Exploring the AIA European Equity Fund and Its Investment Opportunities

In today’s ever-evolving financial landscape, the pursuit of growth can lead investors to exciting avenues beyond their local horizons. With an abundance of markets available, savvy individuals are increasingly looking toward opportunities that span different regions, seeking to diversify their portfolios and tap into unique potential. This section will delve into a particular investment vehicle that allows participants to engage with a wide range of international assets, aiming to strike a balance between risk and returns.

Understanding the intricacies of such an investment option can be both rewarding and challenging. It serves as a gateway for those eager to explore the dynamic interplay of various economies and industries. By shedding light on this type of investment, we will uncover the strategies and thought processes behind choosing the right mix of assets, what to consider when venturing beyond familiar territories, and the benefits that can arise from such decisions.

Join us as we navigate through the compelling world of global investments, where new ideas and perspectives await. An informed approach can not only enhance one’s understanding of market trends but also empower investors to make choices that align with their financial goals and aspirations.

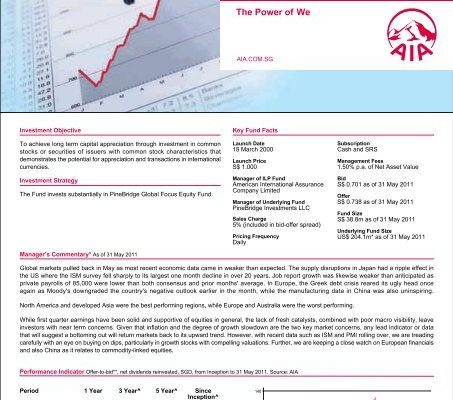

Overview of the Investment Vehicle

This section provides insights into a specific type of financial portfolio that focuses on companies located within a particular region of the world. By investing in this asset collection, individuals aim to benefit from the growth potential of various industries while enjoying diversification benefits. It’s all about harnessing opportunities that arise from different market trends and economic conditions.

The primary goal of this investment option is to maximize returns by selecting a mix of established and emerging businesses. Investors often look for diversified exposure, allowing them to spread risk across multiple sectors and geographic locations. The management team typically conducts thorough research and analysis to identify promising candidates that could deliver significant long-term gains.

Another important aspect worth mentioning is the performance evaluation. Investors tend to monitor results against benchmarks to gauge success. This ongoing assessment helps in making informed decisions about reallocation or adjustments in strategy to enhance future outcomes.

In summary, this investment approach is designed for those seeking to capitalize on the growth prospects of a dynamic marketplace. With a well-thought-out strategy and a keen eye on market developments, participants can position themselves to reap the rewards of economic progress.

Investment Strategy and Objectives

The approach to investing in a diverse range of stocks comes with a clear intention: to generate sustainable growth and achieve attractive returns over time. By focusing on companies with strong fundamentals and promising potential, the aim is to build a portfolio that not only withstands market fluctuations but also capitalizes on emerging opportunities across various sectors.

To realize this vision, a disciplined methodology is employed, combining rigorous research and analysis with strategic asset allocation. This includes identifying undervalued assets and engaging in proactive monitoring, ensuring that the portfolio remains aligned with both market trends and the overarching financial goals. Risk management plays a crucial role in this framework, helping to safeguard investments while pursuing upside potential.

Ultimately, the objective is to enhance wealth steadily, offering investors a compelling avenue for long-term prosperity. By remaining adaptable and responsive to changes in the economic landscape, the strategy seeks to deliver consistent performance and foster confidence among stakeholders.

Performance Analysis and Trends

In this section, we’ll dive into the evaluation of investment strategies and their outcomes over time. Understanding how different market elements impact returns can provide valuable insights for investors looking to navigate the dynamic landscape of assets.

Recent data highlights a diverse array of performance metrics that showcase varying levels of growth and volatility. Factors such as economic conditions, geopolitical events, and regulatory changes play a crucial role in shaping these results. It’s essential to keep an eye on historical patterns to predict future movements and better align with investment goals.

One notable trend is the shift towards sustainable investing, which has gained momentum among investors. This has led to increased interest in companies that prioritize environmental, social, and governance (ESG) factors. As a result, portfolios focusing on these criteria have often outperformed traditional ones, reflecting a broader awareness of responsible investment practices.

Another key observation is the increasing globalization of markets. Investors are now more inclined to explore opportunities beyond their borders, seeking potential returns in emerging sectors. This diversification can mitigate risks and enhance overall portfolio robustness, allowing for more balanced growth.

In conclusion, ongoing analysis of performance helps in identifying significant trends and making informed decisions. By staying attuned to the changing landscape and embracing innovative approaches, investors can position themselves for success in an ever-evolving financial environment.