metrics shed light on how this powerhouse navigates through challenges and opportunities. Whether it’s about revenue streams, operational efficiencies, or market strategies, there’s always something new to uncover.

Delving into the numbers can reveal patterns that not only highlight the current standing but also project future potential. With a range of sectors and products under its belt, the nuances of its economic health are as diverse as its offerings. This exploration aims to break down the key figures and trends that define the recent accomplishments and hurdles faced by this retail titan.

As we unravel the intricacies of the data, it’s imperative to grasp the broader implications of these statistics. They don’t just tell a story about profits and losses but also reflect consumer behavior and industry shifts. Join me as we dissect the latest findings and what they mean for the brand and its patrons moving forward.

Key Insights from Amazon’s Financial Performance

Analyzing the latest earnings updates from this e-commerce giant reveals some enlightening trends and shifts in its operational landscape. By diving into the numbers, stakeholders can better understand how the organization is navigating through various market dynamics and consumer behaviors.

One of the standout factors is the remarkable growth in online sales, which indicates a thriving demand for digital shopping experiences. This surge not only highlights the company’s ability to adapt but also underscores changing consumer preferences. Coupled with strategic investments in logistics and technology, these trends position the entity for robust future performance.

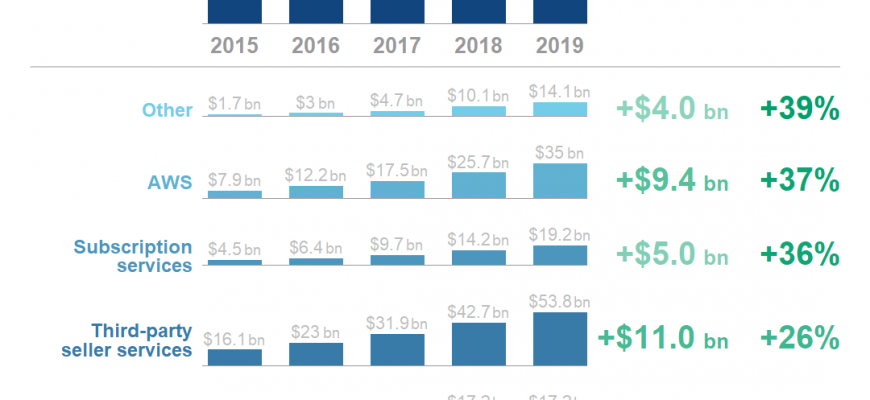

Additionally, the expansion of subscription services has contributed significantly to revenue streams, showcasing how diversifying offerings can enhance customer loyalty and retention. This approach signals a well-rounded strategy that embraces both e-commerce and beyond.

On the cost side, efficient management of operational expenses has provided a cushion against market fluctuations. Streamlining processes and leveraging technology reflect a commitment to sustaining profitability while facing external challenges.

Lastly, exploring geographic expansions and new market opportunities suggests a forward-thinking mindset. By focusing on growth in emerging markets, the organization seeks to tap into untapped potential, ensuring long-term success.

Impact of Market Trends on Revenue

Market dynamics play a crucial role in shaping an organization’s income streams. Fluctuations in consumer preferences, shifts in economic conditions, and emerging technologies can significantly influence how much revenue a company generates. Understanding these trends allows businesses to adapt their strategies and maintain a competitive edge.

For instance, an increase in online shopping has transformed the retail landscape, leading many companies to enhance their digital presence. This shift not only boosts sales but also requires investment in logistics and technology to meet customer demands. Furthermore, economic factors such as inflation or a recession can directly affect consumer spending habits, prompting organizations to adjust pricing strategies or promotional efforts accordingly.

Another critical aspect is the impact of social trends, like sustainability and ethical consumerism, which have prompted businesses to reevaluate their practices to align with customer values. By doing so, companies can not only attract a broader audience but also foster brand loyalty, ultimately affecting their bottom line positively.

In summary, staying attuned to market developments is essential for any organization aiming to optimize its earnings. By proactively responding to these changes, businesses can navigate challenges and leverage opportunities, ensuring sustained growth and profitability.

Future Projections for Growth

Looking ahead, there are exciting expectations for expansion in the upcoming years. The company is poised to leverage emerging technologies, diversify its offerings, and enhance customer engagement. These strategies indicate a strong commitment to maintaining relevance in a rapidly evolving marketplace.

Analysts anticipate significant advancements in logistics and delivery services, which could remarkably reduce shipping times and improve overall customer satisfaction. As online shopping continues to gain traction, optimizing operational efficiencies becomes crucial for sustaining a competitive edge.

Additionally, the focus on cloud computing and artificial intelligence suggests that the organization will not only enhance existing services but also create new revenue streams. Over time, this shift will likely establish a more robust presence in various sectors.

Moreover, the potential for international expansion opens up numerous opportunities for tapping into new markets. With increased globalization and changing consumer habits, the organization could significantly increase its footprint across different regions.

In conclusion, the outlook for growth is promising, with multiple factors at play that could bolster performance and foster long-term success. By continuing to innovate and adapt, the company is setting itself up for a bright and dynamic future.