Exploring the Allianz Europe Equity Investment Opportunity and Its Benefits

In today’s fast-paced financial landscape, investors are constantly seeking avenues to grow their assets. One particular region stands out, captivating those who are keen on diversifying their portfolios. This area is known for its robust economic stability and promising growth potential, making it an attractive destination for investment strategies.

When delving into this dynamic market, you’ll uncover a plethora of options that cater to various risk appetites and investment goals. Whether you’re a seasoned investor or just starting your journey, understanding the nuances of this environment can significantly enhance your investment outcomes. The intricate interplay of local businesses and international players shapes a unique financial ecosystem where opportunities abound.

As we navigate this exciting terrain, it is essential to explore the driving forces behind market performance, identify key sectors ripe for exploration, and consider how socio-economic factors contribute to overall growth. By gaining insight into these elements, you’ll be better equipped to make informed decisions and potentially reap substantial rewards in your investment endeavors. Embrace the challenge and let’s dive into the depths of this financial treasure trove!

Understanding the Investment Fund

When it comes to exploring investment opportunities, one option that often captures attention is a particular fund focusing on a diverse selection of companies within a specific region. These funds typically aim to provide investors with exposure to a wide array of equities, allowing them to benefit from the potential growth of multiple sectors and industries. In this section, we’ll delve into the nuances of such an investment vehicle, highlighting its objectives, advantages, and the strategies behind its management.

This fund is designed to cater to those looking to capitalize on the economic dynamics of established markets. By investing in a carefully curated portfolio of publicly traded companies, it offers a balance between risk and return. It’s not just about playing it safe; it’s about strategically allocating resources to harness opportunities in various industries that are poised for growth.

By participating in this kind of investment approach, individuals can benefit from professional management and extensive research. The fund’s managers continually assess market conditions, adjusting the portfolio to optimize performance. This agility is crucial in navigating the often volatile landscape of international finance, ensuring that investors remain well-positioned to take advantage of emerging trends.

In summary, the appeal of such a fund lies in its potential for diversification and professional oversight, making it an attractive option for those seeking to enhance their investment strategies while tapping into the economic growth of a specific area.

Investment Strategy and Performance Insights

When exploring avenues for wealth growth, having a robust approach is essential. A strategic plan not only aims for long-term gains but also seeks to minimize risks associated with market fluctuations. By focusing on a mix of diverse assets, the objective is to harness opportunities while catering to various investor preferences.

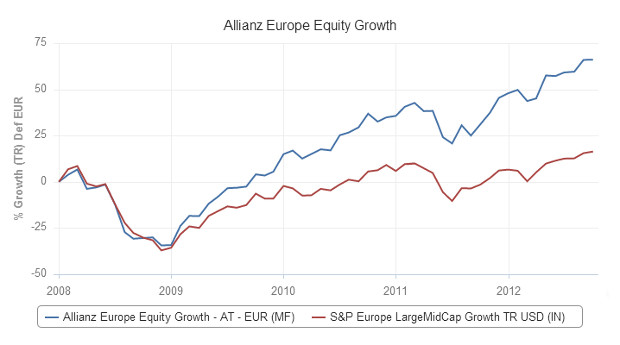

Analyzing past achievements can provide valuable lessons for future endeavors. Performance metrics are crucial in assessing how well a strategy is holding up against market dynamics. Tracking returns, understanding volatility, and evaluating key indicators help investors gauge whether their chosen path aligns with their financial aspirations.

Additionally, adaptability is a cornerstone of successful investing. Markets evolve, and strategies must be responsive to changes and emerging trends. By regularly reviewing holdings and adjusting tactics, investors can better position themselves for sustained success and capitalize on new opportunities as they arise.

Ultimately, a well-rounded investment philosophy combined with diligent oversight can lead to fruitful outcomes. Understanding the balance between aggressive growth and cautious positioning is vital for navigating the complex landscape of modern finance.

Benefits of Investing in European Shares

Diving into the world of shares from the continent can be a rewarding adventure. There are numerous advantages that come with placing your trust in assets from this region, appealing to various types of investors. Not only does this offer the chance to tap into a diverse market, but it also opens doors to growth potential and stability that can enhance your portfolio.

One of the standout features is the robust regulatory environment often found in many nations here. This fosters transparency and accountability, giving investors more confidence in their choices. Additionally, companies operating in these markets span a wide range of sectors, from technology to finance, which helps in spreading risk and balancing investments.

Moreover, many firms are recognized for their innovation and excellence, positioning them well for future growth. This potential, combined with competitive dividends, often makes investing in these assets an attractive proposition. Lastly, engaging with markets in this part of the world can provide valuable insights into global economic trends, enriching your overall investment strategy.