Exploring the Benefits of the 2025 Used Electric Vehicle Tax Credit for Savvy Buyers

As we navigate the ever-evolving landscape of environmentally friendly transportation, there’s an exciting shift on the horizon for those looking to make sustainable choices. The focus is increasingly on offering benefits that help individuals transition to electric vehicles, making them more accessible and appealing. This marks a significant change in how we view the affordability of these innovative machines.

With the growing popularity of electric cars, many people are eager to understand the financial benefits available to them. Programs designed to assist potential buyers could play a crucial role in encouraging a wider adoption of these eco-friendly alternatives. It’s a win-win situation: not only do individuals save money, but the planet benefits as well.

So, if you’ve been considering making the switch, now is a fantastic time to explore your options. With various initiatives aimed at easing the burden of upfront costs, driving an electric vehicle is becoming less of a dream and more of a reality for many households. Let’s delve into what this means for potential new owners and how these incentives will shape the future of motoring.

Understanding the 2025 Used EV Tax Incentives

As we look ahead, there’s an exciting evolution in the landscape of electric vehicle purchases, especially for those who are considering environmentally friendly options without breaking the bank. The upcoming financial benefits aimed at second-hand electric cars are designed to make it more accessible for everyone to transition towards greener transportation. These incentives could provide significant savings for buyers, stimulating interest and adoption of electric mobility solutions.

The recent reforms are aimed at promoting sustainable transport solutions. This means that if you’re thinking of investing in a pre-owned electric vehicle, you could potentially enjoy a range of financial perks. From reduced tax liabilities to direct monetary rebates, these offers encourage more consumers to choose electric over traditional fuel-powered vehicles, thereby improving air quality and reducing carbon emissions.

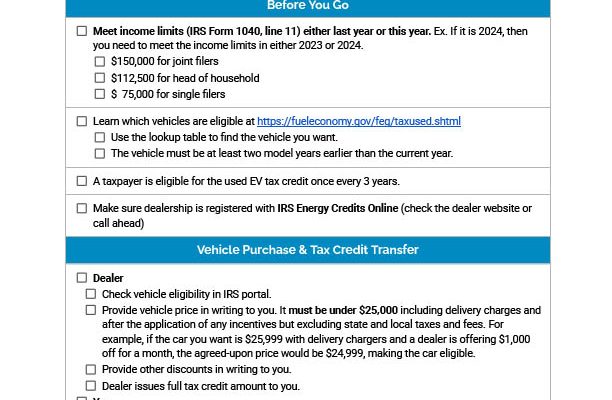

So, how do these benefits work? Essentially, if you meet certain qualifications, you may be entitled to a reduction in the overall amount of tax you owe at the end of the fiscal year. This is determined by various factors including the type of vehicle and its pricing. Additionally, there may be stipulations related to the vehicle’s age and battery capacity, which could influence the magnitude of the incentives available to you.

It’s a splendid opportunity for anyone looking to make a positive impact on the environment while enjoying significant financial relief. Before making a purchase, it’s crucial to stay informed about the particulars and ensure you’re taking full advantage of what’s on offer in this new era of sustainable vehicle ownership.

Eligibility Criteria for Electric Vehicle Incentives

When considering the benefits associated with electric vehicles, it’s essential to understand who qualifies for these enticing offers. Various factors play a role in determining eligibility, and knowing them can help potential buyers make informed decisions. The guidelines often encompass aspects such as vehicle type, purchase timing, and even the buyer’s tax situation.

One aspect to consider is the kind of vehicle being acquired. Specific models may meet the necessary standards for incentives, while others might fall short. Additionally, timing can affect qualification; certain programs may be tied to specific model years or production limits. It’s worth checking the latest updates as regulations may shift.

Moreover, the financial profile of the purchaser can influence eligibility. Some programs may stipulate income limitations or specify the type of taxes that can be applied. Understanding your own tax scenario and any associated obligations will clarify what you can claim. Lastly, ensuring that the vehicle is purchased from a certified dealer might also be a requirement for certain incentives, reinforcing the need for due diligence when choosing where to buy.

Impact of Pre-Owned Electric Vehicle Incentives on Environment

When it comes to reducing our ecological footprint, encouraging the use of electric vehicles that have already been driven can play a significant role. These incentives make it more appealing for consumers to opt for electric cars that have previously been owned, thus promoting a shift from traditional combustion engines to cleaner alternatives. The overarching goal is to enhance sustainability while minimizing greenhouse gas emissions.

One of the most immediate benefits of transitioning to previously owned electric vehicles is the reduction in overall carbon emissions. Every electric car on the road contributes to fewer harmful pollutants being released into the atmosphere. Given that many of these vehicles are already manufactured, bringing them back into circulation helps save resources that would otherwise be consumed in producing new models.

Moreover, the positive ripple effect resonates throughout the community. As more people adopt environmentally friendly transportation options, the demand for fossil fuels decreases, which can lead to a decline in oil extraction and its associated environmental damages. This shift fosters cleaner air quality and offers a healthier habitat for everyone.

Additionally, promoting the use of pre-owned electric vehicles can also have socio-economic benefits. Lowering the barriers to entry for eco-conscious transportation can lead to a broader demographic embracing greener practices, further amplifying the environmental impact. In essence, these incentives are not just about boosting sales; they represent a collective move towards a more sustainable future.