Exploring the 2025 Tax Credit Benefits for Newborns and Their Families

Starting a family is an exciting journey filled with joy and challenges. As new parents, you might be wondering how to manage the financial aspects of welcoming a tiny human into your world. Good news is on the horizon! There’s a supportive initiative aimed at helping families during this transformative time, easing some of the financial burdens that come with caring for a precious infant.

In this section, we’ll explore a fantastic opportunity that can provide you with some relief. The goal is to assist families in navigating the expenses associated with raising children, which can often feel overwhelming. Understanding this program can pave the way for a brighter financial outlook as you embark on your parenting adventure.

By taking advantage of this offer, families have the potential to receive substantial assistance, allowing them to focus more on cherishing those early moments rather than worrying excessively about finances. It’s all about making life a little easier so that you can enjoy this beautiful chapter without unnecessary stress.

Understanding the 2025 Newborn Tax Credit

Welcoming a little one into your home is a joy like no other, but it often comes with financial challenges. Luckily, there are assistance programs designed to support families during this exciting time. Whether you’re a first-time parent or adding to your growing family, knowing how these benefits work can ease some of the burdens.

This initiative aims to provide financial relief to eligible families. By understanding the guidelines and how to apply, you can take advantage of the support available. It’s worth diving into the details so you can plan your budget effectively and ensure you’re making the most of any assistance you qualify for.

Eligibility criteria are usually in place, meaning you’ll want to gather the necessary documentation. Factors such as income levels, residency, and family size often play a role. Keep in mind that this kind of support can significantly ease the transition into parenthood, allowing you to focus more on your growing family and less on financial worries.

Make sure to stay informed about updates and changes to the program. As policies evolve, being proactive can help you maximize your benefits, ultimately making life a bit easier during those hectic early months. Remember, families come in all shapes and sizes, and there are programs tailored to assist you regardless of your background or circumstances.

Eligibility Requirements for Parents

When welcoming a little one into your family, there are certain criteria you need to meet to benefit from available financial assistance. Understanding these qualifications can help you navigate the process smoothly and ensure you’re making the most of what’s offered to support your family’s needs.

Age of the Parents: Generally, there are age restrictions that apply. Usually, parents need to be of legal age, which varies by region. This ensures that they are responsible and capable of meeting the associated requirements.

Residency: Another factor to consider is where you reside. Certain programs are only available to those residing in specific areas. Ensure you’re familiar with the local regulations to verify your eligibility.

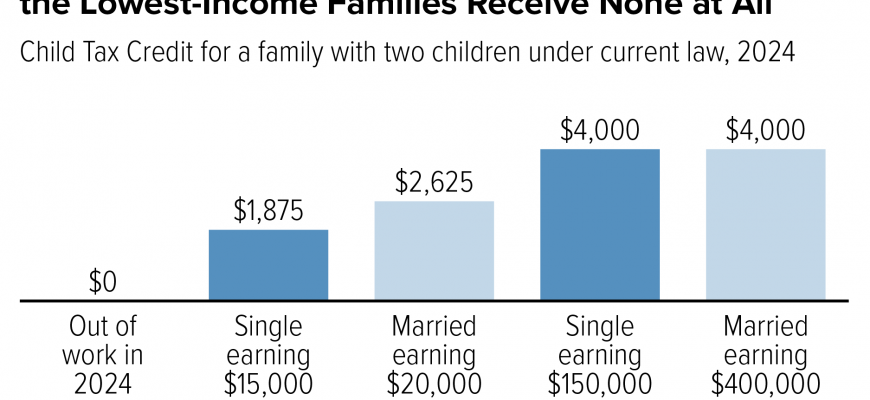

Income Level: Financial standing is also a key aspect. Many programs have income thresholds that must be adhered to; thus, it’s important to know where your earnings place you in relation to these limits.

Dependent Status: Lastly, the number of dependents you have can impact your qualification. Programs often take into account the total number of children in your household, so make sure to accurately report this information.

By keeping these aspects in mind, you can better assess your eligibility and approach the application process with confidence.

Benefits and Financial Impact on Families

Welcoming a little one into the family is a joyous occasion, but it also comes with a host of financial challenges. Fortunately, there are supportive measures in place designed to alleviate some of the financial pressure on new parents. These initiatives aim to provide families with a boost during those crucial early years, allowing them to focus more on nurturing their child rather than stressing about expenses.

One of the most significant advantages of these financial incentives is the added funds that families can receive. This support can help cover essential needs, such as diapers, baby clothes, and healthcare expenses. Instead of viewing parenthood solely as a financial burden, this assistance encourages parents to embrace the joys of raising their children without the constant worry of money matters. It fosters a positive environment where families can thrive, providing stability and comfort in those early, formative years.

Moreover, the impact goes beyond immediate financial relief. With extra resources at hand, families gain the opportunity to invest in future growth and development. Whether it’s setting aside funds for education, saving for emergencies, or even enjoying a family outing, the effects of increased financial support can resonate long into the future. This encouragement can lead to healthier family dynamics and a more secure upbringing for children.

Overall, these beneficial initiatives play a crucial role in shaping the experiences of families during a pivotal time in their lives. They help transform the journey of parenthood into a more enriching experience, allowing parents to focus on what truly matters–creating lasting memories with their little ones.