Exploring Three Effective Strategies to Secure Financial Aid

Facing the rising costs of education can be overwhelming, but there are numerous avenues to explore that may help alleviate the financial burden. Understanding the support systems available opens doors to opportunities that might otherwise seem out of reach. It’s essential to navigate this landscape with intention and knowledge.

Whether it’s tapping into government resources, seeking out private scholarships, or connecting with institutions that offer unique programs, the choices are diverse and plentiful. Each option presents its own set of requirements and advantages, making it vital to assess personal circumstances and priorities. This journey towards securing necessary support can lead to greater peace of mind and a clearer path to success.

Exploring these various opportunities not only enhances one’s prospects but also fosters a sense of empowerment in managing educational expenses. By staying proactive and informed, individuals can uncover the assistance they need to thrive academically and financially. Let’s delve into some of the most effective methods to obtain that essential support.

Exploring Scholarships for Education Funding

Diving into the world of scholarships can open up a treasure trove of opportunities for those pursuing higher learning. This financial support mechanism is designed to ease the burden of educational expenses, allowing students to focus on their studies rather than worrying about the cost. With a wide array of options out there, it’s essential to navigate through them carefully to find the perfect match.

Many organizations, institutions, and even individuals offer scholarships based on various criteria, be it academic excellence, specific talents, or community service. This diversity means that more individuals have a chance to secure funding tailored to their strengths and aspirations. Whether it’s a local community group or a prestigious university, countless avenues exist waiting to be explored.

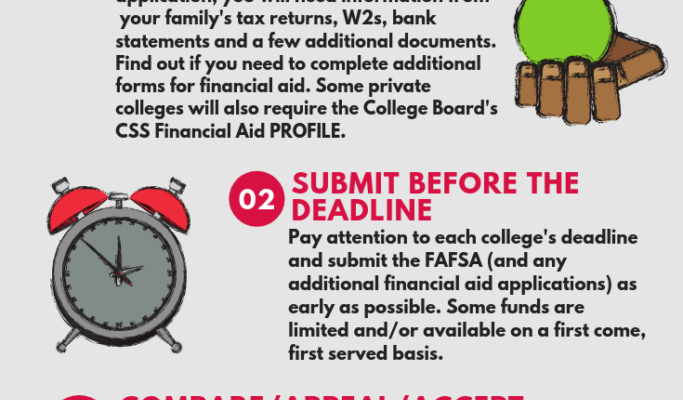

The application process can sometimes seem daunting, but breaking it down into manageable steps can make it less overwhelming. Researching available scholarships and understanding their requirements is key. Preparing an impressive application that showcases unique qualities and achievements can set a candidate apart from the competition.

Understanding Federal Student Loan Options

Navigating the complexities of student funding can feel overwhelming, especially with the various options available. Federal student loans represent an accessible avenue for many individuals seeking support in their educational pursuits. Delving into these loan types reveals essential features that make them appealing to borrowers.

Primarily, federal student loans often come with lower interest rates compared to private lenders. This aspect enables students to manage their repayments more effectively. Additionally, various repayment plans cater to diverse financial situations, allowing individuals to select terms that align with their capacities. Another significant advantage lies in the potential for loan forgiveness programs, which can significantly reduce the burden of debt for those pursuing careers in public service or non-profit sectors.

Understanding distinct loan categories, such as Direct Subsidized and Unsubsidized Loans, is crucial. Subsidized loans have interest covered by the government while in school, making them an attractive choice for eligible students. Conversely, Unsubsidized Loans accrue interest from the moment they are disbursed, requiring more careful planning for future payments. Grasping these differences can empower borrowers to make informed decisions about their educational financing strategies.

Alternative Financing: Grants and Community Resources

Exploring unique funding opportunities opens up a world of possibilities for those looking to alleviate the burden of expenses. Often overlooked, various resources exist that can provide crucial support without the need for repayment. Communities and organizations regularly offer assistance tailored to different needs, making it essential to dive into these options.

Grants represent a fantastic avenue to consider. These funds, typically awarded based on specific criteria, do not require any repayment, allowing recipients to focus on their goals without added financial stress. Understanding the eligibility requirements and application processes can greatly enhance the chances of securing such funds.

In addition, local community resources can be invaluable assets. Many organizations are dedicated to supporting residents through programs designed to provide educational resources, mentorship, and sometimes direct financial help. Engaging with these community entities not only helps in gaining necessary support but also fosters valuable connections within the local network.

Ultimately, tapping into grants and community support can serve as a significant advantage. By researching and utilizing these alternative financing options, individuals can pave the way toward achieving their aspirations while easing the financial strain. It’s all about being proactive and seeking out the right resources at the right time.